In looking for opportunities after Black Thursday it is a no-brainer that the markets that were hit hardest should be considered. One of those markets that got crushed: silver. Yes we were fans of the precious metals market a month ago, and especially gold miners got crushed. Point taken, we have eyes and can see the charts as well. But precious metals are great long term holdings, and are worth accumulating around current levels. We are really much more interested in the next momentum play, for a medium term oriented portfolio. The daily silver chart gives us clear clues, and we have one particular play in mind that may crush any other silver play. Our silver forecast features long term charts, in this article we focus on the short to medium term silver chart.

The ‘art of the chart’ is all about finding the clues that the market gives on when it is bearish, bullish or neutral.

The silver chart particularly is pretty clear in this, and gives us great (easy) guidance on when we should consider it as a momentum play.

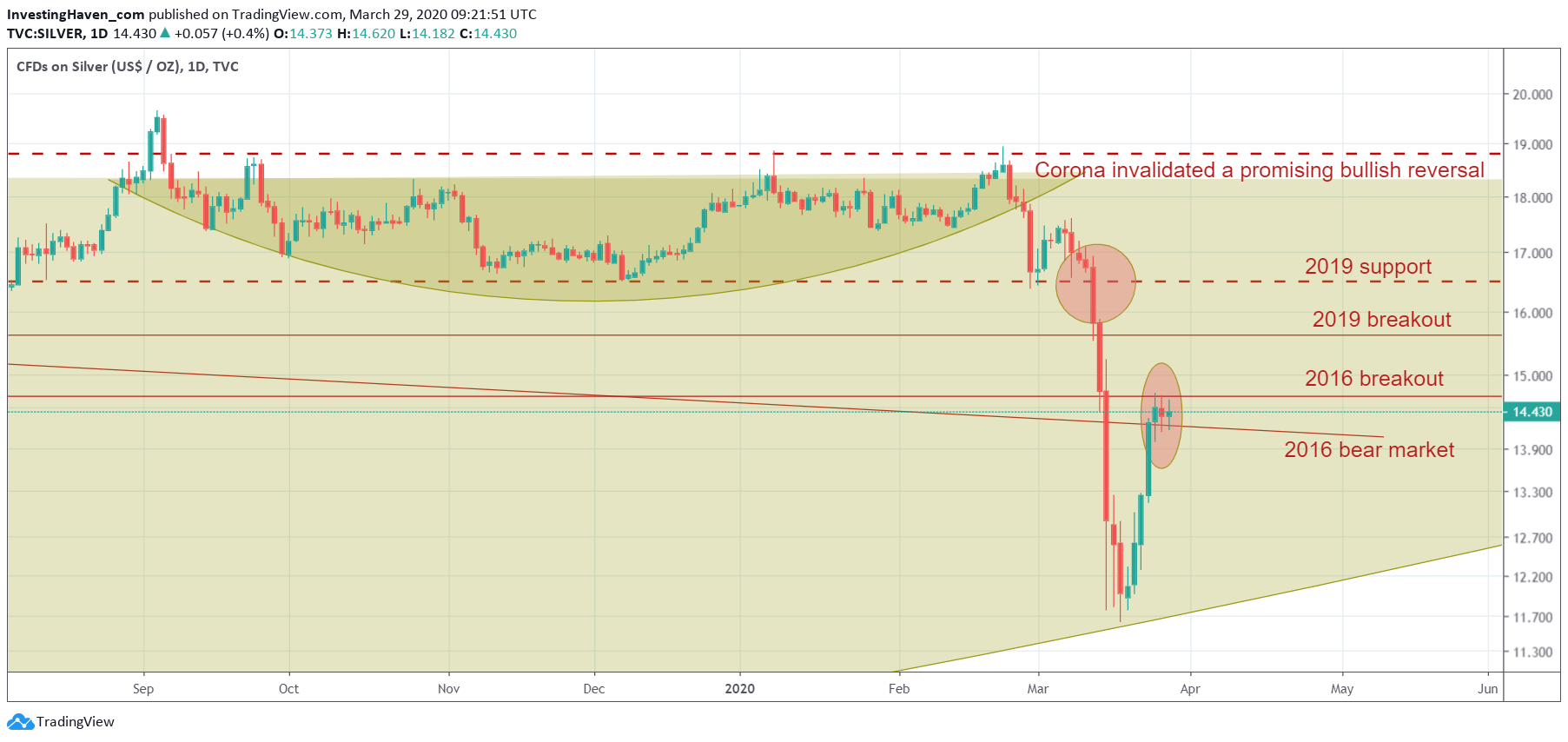

Below is the daily silver chart.

There are a few trends in play:

- A giant bullish reversal pattern (yellow background). Silver fell to the 11.7 USD level, exactly the long term reversal boundary.

- The 2016 bull/bear market as well as breakout levels are annotated. Silver is now ‘testing’ this trend. A move above 14.60 would confirm that silver successfully tested the 2016 trend, and leaves it behind.

- The 2019 bull market trend is next. Watch 15.70 to 16.70 USD.

- The last resistance level represents the most recent trend: 18.90 USD.

Below 14.00 is bearish, not likely to happen.

Between 14.60 and 15.70 we expect a fast rise.

Once above 16.70 we expect some hard work to occur (16.70 to 18.90).

We prepare a momentum investment once silver rises above 14.60 USD. There is one particular silver play that we expect to do amazingly well in the medium term, and one for the long term.

We are considering a great precious metals play for the medium term, if and when we get a confirmation that precious metals miners become a momentum trade. This might start as soon as next week, or a bit later, but a precious metals momentum trade looks inevitable in the next few weeks.