Did we say that the silver price needs a boost from the Euro? Yes, indeed. Not just because the Euro is inversely correlated to the Dollar, and most investors know the correlation between silver, gold and the Dollar. More importantly, the Euro has a much more outspoken setup for any silver prediction.

It is a while ago that we covered silver. The last time we spoke about silver was in the first week of September, when we suggested to sell our hugely profitable First Majestic Silver position: Investing Opportunities #7: Silver Exit Plan vs The Next Sector That Might Heat Up.

We were spot-on in forecasting the huge silver miners move, and more importantly we spotted the right moment to get out. Getting into a market is easy, spotting the right exit point however is much more challenging!

In May of this year we wrote First Majestic Silver Rises 6% Today. Welcome New Bull Market?, and a bit more than 3 months later we suggested to exit.

With silver’s price retracing most investors tend to lose interest in the silver market. That’s normal, and the silver news particularly is doing what it is good at: mislead investors. And this is a common pitfall which we want to avoid at all cost. If silver remains in a bull market we want to get exposure again.

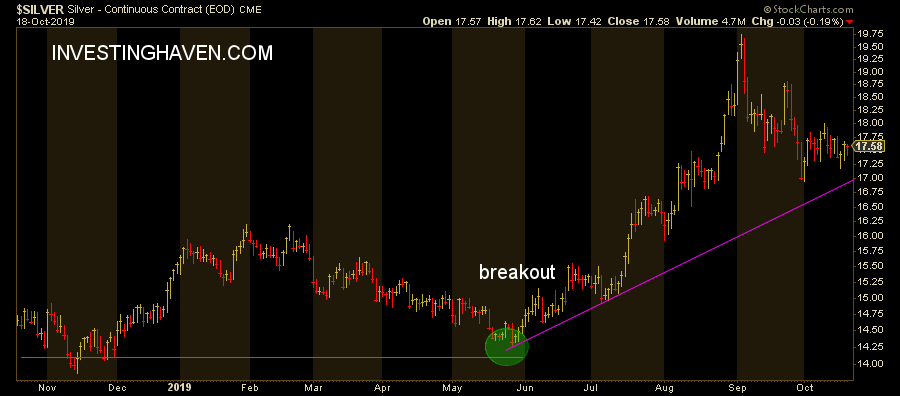

However, we first need to see silver’s support line respected. Below we see that silver is very close to test support.

Interestingly as said earlier before The Euro As THE Leading Indicator Is About Change Trends In Global Markets. If anything the silver price retracement may be testing support right at a time when the Euro turns bullish.

If, and only IF, this happens we will see support in the silver price. It is a matter of days until we will know. Stay tuned.