Steel stocks are attempting a secular breakout. These type of secular breakouts are not a characteristic of a bear market. As said countless times, no stock market crash in 2023, as per our 2023 forecast we predict a bullish resolution in broad markets.

Steel stocks may not be the most ‘sexy’ market out there (not like AI or autonomous vehicles).

Still, the chart is very ‘sexy’. Interestingly, the longer the timeframe, the more interesting the chart becomes.

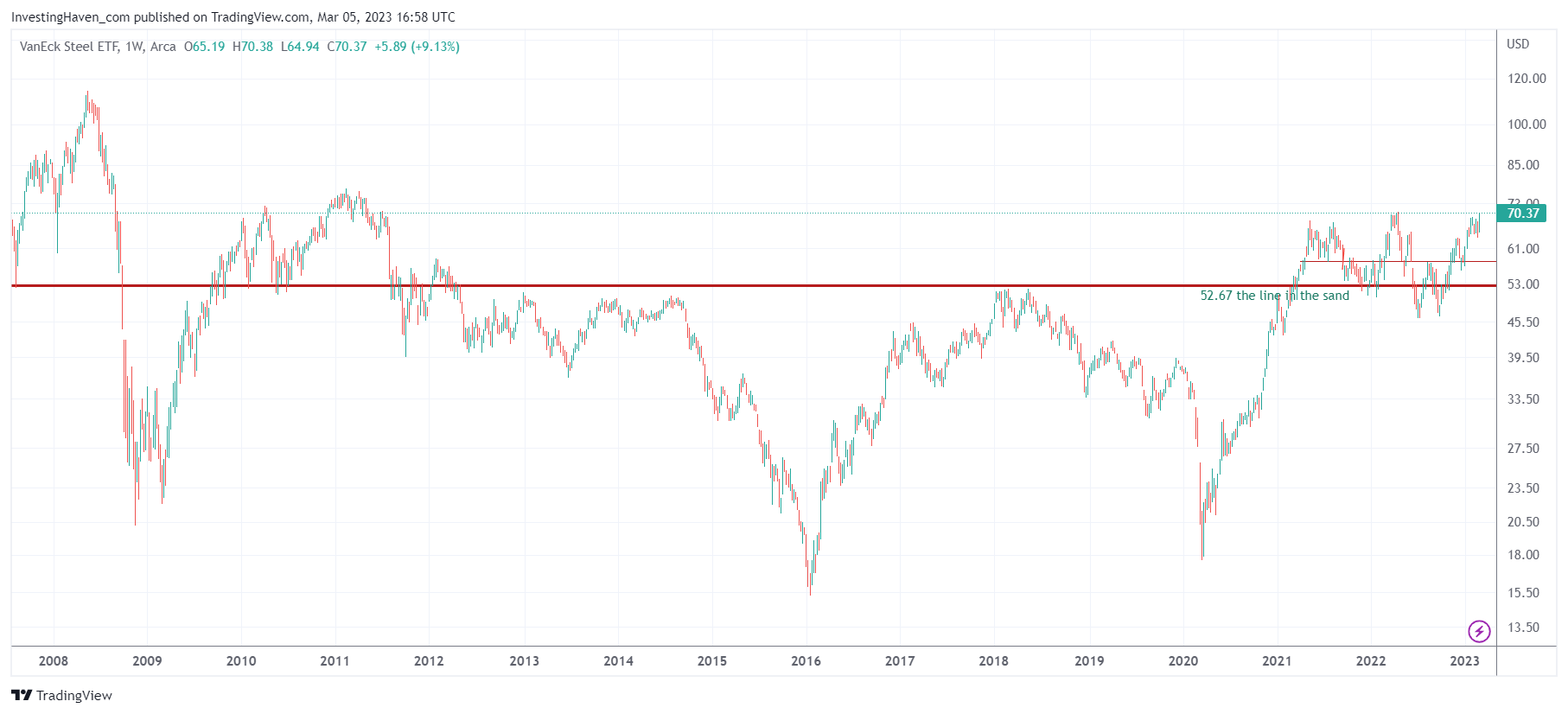

Below is the weekly SLX ETF representing the steel stocks sector.

The one annotation on the chart are self-explanatory. In the spirit of ‘keep it stupid & simple’ we also do not need more annotations:

- The secular level 52.67 was the line in the sand.

- The breakout in 2021 came with top around 67 points.

- Today, almost 2 years later, it looks like this ETF created a bullish reversal around/above the 52.67 level.

The bearish case for SLX ETF is that it is is in the process of creating a head & shoulders setup. We cannot exclude it, but this pattern looks much more like a bullish reversal above the secular level 52.67 especially as it came after a monster W reversal between 2012 and 2021.

In our stock market investing service Momentum Investing we are preparing our top picks in what we call our “stocks shortlist”. We have a few steel stocks which will hugely benefit from a confirmed breakout in the steel sector.