Is the uranium market attractive after a pretty steep rise last year? Although we tend to publish quite some market forecasts every year we did not publish an uranium 2022 forecast.

We’ll look at 3 distinct charts to answer the question whether the uranium market is still attractive as an investment or whether it’s too late.

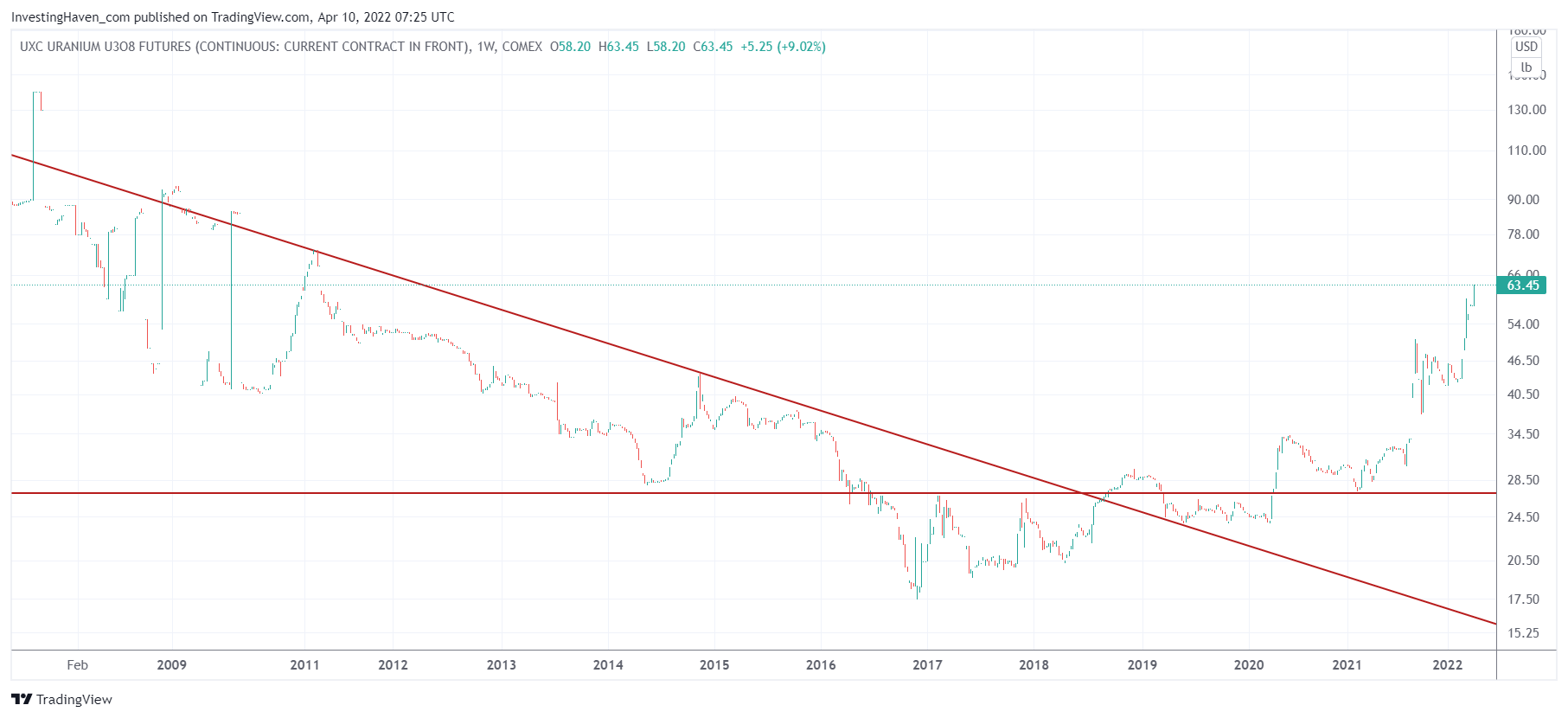

First, the uranium price, undoubtedly the number #1 leading indicator for the uranium market.

Below is the weekly chart since 2008 which marked the top of the uranium spot price.

Visibly, uranium had a spectacular turnaround and broke out a long basing pattern around summer of 2021. Since then, uranium spot is up 50%.

This chart suggests that uranium is 50% below its ATH. So, one way to think of it is that there is plenty of upside potential until ATH. The question is whether uranium is moving to ATH. The answer is unknown, but all we can say is that this chart structure is really bullish, long term. While the recent rise was steep, it shouldn’t be the end of the bull run.

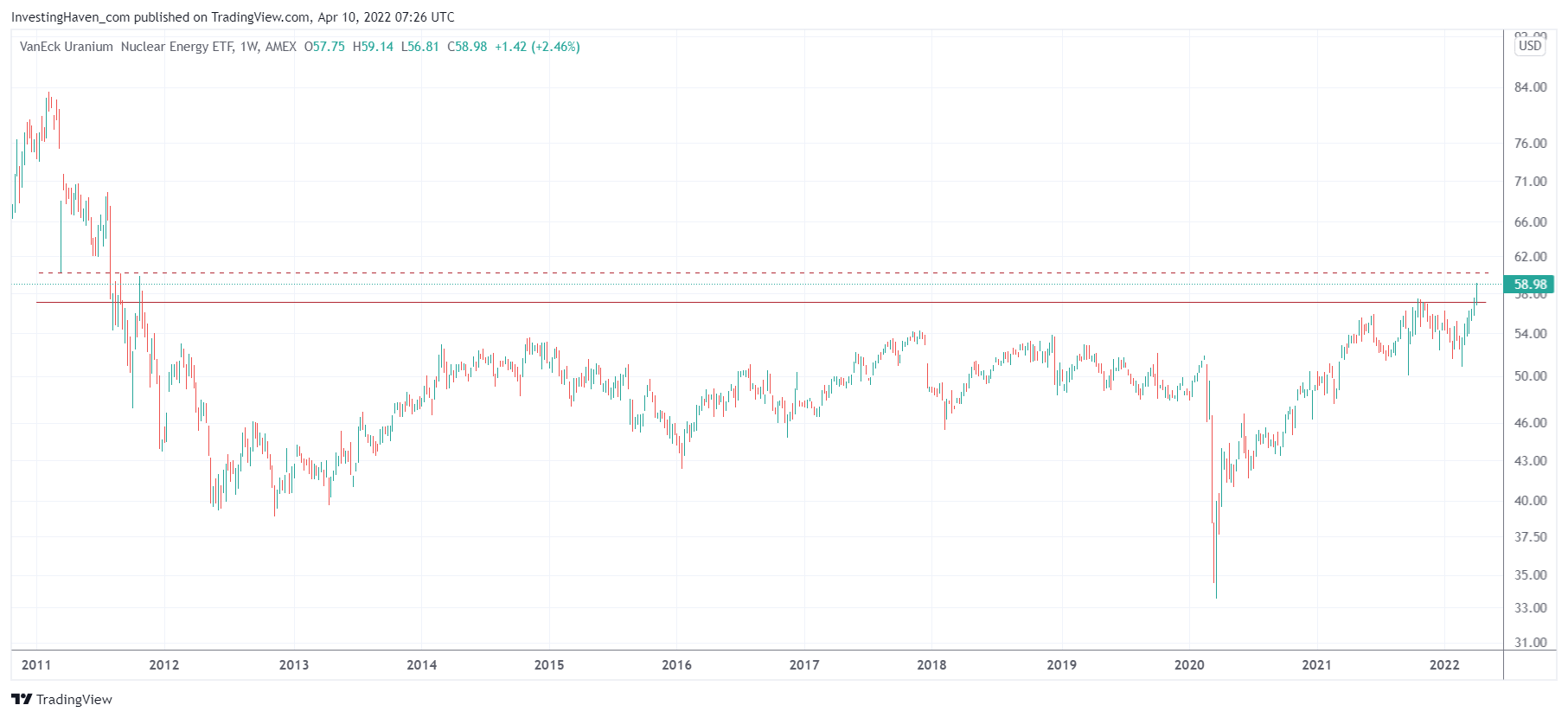

Uranium stocks as per NLR ETF look really strong here. In fact, this ETF just started a secular breakout. Yes, this comes after a really big run in the last 24 months. The final hurdle to overcome is 60 points, however we believe that NLR ETF is well positioned to continue and confirm its breakout!

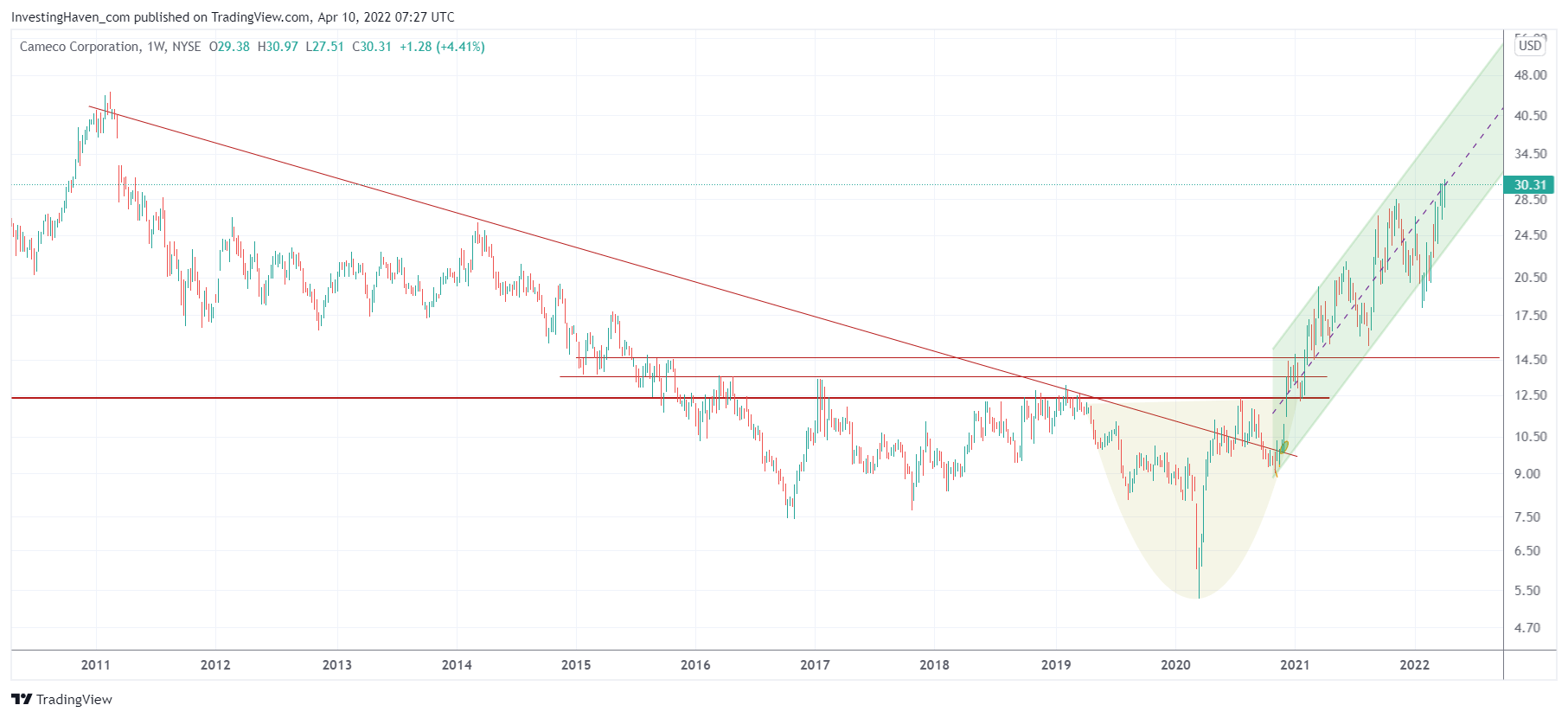

We look at Cameco as the largest uranium stock, on the weekly chart, and see that it is trading approx. 30% below ATH. Given the charts shown above we believe that a test of ATH is in the making. However, the rising channel has to hold as the one and only pre-requisite.

While we are not invested in the uranium market we continue to track uranium as one of the commodities that are on fire. Frankly, we prefer the green battery metals space which is going through a much stronger bull run compared to uranium. Many of our Momentum Investing members are hitting multi-baggers (from 100% to 500% upside) in green battery metals. On April 1st, we featured 3 lithium plays. On March 9th, we featured 2 lithium plays. See Momentum Investing archives. All of them are worth buying, even after some of them went up 30%. We believe lithium stocks will far exceed returns in the uranium market. Moreover, annual members can ask us questions for custom charting (up to 15 custom charts per year), about uranium or any other market (please contact us if you are interested in this).

While we are not invested in the uranium market we continue to track uranium as one of the commodities that are on fire. Frankly, we prefer the green battery metals space which is going through a much stronger bull run compared to uranium. Many of our Momentum Investing members are hitting multi-baggers (from 100% to 500% upside) in green battery metals. On April 1st, we featured 3 lithium plays. On March 9th, we featured 2 lithium plays. See Momentum Investing archives. All of them are worth buying, even after some of them went up 30%. We believe lithium stocks will far exceed returns in the uranium market. Moreover, annual members can ask us questions for custom charting (up to 15 custom charts per year), about uranium or any other market (please contact us if you are interested in this).