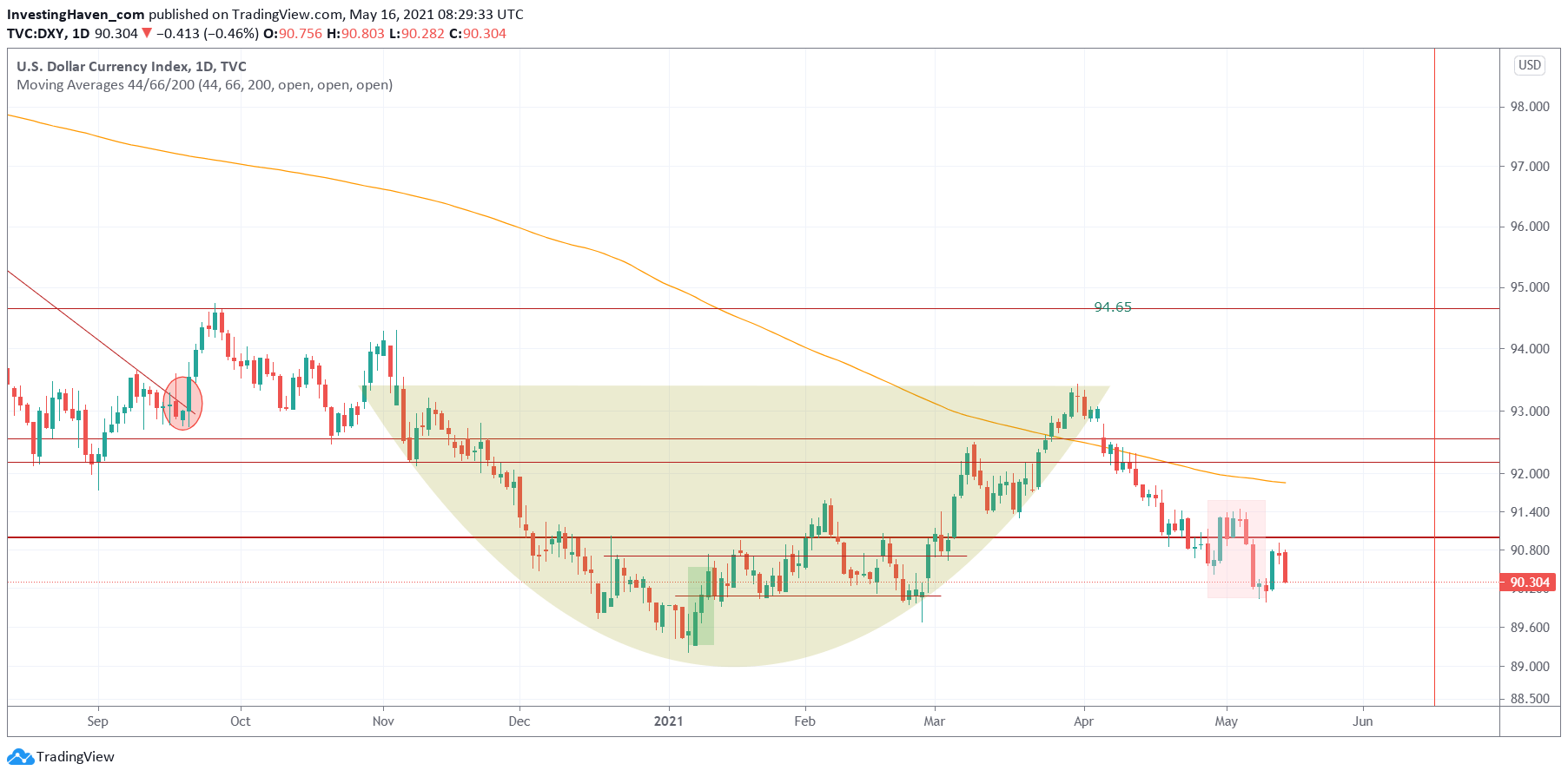

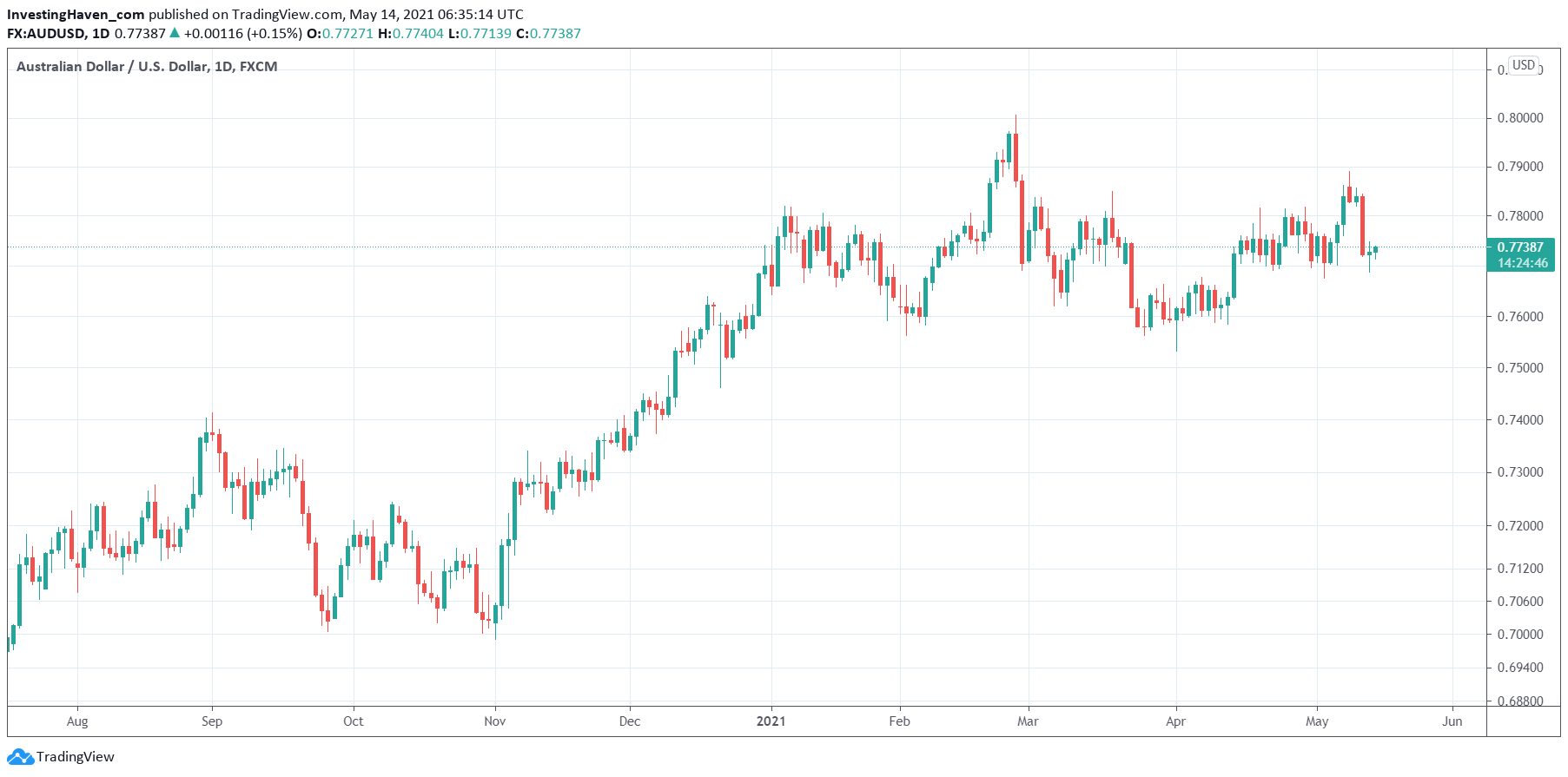

Commodities require a weak USD to do well. The USD chart currently looks weak. Moreover, the Australian Dollar continues to be bullish. We believe this combination is a great setup for us to forecast that commodities which should continue to do well in the short to medium term.

It was a very volatile weak in markets and commodities.

It’s one week ago that we wrote about wheat:

Wheat: Among The Most Powerful Commodities In 2021

Wheat was pretty volatile, but still has a bullish bias especially because it’s coming out of a giant basing pattern. We buy reversals, we are very selective buying ATH or other ‘tops’.

It was even more volatile in a few other commodities, think of some base metals and agriculturals.

On the other hand precious metals did very well: gold, silver, platinum recovered after some ‘bullish selling’ mid-week.

This brings up the question: what to expect from commodities in the short to medium term?

If anything, both the USD and the AUD charts suggest the party is not over yet in commodities. Obviously, there are so many segments in commodities that we have to look at them one by one for an in-depth view. We’ll generalize commodities as a group in this article.

The USD chart complete a bearish micro pattern last week, see small red box on below chart. The USD is also below its 200 DMA, one we do not follow and certainly don’t include it in our methodology. We just have fun watching it from time to time. It is starting to flatten though, so this might play a role in a few weeks or months from now.

The AUD is now turning bullish after some hesitation a few weeks ago. We require the AUD to move above 0.79 points to be strongly bullish.