Gold miners are coming to life. We believe they are approaching a ‘buy’ area. They are just not ready yet. Gold miners flashed a serious wake-up call, not yet a buy signal. Our shortlist with momentum stocks now has gold miners top of the list. We are eagerly waiting to deploy our capital in this sector. The moment is almost there, and it is clear that gold miners will largely outperform broad stock markets during at least one 3 month cycle in 2022. At the same time, we believe gold miners are confirming our bullish 2022 gold forecast and silver prediction.

Gold miners are known to be very volatile. Bullish momentum can push these stocks double and triple digits higher in a matter of months. The opposite is true as well: better be sidelined when bearish momentum is picking up in the precious metals market.

One might wonder why gold is rising. In the end, the Fed is pushing to raise rates, and rising rates are not good for gold.

Let’s try to answer this fair question in a candid way: it’s pointless to try to find the ‘reasons’ for gold’s rise. Let’s face it: markets are ‘confused’, pushing in all directions for nearly 4 months now. If anything, there is one thing we do know: nobody knows, even the market is clueless.

Here is the more factual answer: there are so many opposing forces at work. Other than the effect of rising rates induced by the Fed, there is a huge monetary inflation, historic level of price inflation and now producer price inflation is picking up as well, economic activity is heating up, and so on.

These macro economic trends are conflicting.

The market is trying to figure out which trend(s) will win.

The fact that there is no sustained trend in the last 4 months means that multiple trends might ‘win’. It also means it’s not clear, at this point in time, which trend(s) exactly will win.

In sum, it makes perfect sense for gold to start rising. All we need is a confirmation of a sustained uptrend. Once we have a confirmed uptrend in gold, we know that the market sees an ‘inflationary reason’ to justify higher gold prices.

Stated differently, we prefer to turn the viewpoint around: we look at markets to understand which macro-economic trend is taking effect.

Whenever things are complicated we better simplify things.

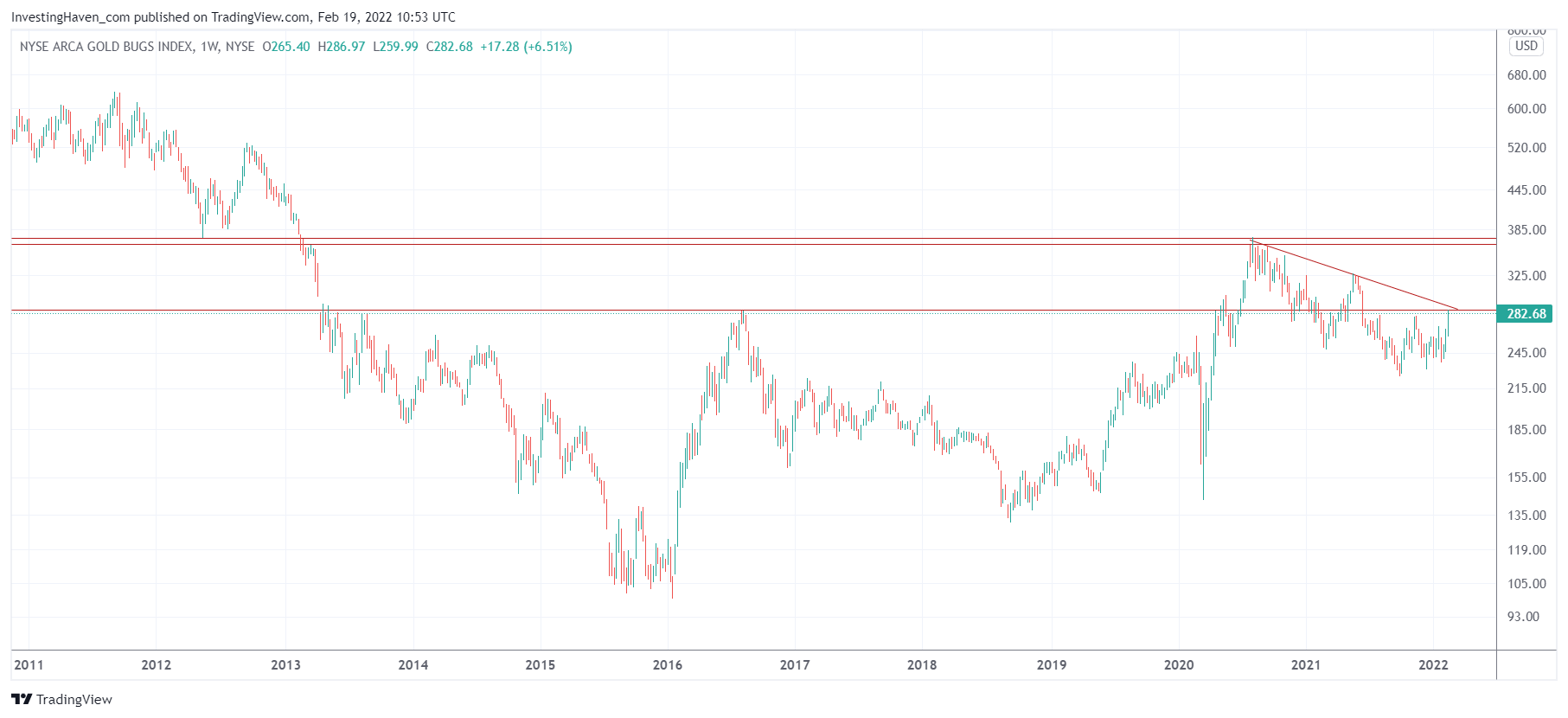

Gold miners have a clearly confirmed bottom now. They may have not yet confirmed a breakout but we believe it is a matter of time until a breakout will occur.

The monthly HUI chart makes the point. Besides, it also shows a huge bullish reversal, sort of a giant W with a handle. A pretty special setup, to say the least.

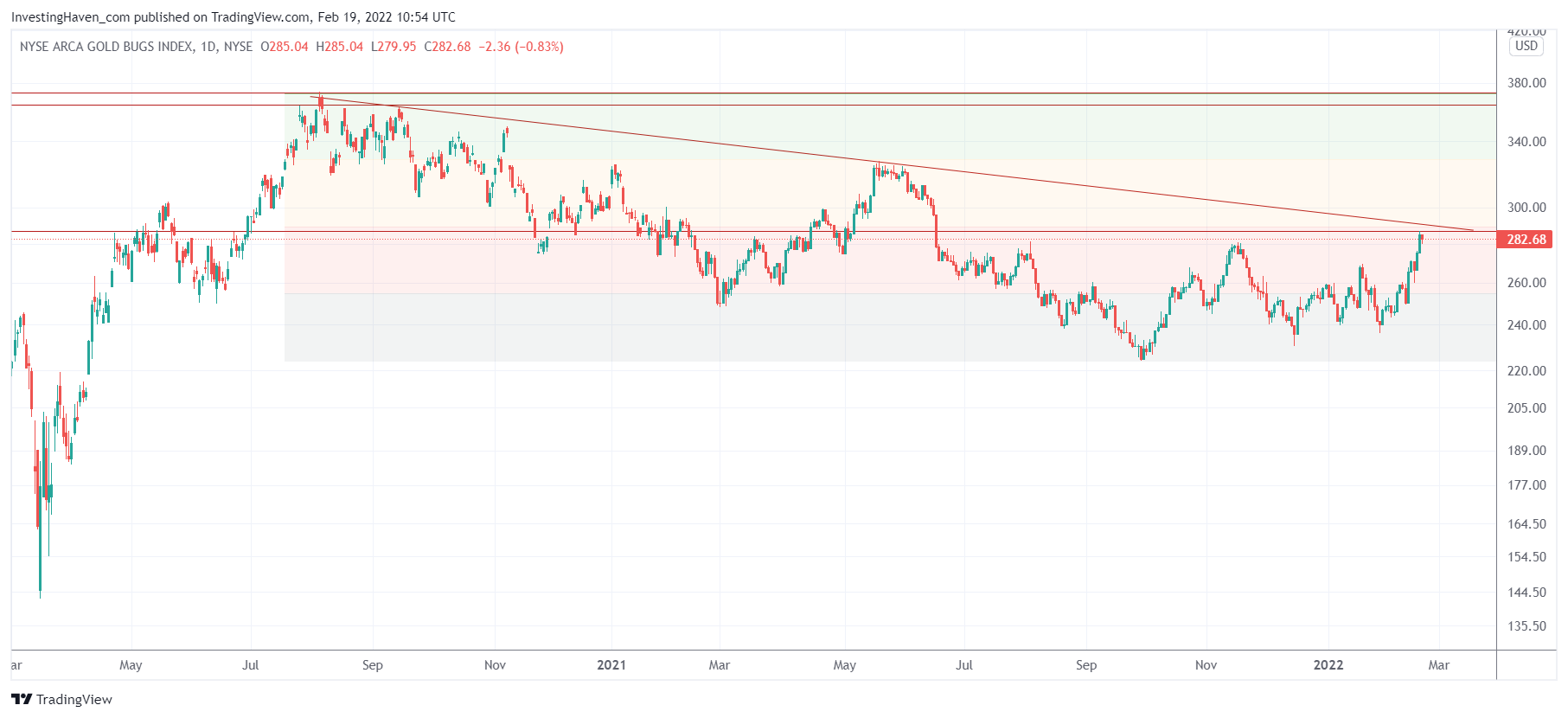

The daily gold mining index HUI shows the ongoing reversal (which is the ‘handle’ on the above monthly chart). This is a bullish setup, but it’s hitting double resistance now. We believe gold miners will overcome this resistance but it needs some more time.

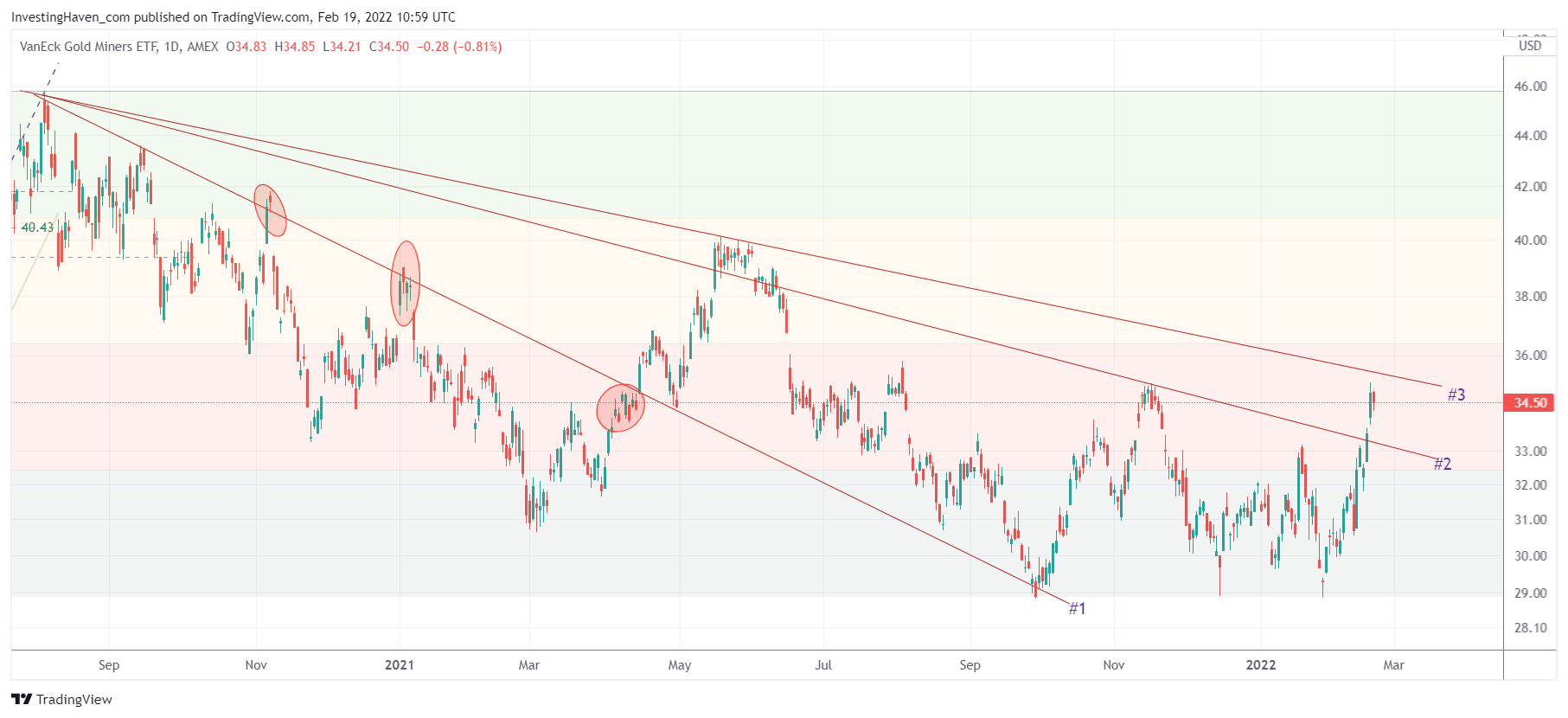

Another gold mining index is GDX ETF.

Same story: a bottom formation has been setup, but this index is close to hitting resistance. We expect that GDX will print a bullish micro pattern between trendlines #2 and #3. It will come with the bullish energy that’s required to start a breakout with 40 as a first target and 46 as a second target.

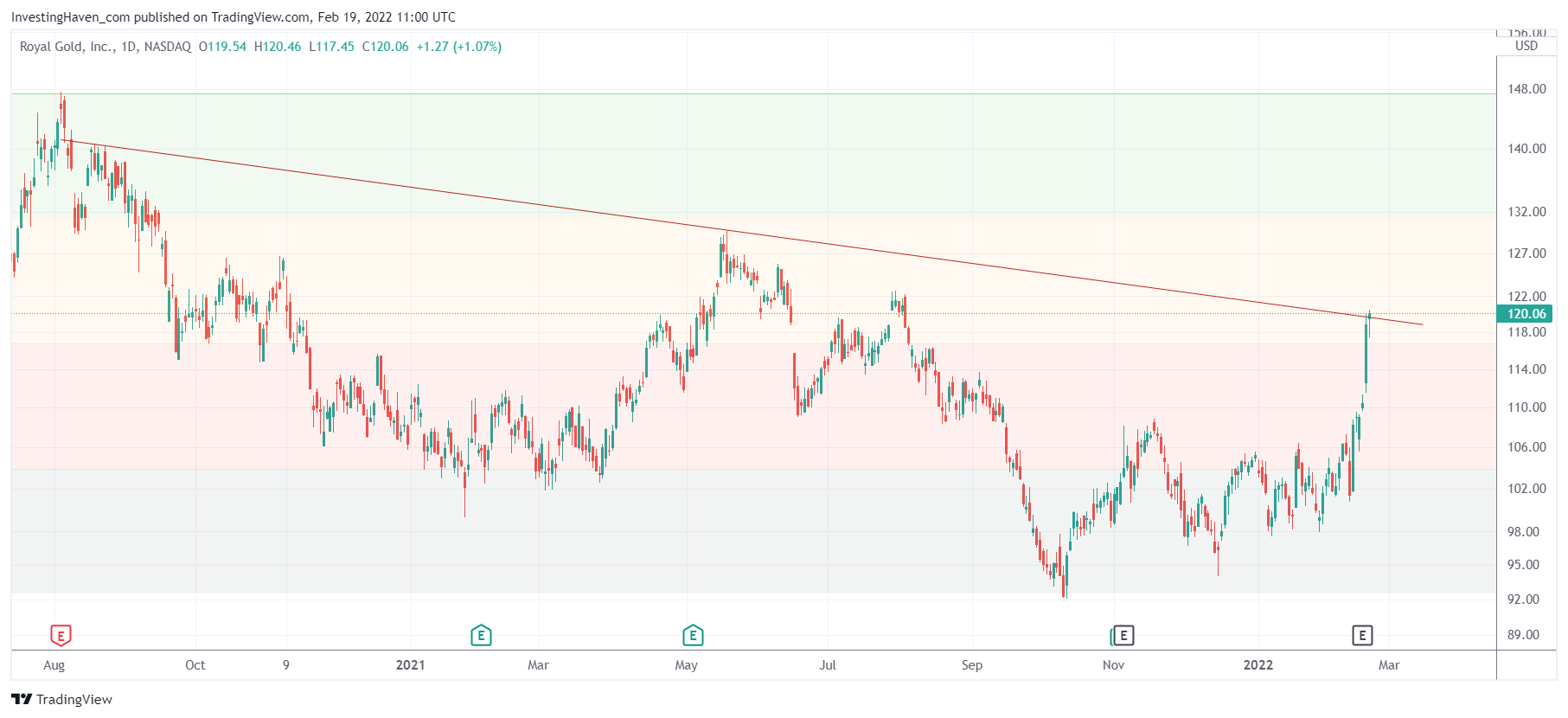

One of the most beautiful setups in GDX or in the HUI is Royal Gold (RGLD). This stock is also hitting resistance, but it’s a stock to closely track and it probably is justified to consider ‘buying the dip’.