Bitcoin is about to touch 50k. An historic moment is upon us. The day BTC touches 50k the entire world will be watching as it may be major resistance simply because of the fact that it’s a rounded number. In the end BTC was stopped by a similar number, 20k, more than 3 years ago. However, given ultra bullish momentum in the crypto sector BTC might truly crush this 50k level. Our bullish crypto predictions for 2021 are already achieved and exceeded, with the exception of our XRP forecast which became a drama thanks to the SEC allegations.

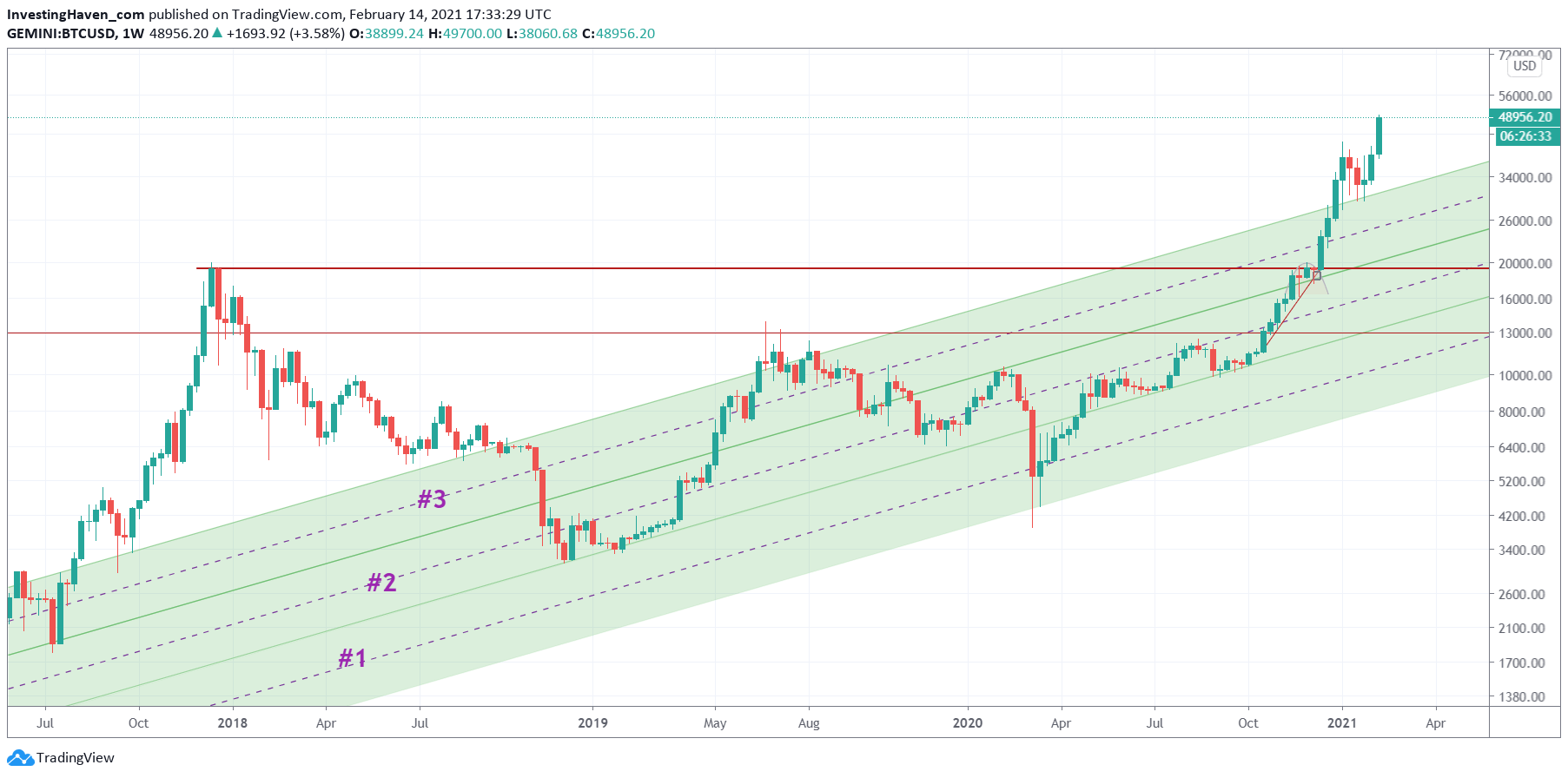

It’s interesting for crypto analysts. BTC has multiple chart setups. Depending on how you look at the long term BTC chart you can find multiple trend channels.

Makes it very challenging to spot turning points, as there is some ambiguity on which trend channel exactly is dominant on BTC’s chart.

To illustrate this, we used to work with this one channel which is visible on the long term BTC chart featured below.

As it stands, BTC turned the top of this long term channel into support, three weeks ago, at the lows of its January consolidation.

That’s why crypto analysts always need to be on the look out for all possible trend patterns that are available on the BTC chart. We had found 2 of them, and the most bullish one (not the one below) seems to be dominant now.

What does this most bullish chart pattern suggest? BTC has a first target between 71 and 76k, and the most bullish one around 140k. We are not saying that BTC will meet all these targets! We are saying that those are the most obvious turning points.

Moreover, we cannot exclude that 50k will be this magic number that the market cannot overcome. There is no resistance at 50k as per our charts, but there is a potential imaginary resistance level in the minds of investors (and shorters). So better be careful to spot a potential trend change around 50k, and certainly don’t initiate new positions at this point in time as it’s too late in the bullish cycle.