Cryptocurrencies will go higher as per our crypto predictions. Bitcoin will go higher as per our BTC forecast. XRP will go higher as per our XRP forecast. The latest and greatest cryptocurrency charts show this, and the entire space is about to start a rally again. Too bad for the bears that thought to be smart and start shorting BTC as well as other cryptocurrencies a few weeks ago. As it mostly goes the herd gets into a trade near the end. Anyone who thought to be smart and short cryptocurrencies should have done it in June or July of last year, not after a retracement of +50% obviously. Bitcoin’s long term chart has one clear signal: crypto bull market #3 is in tact and about to start a major move higher. How to play is what we explain in our new crypto investing strategy for 2020, outlined in great detail in our crypto investing research area.

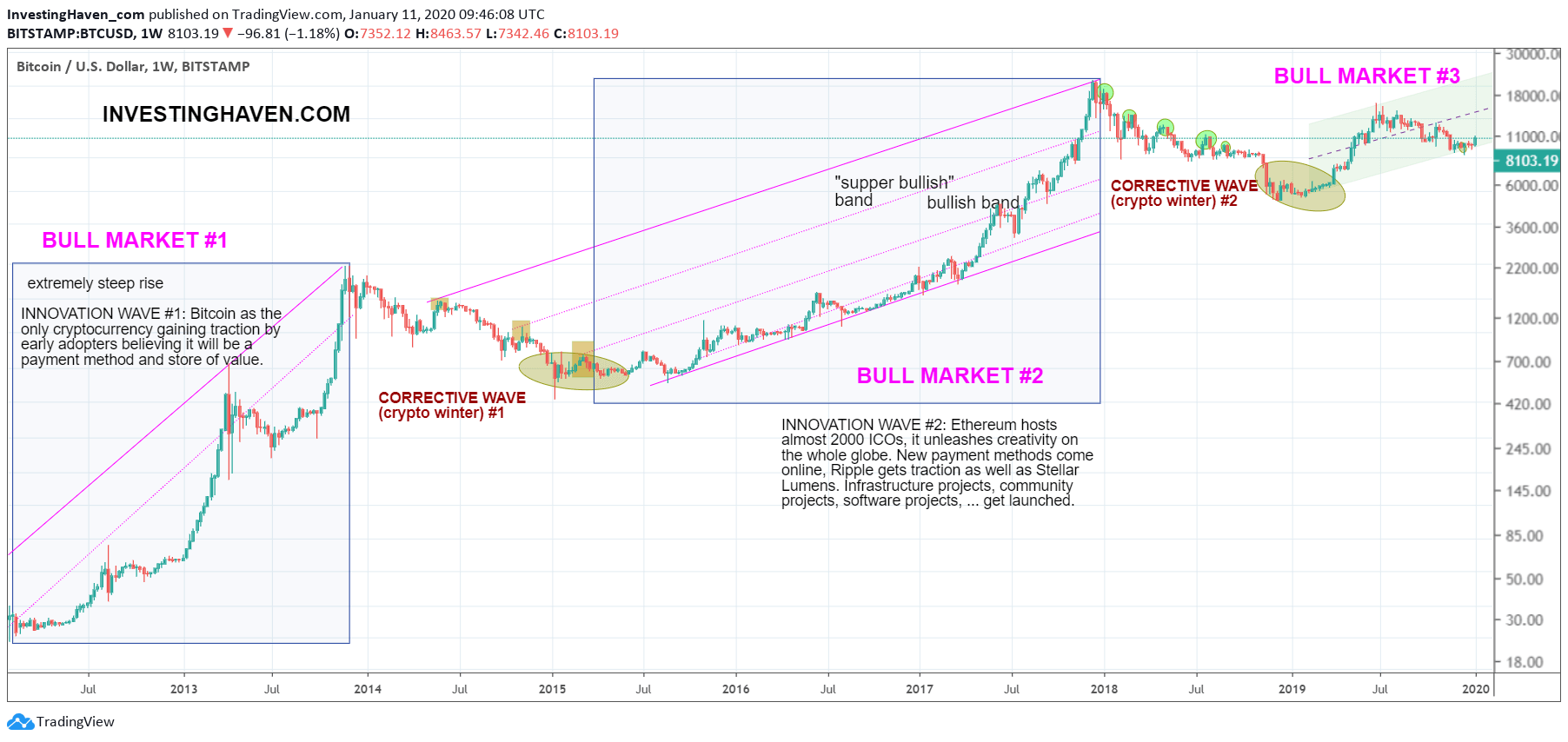

Look at the long term BTC chart.

As said so many times a trend is a trend until proven otherwise.

It is just 3 weeks ago that the entire world was thinking ‘the end of the crypto market, the end of Bitcoin’. This conviction became apparent by the countless messages did we receive over here at InvestingHaven.

That’s when we called the bottom, and wrote this in our crypto investing research:

The whole world is now looking at the same BTC chart with the same downtrend. Everyone around you gets in the same mindset, and people write messages that confirm that view. So it’s a vicious circle, almost a self fulfilling prophecy. This is dangerous, very dangerous! It may signal that the tide is turning.

This quote was sent to crypto investors two weeks after what now seems to be THE bottom of the 2019 retracement.

More importantly probably is this quote written the same day, and published in our research area:

Shorters are running out of steam! Watch out if want to short a market, because once critical mass is lost there is a very (very) nasty effect among shorters which is called SHORT SQUEEZE. This effect is unique to short selling situations, and does not exist in the opposite direction. A short squeeze occurs very fast and is very aggressive. Shorters give up once they see their shorting level is not holding. This is a mass reaction which is why short squeezes are so violent. The chart still follows the bullish pattern in the form of a rounding formation. This might take some time to complete. Things will not ‘feel’ bullish, but this formation is a setup for a bullish outcome which is what matters in the end!

Crypto investors following InvestingHaven have an edge. Sometimes it needs time to translate this edge into profits, but that’s mostly (if not always) due to market conditions.

It really was no coincidence, nor a perma bullish mindset when we wrote Bitcoin Selloff Respects Support, Will Trigger Epic Battle Between Bears and Bulls right at the depth of the sell off in December of 2019. As said a trend is a trend until proven otherwise.

Bitcoin has proven to remain in a bull market, and that’s the message of the monthly chart which shows the dominant pattern.

Want to know more about our new crypto investing strategy for 2020 and beyond? Sign up now, and receive a crypto alert on Monday January 13th, 2020.