BTC Price Predictions

This article covers the latest Bitcoin price prediction and long-term BTC forecast for 2026, 2027, 2028, 2030 and beyond. Backed by analysis of market trends, investor sentiment and technical patterns

- [UPDATE January 2026] – Regardless of the recent drop, Bitcoin remains firmly within its bullish structure, confirming our earlier outlook. Our Bitcoin price prediction points to a break out rally in 2026.

Taking a long term approach to Bitcoin investing, we remain confident in the price prediction for 2026 and expect positive growth with BTC working it’s way towards $180,000 and beyond.

How much will your Bitcoin be worth?

Based on your prediction that the price of Bitcoin will change at a rate of 8% every year, calculate your price prediction return on investment below.

🔑 Key Takeaways – Bitcoin Price Prediction 2026

- Forecast range for 2026: $80,000 – $200,000

- Average analyst target: Around $150,000

- Bullish drivers: ETF inflows, institutional adoption, and bullish technical patterns

- Major support zone: $70,000 – $75,000

- Worst-case scenario: Pullback to $70,000–$75,000, while upside potential remains toward $200,000

Overall outlook: The Bitcoin price prediction for 2026 remains bullish, supported by strong macro and technical indicators.

Bitcoin price predictions overview

| Year | BTC price prediction |

|---|---|

| 2026 | $80,840 - $151,500 |

| 2027 | $100,000 - $189,900 |

| 2028 | $215,000 |

| 2029 | $255,000 |

| 2030 | $277,000 |

| 2031 | $300,000 |

BTC predictions for 2026 from top forecasters:

- Most 2026 Bitcoin forecasts cluster in the $120,000–$175,000 range, with broader analyst bands spanning $75,000 to $225,000. Frequently cited forecasters such as Carol Alexander, CoinShares, Standard Chartered, Nexo, and Maple Finance point to continued institutional adoption and post-cycle normalization as key drivers, supporting a consensus view of six-figure Bitcoin prices in 2026.

BTC timeline forecast (January 2026 Update):

- Our chart analysis leads us to a prediction that Bitcoin is reaching the end of a consolidation period, the last 6 weeks BTC has traded in a tight range but we expect a breakout in the early part of 2026.

- Bitcoin is entering its next bullish window in early 2026, consistent with our long-term cycle analysis. Our latest Bitcoin price prediction anticipates continued upside momentum in the months ahead, supported by improving market structure and investor sentiment.

- We expect bitcoin to set new all-time highs before the end of 2026.

Table of contents

- BTC Price Prediction 2026

- BTC Price Prediction 2027

- BTC Price Prediction 2028

- BTC Price Prediction 2030

- BTC Price Predictions by Top Forecasters

- BTC Price Predictions from Institutions

- BTC Price Predictions from Banks

- BTC Price Predictions Online

- BTC Price Predictions: Industry Study

- Bitcoin to $1 Million Prediction

- Bitcoin Price Drop Predictions

- Bitcoin Price Prediction Tomorrow

- Bitcoin Predictions day-by-day

- Bitcoin Historical Prices

- FAQs

Bitcoin Price Prediction for 2026

Bitcoin price prediction 2026 – Bitcoin’s long-term bullish chart pattern points to a new ATH in 2026. Bitcoin’s forecast for 2026 ranges from a minimum of $80,840 to a maximum of $151,150 with the institutional wave acting as the ultimate catalyst.

January 2026 BTC Prediction – Bitcoin remains within it’s upwards trend in 2026, despite some recent pullbacks we expect to see some explosive moves for BTC soon.

We will be watching Bitcoin closely in 2026 and will identify possible key entry points in our Premium crypto alerts along with other crypto assets that we think have much more explosive potential this year.

Bitcoin price predictions for 2026:

| Year | Price move | BTC price forecast |

|---|---|---|

| 2026 | Lows to highs | $80,840 - $151,500 |

| 2026 | Stretched target | $174,000 - $181,000 |

| 2026 | Buy the dip | $78,000 - $82,000 |

| 2026 | Invalidation | < $29,830 |

GO PREMIUM – Receive crypto market analysis and token tips >>

BTC predictions from top forecasters

A selection of the most reliable and reputable Bitcoin forecasters

Bitcoin predictions for by a selection of premium Bitcoin forecasters are all bullish. The Bitcoin price prediction of this group of experts is unanimously bullish with Bitcoin targets up to $225,000 for 2026.

Our assessment – This is a group composed by highly reliable experts, selected based on our expertise. Their viewpoint is solid, often also unbiased because they communicate as individuals (not as an organization or institution).

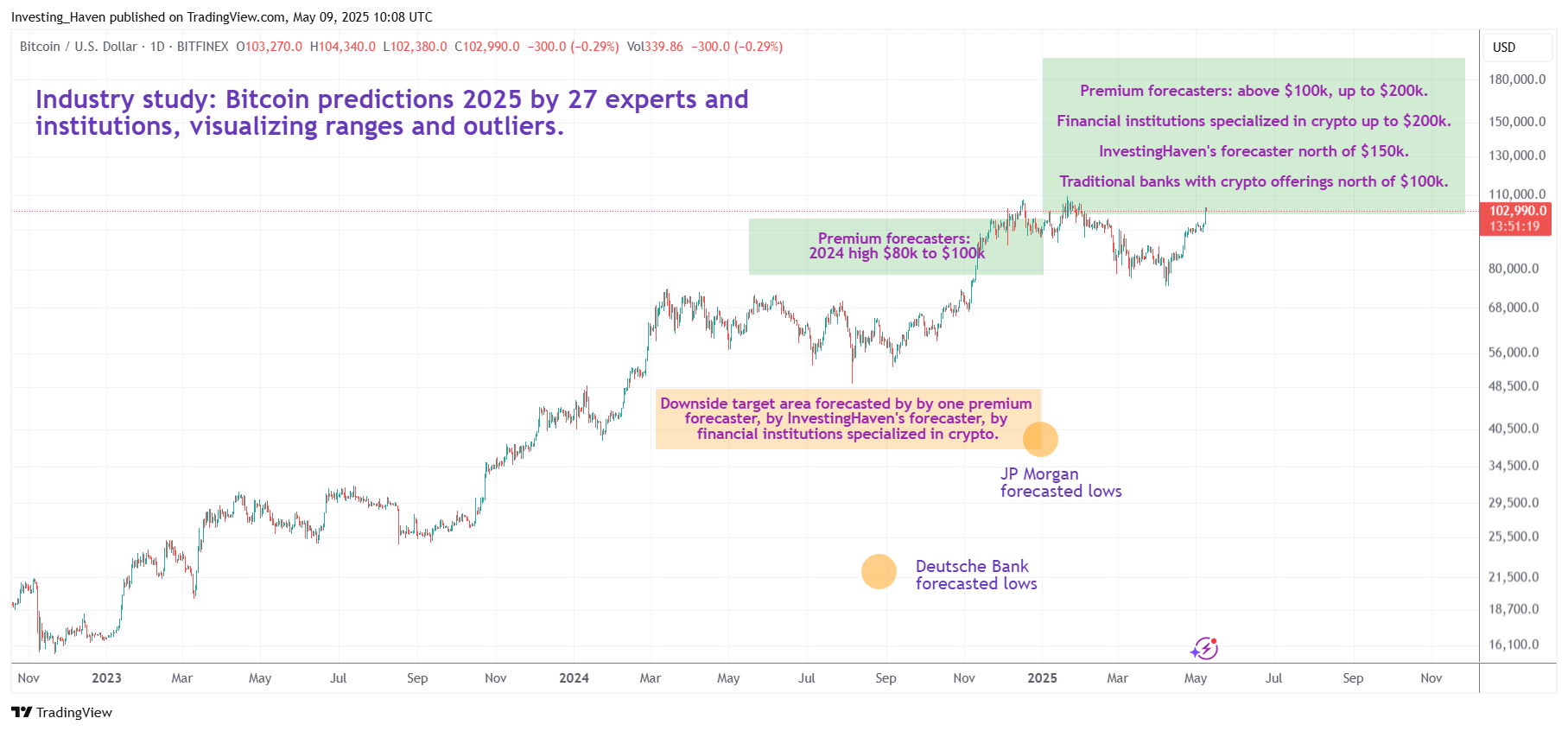

27 Bitcoin predictions summarized on one chart

| Forecasters | Bitcoin price predictions |

|---|---|

| Mike Novogratz | Bitcoin prediction of $100,000 - $140,000 in 2026 |

| Peter Brandt | BTC forecast for 2026 Bull market target of $200,000. |

| Gerber Kawasaki | Bitcoin prediction directionally bullish, no specific price target given. |

| Samson Mow | Bold Bitcoin Price Prediction of $1,000,000 |

| Tone Vays | BTC forecast with lows of $39,000 enabling a bullish BTC forecast 2026 of $200,000. |

| Larry Fink, BlackRock CEO | Bitcoin prediction directionally bullish, no specific price target given. |

CHECK – Our recent multi-bagger successes from 3x to 30x >>

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here

Bitcoin Price Prediction for 2027

Bitcoin price prediction 2027 – In 2027, Bitcoin (BTC) is forecasted to trade between a minimum price of $99,910 and a maximum price of $200,000. This is a rather conservative forecast, and assumes some volatility in broad markets. In the best case outcome, Bitcoin will exceed $200,000 in 2027, assuming limited upside in the US Dollar and continued crypto adoption by institutions.

Bitcoin Price Prediction for 2028

Bitcoin price prediction 2028 – In 2028, Bitcoin (BTC) is forecasted to trade above $200,000. This bullish forecast assumes continued interest by financial institutions in crypto as an asset class. Pre-requisite: BTC clears $126,000 in 2026, and respects $100,000 support by 2027.

Bitcoin Price Prediction for 2030

Bitcoin price prediction 2030 – Bitcoin is expected to hit and exceed $200,000 at a certain point before 2030. Bitcoin maximum price targets before 2030 are round numbers: $200,000 followed by $250,000.

BTC predictions from institutions

Bitcoin predictions from financial institutions that are engaged in crypto markets – obviously very bullish

Crypto-focused financial institutions are unanimously bullish on Bitcoin predictions. Many of these institutions avoid specific targets but they predict significant upside potential in Bitcoin’s price. Those with Bitcoin targets see BTC rising well above $100,000 by 2026.

Our recommendation – We advise to be mindful of bias in predictions by institutions that are fully dependent for their revenue on the crypto market.

| Specialized institutions | Bitcoin price predictions |

|---|---|

| Galaxy Digital | Projects Bitcoin path towards 250,000 by 2027, with options pricing wide 2026 outcomes (roughly 50,000–250,000). |

| Fidelity | $1 Billion by 2038-2040 |

| VanEck | Predicts Bitcoin 2026 ranges of 130,000–200,000 driven by banks and asset managers. |

| Pantera Capital | Bitcoin price prediction of $148,000 and BTC at $740,000 by 2028 |

| Grayscale | Bitcoin forecast directionally bullish, no specific price target given. |

| Blackrock | Bitcoin forecast directionally bullish, no specific price target given for short term. BTC prediction of $700,000 over the longer term |

| Matrixport | Bitcoin prediction bullish with no specific value for 2026 |

| Bitwise | Bitcoin prediction 2026 could exceed $200,000 |

| Bernstein | Bitcoin prediction 2026 up to $200,000 |

| Microstrategy | Bitcoin prediction 2026 up to $125,000 and $1,000,000 by 2035 |

Bitcoin price predictions from traditional banks

Bitcoin predictions from traditional investment banks – it depends their crypto affinity

Bitcoin predictions from traditional investment banks vary from very bearish to mildly bullish. Some important findings:

- What is striking is that several of them are actively exploring offering Bitcoin-related services, which indicates that there is a growing interest from that group to benefit from Bitcoin’s secular uptrend.

- Banks that are not actively looking to offer crypto services tend to be much less bullish to even outright bearish.

Our recommendation – We advise to be mindful of bias in predictions by investment banks.

| Investment banks | Bitcoin price predictions |

|---|---|

| JP Morgan | 6-12 month target in the roughly 150,000–170,000 and expects Bitcoin to outperform Gold in 2026 |

| Deutsche Bank | Outlook for Bitcoin is Bullish but with no specific price target |

| Goldman Sachs | Directionally bullish BTC outlook because of institutional adoption. |

| Morgan Stanley | Directionally bullish BTC outlook because of institutional adoption. |

| Standard Chartered | Directionally bullish with a long term Bitcoin forecast of $150,000 by the end of 2026 |

BTC predictions from popular online outlets

Bitcoin predictions by popular online outlets using machine learning

The Bitcoin price prediction shared by popular online outlets typically use machine learning models:

- They don’t tend to predict a dip which is not realistic, markets don’t move in one straight line.

- Most often, it’s very hard to spot a turning point in those BTC predictions which is not convenient.

Our recommendation – We do know from experience that machine learning models have a capacity to accurately predict the short term but require a bias to predict the long term, be mindful of this also when assessing our own predictive model’s output.

| Online popular outlets | Bitcoin predictions 2026 |

|---|---|

| CoinDCX | Predicts a range of $110K–$140K for Bitcoin |

| Coinpedia | Coinpedia projects strong upside over the coming years, with Bitcoin expected to trade in the mid- to high-six-figure range in bullish scenarios |

| Coincodex | CoinCodex uses algorithmic and technical models, producing more conservative forecasts that typically place Bitcoin in the low six-figure range |

| Changelly | Changelly focuses primarily on short-term and near-term price movements, offering tactical Bitcoin forecasts rather than long-term valuations. Its outlook is generally moderately bullish |

A cross-industry study of Bitcoin price predictions for 2026

| Industry participants | Bitcoin price predictions |

|---|---|

| Premium crypto forecasters | Directionally bullish but cycle-aware. Leading analysts view 2026 as a consolidation year after the 2025 peak, with Bitcoin holding elevated levels amid volatility rather than setting aggressive new highs. |

| Financial institutions specialized in crypto | Structurally bullish. Firms like Fidelity, VanEck, and MicroStrategy expect Bitcoin to sustain six-figure valuations in 2026, supported by ETFs, institutional custody, and long-term adoption trends. |

| InvestingHaven's top forecaster | Very bullish long term with BTC target north of $150,000. |

| Traditional banks | Cautiously bullish. JPMorgan, Deutsche Bank, Goldman Sachs, and Morgan Stanley cite institutional adoption and macro positioning, expecting Bitcoin to remain resilient without issuing specific price targets. |

| Popular online outlets | Generally bullish. Retail-focused platforms project Bitcoin staying in a six-figure range in 2026, though forecasts are model-based and less precise than institutional outlooks. |

Bitcoin price drop prediction

The recent drop in Bitcoin’s price appears healthy, as it continues to trade well above key support levels.

- A pullback will remain super bullish if Bitcoin respects the $80,000 support zone, with $75,000 acting as a deeper safety net in the event of further dips.

On the upside, a decisive break above $120,500 could pave the way toward $130,000+ in 2026, driven by bullish chart formations, sustained ETF inflows, and accelerating institutional adoption.

| BTC price drop | Outcome | Predicted probability |

|---|---|---|

| $110,000 | Very bullish | High |

| $108,000 | Bullish | High |

| $75,000 | 50% - Bullish | Medium |

| $55,000 | Bearish | Low |

| $40,000 | Extremely bearish | Very low |

Bitcoin to $1 million predictions

Can Bitcoin ever hit $1,000,000?

According to InvestingHaven.com’s analysis, Bitcoin is unlikely to hit $1 million before 2030. Current blockchain limitations (performance, speed, scalability), evolving regulations, global economic conditions, and overall market dynamics make such a valuation unrealistic in the near term. A $1 million price would also be out of alignment with the valuation of global economies, major companies, and comparable asset classes.

Who is predicting Bitcoin to hit $1 million?

Be careful with Bitcoin to $1 million predictions. The people forecasting BTC to $1,000,000 either have no track record forecasting Bitcoin or use a thesis that is based on incorrect market dynamics. Obviously, there are forecasts made as click baits; they are not backed by a methodology nor rational framework.

Can BTC ever hit $1,00,000? Read InvestingHaven’s in-depth analysis.

Bearish Bitcoin predictions

Bearish Bitcoin price predictions

The most cautious credible forecasts see Bitcoin dropping to the $70K–$75K range if key support fails, with an extreme stress-test low near $55K–$57K in a severe macro downturn. Analysts like Tyler Richey (Sevens Report) and 10X Research highlight these levels as possible in worst-case scenarios. Peter Brandt assigns a 25% probability to such a pullback, noting that a deep drop could set up a strong bullish recovery.

Bitcoin crash predictions

Perennial Bitcoin skeptics have predicted a crash for years while BTC trended higher. Notable “perma-bears” such as Nouriel Roubini continue to forecast collapse, but their past records have been poor. While extreme crash calls persist, most reputable 2026 outlooks still see Bitcoin holding well above $55K even in the harshest scenarios.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here

BTC prediction tomorrow (coming soon)

Bitcoin price prediction tomorrow:

Today, Bitcoin trades at 70490.71. Tomorrow, February 10, 2026, BTC is forecasted to move to 0, a change of 0.00%.

Bitcoin predictions day-by-day (coming soon)

Over the next 30 days, Bitcoin is predicted to see the following price range:

We are renewing the predictive model with an AI capability – day by day predictions will be back soon.

Current Bitcoin price

Bitcoin price, trading, market cap (source):

| Symbol: BTC |

| Name: Bitcoin |

| Price: $70490.71167767 |

| Circulating supply: 19986459.00000000 |

| Total supply: 19986459.00000000 |

| Volume 24h: 40967034792.20800000 |

| Percent change 1h: -0.316% |

| Market cap: 999999999999.99999999 |

Bitcoin Historical Prices

2010: The Genesis Block

Bitcoin made its debut in 2010, with its first recorded price at just $0.003 per BTC. Trading was limited, and few recognized its potential. Despite the humble beginnings, Bitcoin laid the groundwork for a revolution in digital finance. The first block was actually mined in 2009, with the words “The Times 03/Jan/2009 on brink of second bailout for banks” inscribed.

2011: Early Adoption

As awareness of Bitcoin grew, so did its price. In 2011, BTC reached parity with the US dollar, trading at around $1 per coin. The coin gained traction among tech enthusiasts and libertarians, heralding the beginning of a new era in finance. At this stage, it was viewed much like a meme coin such as Doge, with no serious potential.

2012: Price Volatility

Despite its growing popularity, Bitcoin’s price remained highly volatile in 2012. Prices fluctuated between $5 and $13 per BTC, reflecting the speculative nature of the market. However, this volatility did not deter early adopters, who saw the long-term potential of digital currency. The mainstream media was mainly hyper-critical of the token and remained that way until 2024, when it became institutionally acceptable.

2013: The Bull Run Begins

In 2013, Bitcoin experienced its first major bull run, with prices soaring to over $1,000 per BTC by the end of the year. The meteoric rise captured the attention of mainstream media and investors worldwide, sparking a frenzy of buying and speculation. However, this rapid ascent also raised concerns about the sustainability of the rally.

2014: Mt. Gox Collapse

The optimism of 2013 was short-lived – the collapse of the Mt. Gox exchange sent shockwaves through the cryptocurrency community. Prices plummeted, falling from over $1,000 to below $400 per BTC. The incident highlighted the risks associated with centralized exchanges and the need for tighter security measures in the industry. Others stated that crypto was never meant to be kept in centralized exchanges in the first place.

2015: Market Recovery

Despite the fallout from the Mt. Gox debacle, Bitcoin began to recover in 2015. Prices stabilized around $200 to $300 per BTC, as investors regained confidence in the resilience of the cryptocurrency. The focus shifted towards building a more secure and sustainable ecosystem for digital assets.

2016: Halving Hype

The Bitcoin halving in 2016 generated renewed interest in the cryptocurrency, as supply dynamics came into focus. Prices started to climb, reaching over $700 per BTC by the end of the year. The event underscored Bitcoin’s deflationary nature and its appeal as a store of value in an uncertain economic landscape.

2017: The Year of the Bull

2017 was a watershed moment for Bitcoin, as prices surged to unprecedented heights. BTC reached an all-time high of nearly $20,000 per coin, driven by a perfect storm of institutional interest, retail FOMO, and mainstream adoption. However, the rapid ascent also led to concerns of a potential bubble and regulatory crackdown. The same day that futures were launched on major exchanges, BTC prices fell, leading some to cite insider trading and fraudulent activities..

2018: The Crypto Winter

The euphoria of 2017 was short-lived, as Bitcoin entered a prolonged bear market in 2018. Prices plummeted, falling below $4,000 per BTC, as regulatory uncertainty and investor fatigue took their toll. The ICO industry was also rife with hacks and scams, which scared away some of the more influential investors.

2019: Signs of Recovery

Despite the challenges of the previous year, Bitcoin showed signs of resilience in 2019. Prices gradually recovered, climbing back above $10,000 per BTC by mid-year. Institutional interest also began to grow, with major corporations and financial institutions exploring the potential of digital assets. The stage was set for a new chapter in Bitcoin’s evolution.

2020: The Halving Effect

The Bitcoin halving in May 2020 once again captured the attention of the market, as supply issuance was cut in half. Prices surged, surpassing $20,000 per BTC by the end of the year, fueled by a combination of institutional adoption and macroeconomic uncertainty. With COVID-19 well underway, the value of BTC as a hedge against inflation was a contributor to its growth.

2021: Institutional Adoption

In 2021, Bitcoin cemented its status as a mainstream asset class, as institutional adoption reached new heights. Prices surged to over $60,000 per BTC, driven by corporate treasuries, investment funds, and billionaire investors. It also prompted other coins to rise in value, as this was the best-performing year for the wider crypto industry. However, regulatory scrutiny and environmental concerns also emerged as key challenges for the cryptocurrency industry. One study in particular about BTC using more electricity than most countries did a lot of reputational damage.

2022: Market Correction

After the euphoria of 2021, Bitcoin faced a market correction in 2022, as prices retreated from their all-time highs. Prices fluctuated between $30,000 and $50,000 per BTC, reflecting a more cautious sentiment among investors. The pullback was seen as a healthy consolidation after the rapid gains of the previous year, providing opportunities for long-term investors to accumulate. As we have always stated at IH, market corrections are wonderful buying opportunities – assets are not going to rise in a straight line forever.

2023: Resilience and Adaptation

Despite the challenges of the previous year, Bitcoin continued to demonstrate resilience in 2023. Prices stabilized around $40,000 to $60,000 per BTC, as the cryptocurrency found support from institutional investors and retail traders alike. The focus shifted towards addressing scalability and sustainability concerns, laying the groundwork for future growth and adoption. The narrative that Bitcoin was a fringe asset had finally died off, and even TradFi investors like Jamie Dimon and Warren Buffet had to reevaluate their assessments.

2024: Bullish Breakout Confirmation

Bitcoin solidified its bullish breakout in 2024, maintaining prices between $36,000 and $75,000. Institutional adoption grew, and mainstream acceptance cemented its position as a core portfolio asset. The year marked the end of the “fringe asset” narrative, as even skeptics acknowledged Bitcoin’s resilience and long-term potential.

2025: Institutional Momentum and New Highs

Bitcoin entered 2025 with strong institutional tailwinds, fueled by record ETF inflows and accelerating corporate adoption. Prices surged to fresh all-time highs above $126,000. While occasional pullbacks tested market sentiment, the overall trend remained decisively bullish. Regulatory clarity in major markets and growing recognition of Bitcoin as a strategic reserve asset reinforced its role as a cornerstone in diversified portfolios.

Bitcoin 2026 FAQs

Is Bitcoin a good investment in 2026?

Bitcoin is considered a strong long-term investment in 2026, with institutional adoption, ETF inflows, and regulatory clarity driving forecasts of $125K–$200K, despite potential pullbacks during the overall bullish trend.

How much will Bitcoin be worth in 2026?

Most analysts expect Bitcoin to be worth between $125K and $200K in 2025, driven by ETF inflows, institutional adoption, and bullish market structure, with worst-case scenarios placing support around $70K–$80K.

Will Bitcoin rise in 2026?

Analysts widely expect Bitcoin to rise in 2026, with forecasts targeting $125K–$200K on the back of ETF inflows, institutional adoption, and strong technical trends, while key support near $70K–$80K underpins the bullish outlook.

What price may Bitcoin reach in 2026?

Bitcoin may reach between $125K and $225K in 2026, according to most analyst forecasts, supported by ETF inflows, institutional adoption, and bullish technical patterns, with downside risk limited by strong support near $70K–$80K.

Bitcoin prediction FAQs until 2030

Will Bitcoin go up or down?

Bitcoin is expected to trend higher through 2030, with many long-term forecasts projecting prices well above current levels — some exceeding $1M — driven by adoption growth, supply scarcity, and institutional investment, though interim pullbacks are likely.

What will Bitcoin be worth in 2030?

Most long-term forecasts see Bitcoin worth well above $500K by 2030, with some projecting over $1M, driven by global adoption, limited supply, and expanding institutional investment, despite potential volatility along the way.

Will Bitcoin ever hit $1 million?

Many long-term forecasts suggest Bitcoin could hit $1M by 2030 or later, driven by increasing adoption, fixed supply, and institutional investment, though timing will depend on market cycles, regulations, and macroeconomic conditions.

How much is Bitcoin worth today?

Today, Bitcoin is worth $70490.71.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here

Disclaimer: The information presented in this article is for informational purposes only and does not constitute financial or investment advice. All opinions are those of the author and should not be interpreted as specific trading or investment recommendations. We do not guarantee the completeness, accuracy, or reliability of this content. Cryptocurrency markets are highly volatile and can experience unpredictable fluctuations. Readers are encouraged to conduct their own research, consider multiple perspectives, and understand local regulations before making any investment decisions.