Bitcoin sold off this week. Pretty painful for the bulls, very gainful for the bears. That’s the short term picture, and certainly interesting for traders. But what about the long term picture which is what investors are interested in? When will the bleeding stop? Did the bull market end? Any reason to be concerned? Those are fundamental questions, and if there is one thing we have figured out is that (crypto) investors do not find the answers in the public domain. Pretty sure any crypto holder was looking for insights this week, as the sell off was happening, in financial and social media, to understand the bigger picture impact. Pretty sure as well this was a waste of time on the one hand and resulted in even more confusion on the other hand.

The big problem with financial + social media is that there is way too much information but hardly any relevant insight for investors.

That’s a big, big problem for two reasons.

The problem: information on the internet is useless

First, investors looking for information are wasting their precious time. They could choose to do something different with their time, for instance work out their own model or methodology to understand what’s happening. That’s at least what we did, and opened up our method 2 years ago. In our premium crypto investing research service we give the guidance that WE need, and share it with what YOU need.

Just to illustrate this: there are exactly 8 charts we have been tracking this week to understand the impact of Bitcoin’s sell off. Not more, not less, no news, no tweets, no facebook posts, no Bloomberg or Forbes articles, nothing of all that.

So those 8 charts are the ones we have shared with members of our crypto investing service, and got so many messages back confirming that this is *exactly* what a crypto investor needs.

Again, just 8 charts, nothing more nothing less.

One of those 8 charts is embedded in this article, the other ones are instantly available after signing up here (for just 9 USD per month).

Second, and related to the first point, the info that you will find in the public domain is not written for investors. It is written to sell clicks.

Anyone found out that most, if not all, Bitcoin headlines are written to trigger an emotion? Anxious, painful, worst, danger, massive wealth transfer, … those are the words that come back, continuously.

What’s the added value for you as an investor?

Exactly, zero point zero!

The fear & greed index of Bitcoin is close to hitting extremes. Really? We don’t need indices to bring us this message, one look at the chart that by the way millions of other Bitcoin investors are looking at as well (exactly the same chart and patterns that you are looking at) is what the whole world sees: breakdown potential.

The solution: focus on a few highly relevant data points and charts

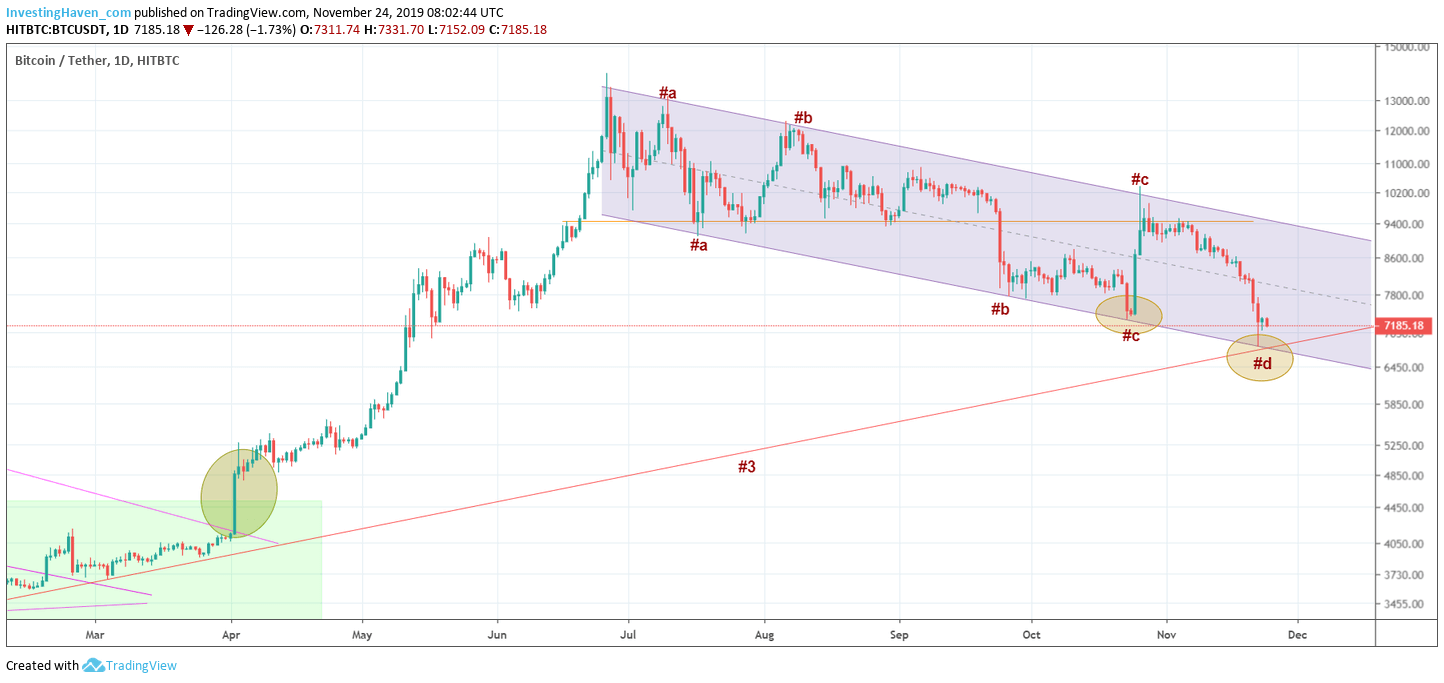

So let’s give away one chart of those 8 that our premium members received this week: the daily BTC chart (below).

The pattern is clear:

- First, a giant breakout on April 2nd of this year.

- A giant rally until June 25th of this year.

- A falling channel that is going on for 5 months now, exactly today.

There is one last support trendline, the one indicated with #3, that can bring support. Interestingly, this support coincides with the bottom of the falling channel, see point #d.

If both horizontal and diagonal support coincide you can be sure there is decent support.

Does anyone need indices, tweets, articles, gurus … to tell that this is a place where bulls and bears will fight an epic battle?

These are important days. What happens as a result of this battle will be telling for the crypto market in 2020.

We will *only* write our 2020 crypto forecasts after we get an outcome. Note that we have published already many dozens of our annual forecasts for 2020 except the ones about crypto. We need the market to confirm our long term bullish outlook before we write a shorter term forecast.

Anyone interested to get the guidance during these sell offs, but also be among the first one(s) to get guidance on the outperformers once the tide turns, we invite you to become a premium crypto member here.