What a difference a month makes in the crypto market. Exactly one month ago the entire world was convinced that the one and only position in Bitcoin was a short position. Now a month later there is still fear among crypto investors. However, there is one and only direction that the BTC charts suggests the crypto market is moving towards: much (much) higher. This is perfectly in line with both our BTC forecast for 2020 as well as our latest cryptocurrency predictions.

We said it so many times before, and people clearly have a very hard time to understanding this: don’t go with the consensus trade.

Amusingly this is probably THE biggest pitfall for investors, and the human mind is the explanation.

Let us explain how to think about this.

The human mind works based on a few principles. Among other factors it functions based on associations. It is fed by experiences, and is fueled by visual representations combined with repetition.

Let’s apply this to the crypto market, particularly Bitcoin.

Back in November a breakdown took place. Obviously we gave our followers and particularly our crypto premium members best in class guidance on this. We said not to panic because BTC was simply moving from the top to the bottom in a falling channel, simple as that.

The pseudo gurus on all social media and social investing sites knew better of course. They were all very inventive with the short term timeframes and with their creative charting skills. Charts have so many tools nowadays that you can create the funniest things with them.

In the meantime every passing day the content with the-breakdown-of-Bitcoin-is-now-confirmed messages only grew. It became an idea that kept on feeding itself.

The more times an idea is repeated the stronger the conviction. Consequently this influences the way any investor looks at the chart. It is always possible to get a bullish and bearish take-away from one and the same chart, if you just try it a few times, repeat to yourself, seek confirmation among others, repeat and rinse.

Once a perception is created, and there is social confirmation, it is really hard to see the opposite.

Now this is the psychological approach to investing, and why shorting Bitcoin became the consensus trade.

Over here at InvestingHaven we did everything we could to protect our premium crypto members from this. We want to illustrate this with a few quotes that we sent them in the November / December timeframe.

On December 16th, 2019, at the depth of the panic:

Some believe that the breakdown of the crypto market is already a fact, and argue it started a month ago. Some talk about the ‘big bitcoin short’, the end of crypto, and so on and so forth. We need to stay calm and rationalize market conditions.

The breakdown is not a fact yet, but we are right AT the decision point right now. Things look ugly right now, admittedly, but that’s not a data point we can work with, nor is it a rational argument. In the end every major bottom looks ugly, very ugly. An ugly situation does not help us, it distracts us from what is important.

Another bit of guidance from December when the short-Bitcoin-now crowd was overwhelmingly present:

A Bitcoin bull market that got violated early on has never happened before. This would indicate that the crypto market is undergoing a structural change, and the nature of the bull markets is structurally changing. We have a clear vision around this, but we refuse to publish this until it happens. As investors we stick to our strategy until it invalidates. The point is to have a clear vision if and when these rare events occur, but not execute on them too early.

And another one from November:

Are we now in a new bear market? Not yet, and it really *really* needs to get ugly for a new bear market to start. As in, really ugly. Low probability scenario.

It probably makes the point why the consensus trade mostly s***s, but that’s only clear AFTER the facts. When it was ugly the shorters had the time of their life because everywhere there was confirmation of their prediction: on social media, on social investing sites, in financial mainstream media and the charts because of the perception that was created by continuously repeating the consensus viewpoint.

Shorters are running for the hill now, and we forecasted this to our premium subscribers on Dec 28th:

Shorters are running out of steam! Watch out if want to short a market, because once critical mass is lost there is a very (very) nasty effect among shorters which is called SHORT SQUEEZE. This effect is unique to short selling situations, and does not exist in the opposite direction. A short squeeze occurs very fast and is very aggressive. Shorters give up once they see their shorting level is not holding. This is a mass reaction which is why short squeezes are so violent.

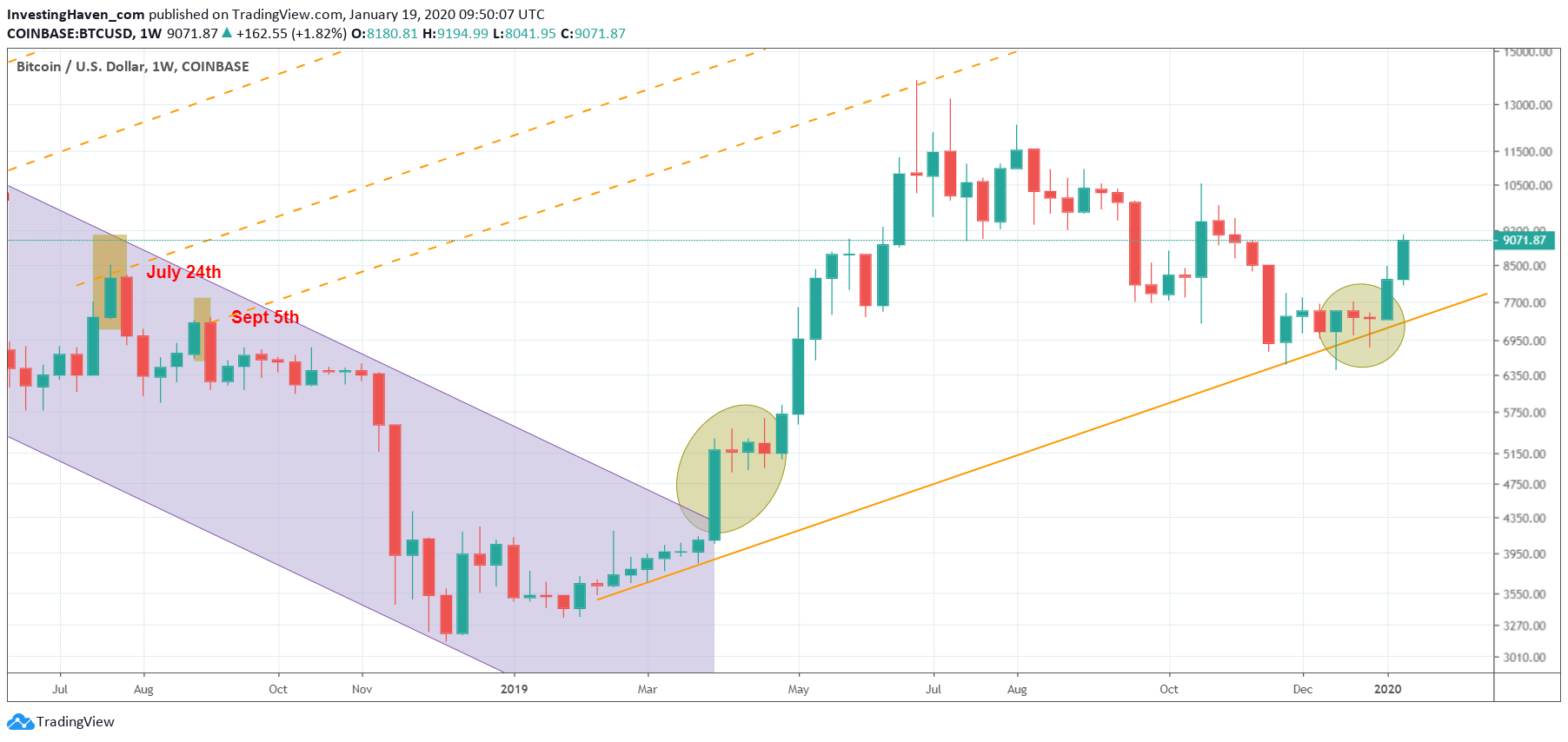

In the meantime we started flashing buy alerts starting January 8th, 2020. The BTC chart has now one and only one message: it wants to move higher, much higher! See the weekly chart below, and the bullish channel in which BTC is moving.

For those who are curious what those dates on the chart mean we strongly recommend to become a member of the first crypto investing research service in the world to find out.

Obviously this is only for those who are willing and able to look at the facts on the charts, not the perception. Don’t forget the point we made about the human mind. Not only can we ‘manipulate’ the way our mind looks and interprets but there is much more: once it is in a certain mindset it might take a long time before changing it.

Those bears and shorters in recent times have repeated their mantra so many times that it may be ingrained in their own psyche as well as the people they influenced.

Every InvestingHaven premium member has an edge. During the times when things looked ugly we protected our crypto members in our cryptocurrency investing premium service. Our market calls were spot-on, and we our charts were razor sharp with the right conclusion: the breakdown was not confirmed (see crypto alert of December 18th, 2019 for those that want to verify our market call). We also published a new crypto investing approach to ride the 2020 + 2021 bull market, only available for premium members.