It is some 2 months ago that Bitcoin experienced a drop of 7 pct or more. Back then, it turned out to be a buying opportunity. Will this time be any different?

The market crushed our 2021 crypto predictions, the question is much higher can crypto go?

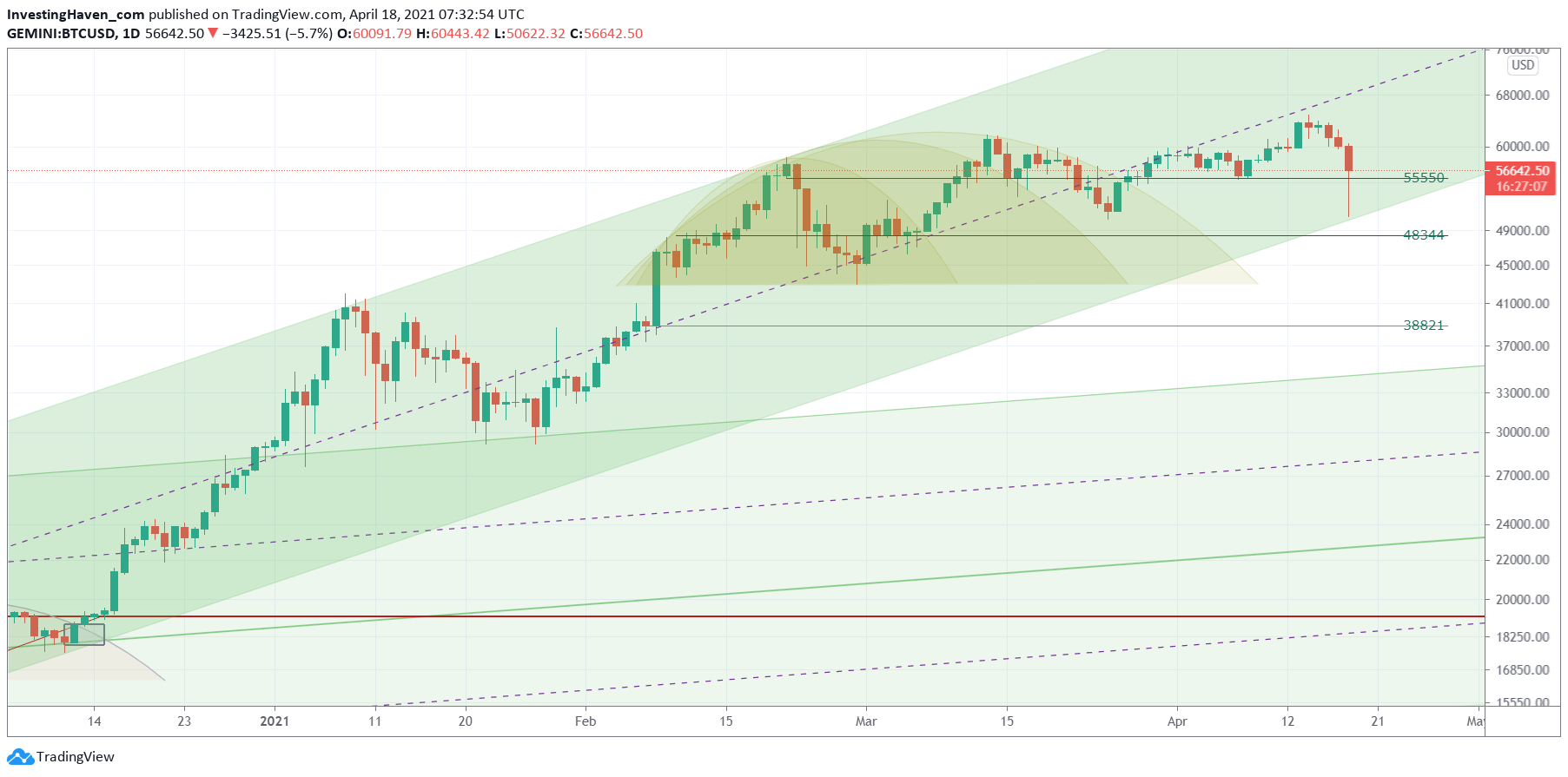

Very tough question to answer right now, because BTC is testing some really important levels here.

Essentially, in the last 2 months BTC has gone nowhere. It trades today exactly at the same level as on February 21st, the day before the previous big decline started.

Benefit of the doubt to the bulls because in the end today’s drop was a test of it rising trend channel. A pretty aggressive test though, not for the faint of the heart.

But is today’s really so innocent? Did it create any damage?

In a way, it could be the start of damage. The short version: BTC urgently has to move back above 57k in order to respect its bull run. The long version was explained in today’s alert to premium crypto members.

The one question top of mind of investors is whether this is a global top. And we need a different view than the rising trend channel we laid out below. There is a possibility that this is a global top, so in other words it *might* be that BTC won’t clear 60k for a very long time. But we need more data in order to confirm this. In today’s crypto alert we went back to check the global tops of 2017 and 2019. They have something in common. We don’t see this yet in today’s picture, but we are on the lookout to find concerning signs on BTC’s chart.

For now benefit of the doubt to the bulls.

Note: we will be watching how the next 3, 5, 8 and 13 trading days unfold. They will print what we call a micro pattern. A micro pattern right a decisive levels have predictive information, and we’ll leverage those insights to understand whether today’s drop was a regular (yet aggressive) successful bull market test or the start of a bigger wave of selling. Our premium crypto members will receive our insights as soon as we get them out of the charts (in the public domain we publish only high level information or insights in retrospective).