We published many market forecasts in 2020 and one of them was our 7 crypto predictions. The market followed our bullish Bitcoin price forecast almost as if we requested the market to do so! We have been saying for a long time that we will see much higher Bitcoin prices in 2020. This is not the end, though, it is the beginning of another major leg in cryptocurrencies, particularly in Bitcoin.

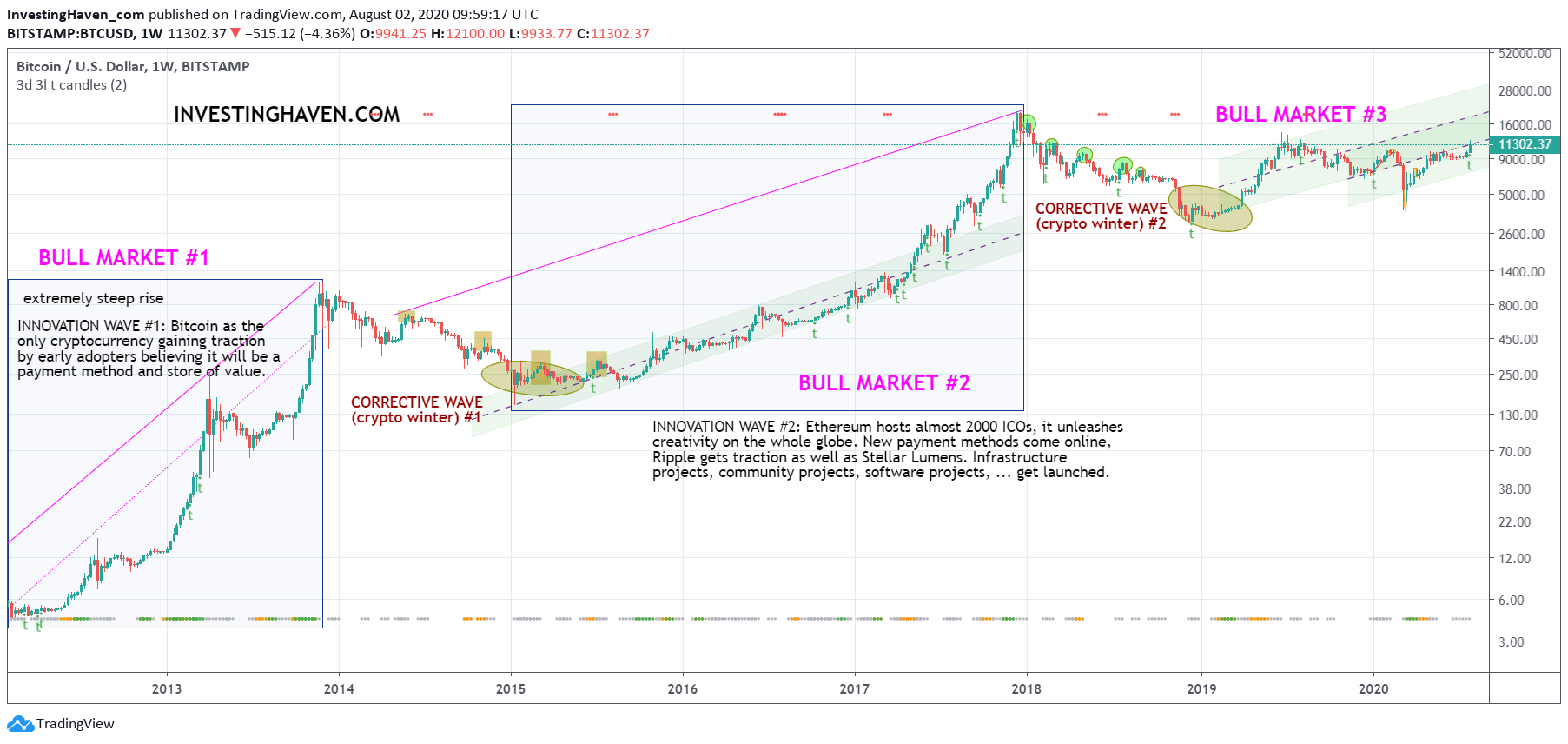

In order to make our point we took one, just one, crypto chart: the long term Bitcoin price chart.

Below is the weekly Bitcoin chart on 10 years.

What a gorgeous chart, absolutely insane it is for those who can see the message of this chart.

Note that this chart comes from our premium crypto investing research section. This week we did update all our top crypto charts, and there were two charts that caught our attetion: the long term Bitcoin chart shown below as well as the XRP chart.

While we’ll give some commentary on the Bitcoin chart, we cannot do so on the XRP chart. In the end the market gave the commentary, because we gave a strong buy rating to XRP some 3 weeks ago, and confirmed it last week. Since then XRP went up almost 50%. That’s the value we provide in our crypto investing research service.

When it comes to the long term Bitcoin chart is clearly, clearly shows the grand secular crypto bull market.

Moreover, it shows how bull market #3 is now warming up?

No, the recent 15% ‘surge’ is not the end, it is the beginning.

Let’s not forget that Bitcoin got ‘stopped cold’ mid-February this year. It was in a perfect uptrend, and the day it confirmed its perfect uptrend we had to sell because of the start of the global Corona market crash. Bitcoin is now simply continuing what it started doing in January/February: bull market #3.

How high will this new bull market bring Bitcoin?

Much, much higher.

And how many crypto investors will be able to profit from it?

A very, very small portion of it. Our estimate is that some 1% of crypto investors will get the maximum profits out of this new crypto bull market. Yes, that’s one percent, it’s not a typo.

How comes? Because crypto investing is much harder than anyone thinks. Volatility in prices creates havoc with the mind and soul of investors, leading them to leave lots of profits on the table.

To illustrate this we said at a minimum 1,000 times in our premium crypto investing writings: LESS IS MORE. In other words, take less trades to realize more profits. And we explain this concept in great detail based on charts, market trends and other market data points.

As per our 50 crypto investing tips:

Cryptocurrency investing tips # 8: Cryptocurrencies that are highly volatile require a trading approach as per the ‘less is more‘ principle. Trading less will result in significantly higher profits provided timing a trade is accurate.

The volatility factor has another implication: the number of trades should not go up, it should go down.

Perfect chart readings (not good nor great but perfect crypto charts) can help achieve this.

Earlier this week our premium crypto members received another update with great investing insights and crypto charts which anyone can access instantly after signing up here >>