Leo Zhao at MEXC calls the dip a tactical entry for institutions. He sees a plausible near-term move to $130K.

Bitcoin fell below $110,000 this week after a sharp unwind of leveraged positions and a large dormant-wallet sale that strained liquidity.

MEXC Investment Director Leo Zhao says institutional accumulation during the dip keeps a near-term run to $130,000 plausible by year-end if ETF flows resume.

READ ALSO: Why Bitcoin Is Down And Whether It’s A Smart Buy

Immediate Triggers: Whale Sale, Leverage And Thin Liquidity

Bitcoin briefly crossed $117,000 after Federal Reserve chair comments at Jackson Hole, but buyers failed to hold gains, exposing thin order books.

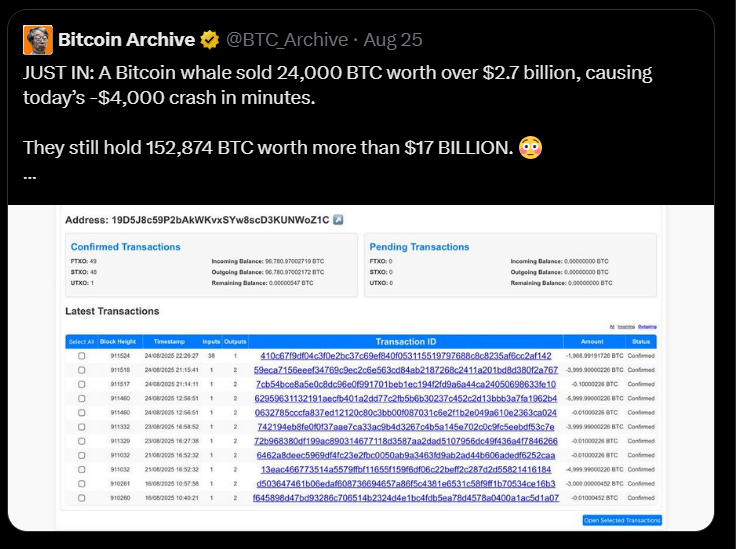

A dormant wallet offloaded about 24,000 BTC into the market, which coincided with more than $900M in leveraged liquidations across exchanges, forcing rapid price moves and a weekend flash crash.

Short-covering amplified declines as stop orders hit thin bids, and attempts to recover were rejected near $113,000, signaling that momentum had collapsed. Traders reported heavy profit-taking from long-term holders, making the market vulnerable to sharp reversals on selling.

RECOMMENDED: Bitcoin $200K in 2025? Scaramucci Reaffirms Bold Price Forecast

ETF Flows, Capital Rotation And On-Chain Signals

Spot Bitcoin ETFs logged more than $1 billion in outflows in the latest week, reversing steady inflows and removing a key buyer class. Investors reallocated to Ethereum products, which attracted multi-billion dollars of inflows in August as ETH outperformed BTC.

On-chain metrics show realized profits falling back toward breakeven, which explains why intraday recoveries lacked follow-through.

Traders prioritized hedging over fresh longs, and short-term momentum metrics such as RSI and MACD signaled weakening strength. The net effect reduced immediate demand for spot BTC and increased downside sensitivity.

YOU MAY LIKE: Bitcoin & Ethereum Await Fed Signal: Rally or Reversal?

Institutional Accumulation And The Path To $130K

Institutions and sovereign buyers continued to add Bitcoin during the dip, using lower prices to scale exposure while retail and leveraged traders de-risked. That steady accumulation has kept net institutional demand above new supply, which preserves a structural floor.

Based on near-term Bitcoin price predictions, BTC may consolidate between $110,000 and $120,000 or test $100,000 if momentum fades. If ETF inflows restart and macro risks ease, a move toward $130,000 before year-end remains credible still.

RECOMMENDED: Bitcoin Warning: Further Pullback To $108,000 In Sight

Conclusion

Sustained ETF inflows, calmer macro conditions, and steady institutional accumulation could reestablish upward momentum, making Zhao’s near-term $130,000 target a realistic scenario before the year closes.

Read our full Bitcoin price prediction here

Don’t Miss the Next Big Move – Access Alerts Instantly

Join the original blockchain-investing research service — live since 2017. Our alerts come from a proprietary 15‑indicator methodology built over 15+ years of market experience. You’re following the service that identified major turning points through crypto winters and bull runs alike

Act now and see why thousands trust us to deliver signals before markets move.

This is how we are guiding our premium members (log in required):

- BTC Testing Long Term Trendline. Here Is Short and Long Term Guidance. (Aug 26th)

- Crypto – To Break Out Or Not To Break Out? (Aug 23rd)

- What Happened This Week? Leading Indicator Analysis and 7 Token Charts. (Aug 16th)

- Crypto Shows More Resilience Than Expected. A Bullish Impulse May Be Underway. (Aug 9th)

- Prepare To Buy The Dip In Crypto (Aug 2nd)

- Alt Season 2025 – Progress Update (July 26th)