KEY TAKEAWAYS

- Use MAS-compliant platforms with SGD on-ramps to reduce risk and friction.

- eToro, Coinhako, Crypto.com, Independent Reserve and Binance support XRP, but costs and rules vary.

- Every XRP wallet locks 1 XRP as a base reserve.

- Limit orders cost less than instant buys for larger trades.

- Hardware wallets are best for long-term XRP storage.

XRP plays a central role in payment rails and liquidity in Singapore’s crypto market. MAS rules, exchange choice and custody shape how you buy and hold XRP.

XRP is one of the most traded digital assets in Singapore and is widely used for cross-border payments, liquidity, and financial services.

The Monetary Authority of Singapore (MAS) classifies XRP as a Digital Payment Token (DPT), giving clarity and regulatory certainty for investors and exchanges operating locally.

Singapore doesn’t tax capital gains on crypto for personal investors, though income tax may apply if trading is treated as a business; GST is generally exempt on crypto trades.

When buying XRP, consider exchange licensing (MAS-regulated), supported SGD deposits, and custody options. The XRP Ledger also requires a small reserve of XRP to activate wallets, so plan your purchases and transfers accordingly.

RELATED: How to Buy XRP in Canada: Fast, Safe & Simple Steps

Where to Buy XRP in Singapore: Best Exchanges for XRP

We recommend using the following exchanges to buy XRP in Singapore:

- eToro

- Coinhako

- Crypto.com

- Coinbase

- Independent Reserve

Coinhako

Coinhako is one of Singapore’s most popular and MAS-regulated exchanges for buying XRP with SGD. It supports direct SGD deposits via PayNow and FAST, making it fast and convenient for local users.

The interface is simple and geared toward retail buyers, though spreads and fees can be higher than global competitors.

Pros

- Supports PayNow & FAST SGD deposits.

- MAS-licensed for local regulatory compliance.

- Beginner-friendly interface.

Cons

- Trading fees around 0.6% and possible spreads.

- Not ideal for advanced traders.

- Some users report relatively high traded spreads.

Fees

- Trading: about 0.6% per transaction.

- PayNow/FAST deposits: typically free.

- Withdrawal costs may vary by method.

Crypto.com

Crypto.com is a global exchange and app widely used in Singapore. It supports XRP and offers several funding methods, including bank transfers and card payments, though availability may vary by region.

The platform suits both casual buyers (through its app) and more active traders (via its exchange order book).

Pros

- Wide range of supported coins including XRP.

- Multiple deposit options (bank, card).

- Mobile app with simple instant buys.

Cons

- Fees can be complex and higher via card.

- Not fully local for SGD rails like PayNow.

Fees

- Trading: about 0.4% maker/taker (varies).

- Card deposit fee: about 3%+.

- Withdrawal: depends on method.

Independent Reserve

Independent Reserve is a MAS regulated exchange with direct SGD on-ramps via PayNow and FAST, and SWIFT for USD.

It also offers an OTC desk for larger XRP purchases with minimized market impact, making it attractive for both retail and institutional investors in Singapore.

Pros

- MAS license and strong compliance.

- SGD deposits (PayNow/FAST) and USD via SWIFT.

- OTC trading available for large orders.

Cons

- Smaller asset selection vs global exchanges.

- Fee tiers can be higher for small traders.

Fees

- Trading: about 0.5% (can drop with volume).

- SGD deposits: free via PayNow/FAST.

- Withdrawals: small nominal network/bank charges.

Binance

Binance offers deep liquidity for XRP across spot markets, P2P trading and card channels.

While you can still use Binance in Singapore, SGD on-ramps aren’t as direct as regulated MAS exchanges.

Some derivatives or advanced features may be restricted regionally, so check product availability for Singapore users.

Pros

- Very deep XRP order books.

- Low trading fees in global markets.

- Multiple trading options (spot, P2P).

Cons

- Limited direct SGD funding rails locally.

- P2P relies on trusted counterparties.

- Some products are unavailable in Singapore.

Fees

- Spot maker/taker: low relative to others (varies by volume).

- P2P fees: small to none, depending on trade.

- Card deposits: additional fees by card issuer.

eToro

eToro provides a retail-friendly app with simple buy flows for XRP and supports popular deposit methods (bank transfer, card, e-wallets).

It’s designed for first-time buyers focusing on easy portfolio management, and Singapore users should verify XRP withdrawal capabilities if they plan self-custody.

Pros

- Easy-to-use platform with clear UX.

- Multiple deposit methods.

- Good for beginners.

Cons

- Fees can be higher than specialist exchanges.

- Check if XRP withdrawals to external wallets are supported.

- Less tailored to active traders.

Fees

- Spread and service fees vary by deposit type.

- Bank/card withdrawal fees apply.

RECOMMENDED: eToro Review 2025: Is It Safe, Legit & Worth It?

How to Buy XRP in Singapore Using eToro

We recommend eToro for Singapore XRP buyers because it’s easy to use, even for beginners, with a clean app and intuitive buy flows that simplify the trading process.

The platform also offers strong security standards and regulatory compliance, helping protect your funds and personal data.

eToro’s broad range of assets and educational features make it a solid choice for new crypto investors.

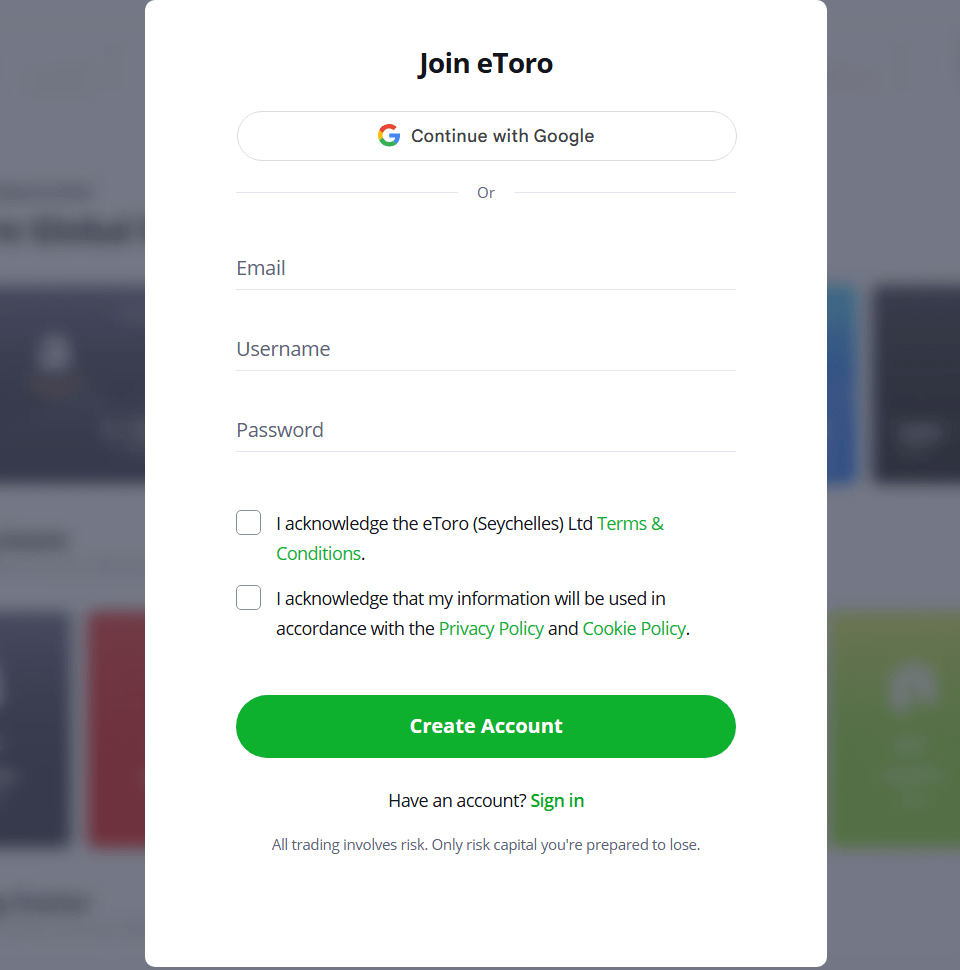

1. Open and Verify Your eToro Account

Start by creating an eToro account and completing identity verification. Singapore users must pass KYC checks before depositing or trading.

Upload a valid NRIC or passport as proof of identity and a recent utility bill or bank statement as proof of address. Submitting clear documents inside the app speeds up approval.

Once verified, your account can deposit funds, buy XRP, and withdraw assets without restrictions.

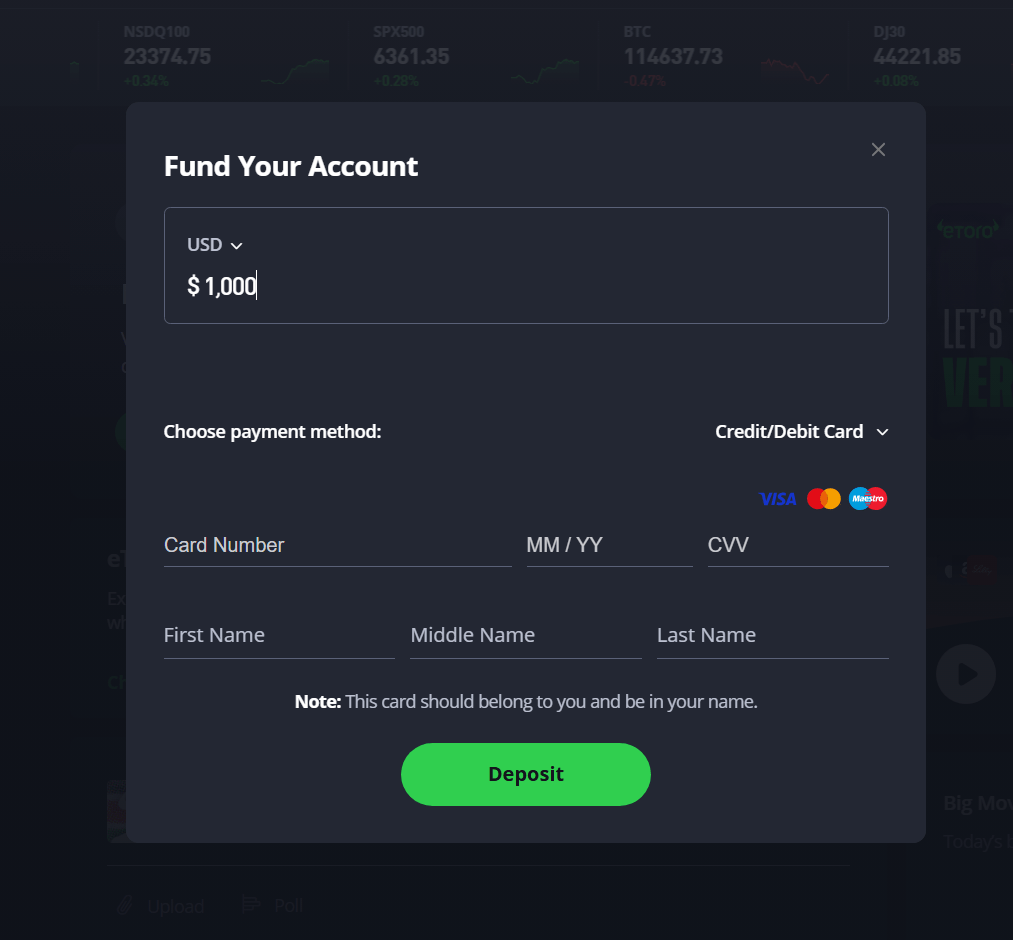

2. Fund Your Account

Choose a deposit method based on speed and cost. eToro supports bank transfers, debit/credit cards, and selected e-wallets for Singapore residents.

Card deposits usually credit instantly but may carry higher fees. Bank transfers are cheaper for larger amounts but can take 1–3 business days to clear.

Always check your regional deposit limits and fees before funding to avoid delays or unexpected charges.

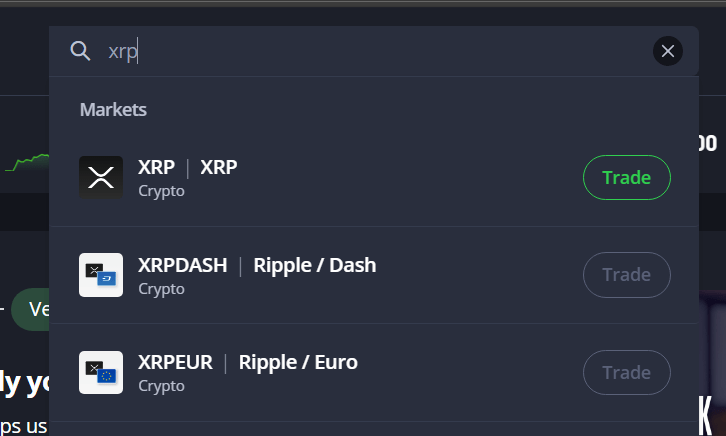

3. Find XRP and Place Your Order

Use the search bar or markets page to find XRP. You’ll see live price data, charts, and basic market stats. For quick purchases, use the instant buy option: enter your SGD amount, review the quoted price, and confirm.

For larger buys, consider a limit order, which lets you set your desired price. Limit orders help reduce slippage, while instant buys prioritize speed and simplicity.

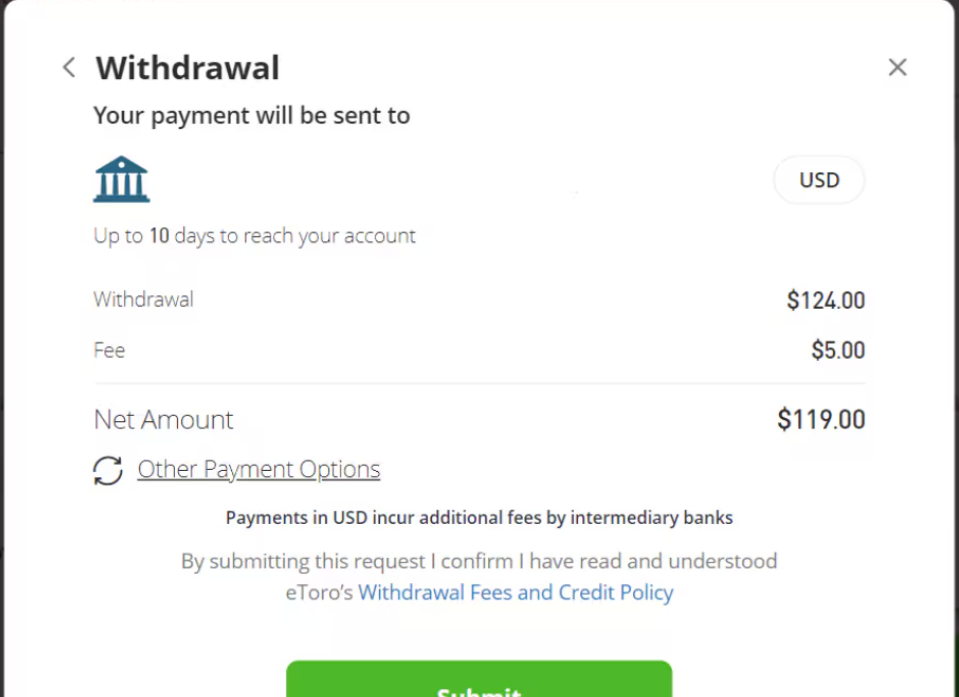

4. Withdraw XRP to a Personal Wallet (Optional)

If you want to self-custody, prepare your external XRP wallet in advance. On eToro, crypto withdrawals typically move XRP first to the eToro Money wallet, then to an external address if supported.

Check the minimum transfer amount and withdrawal fee for XRP before proceeding.

When entering the destination, confirm the wallet address carefully and include any required destination tag or memo, as XRP transactions rely on this for correct delivery.

5. Secure Your Account and Test Withdrawals

Before moving large amounts, send a small test withdrawal to confirm everything works correctly. Once confirmed, transfer the remaining balance.

Enable two-factor authentication (2FA) and use a strong, unique password. Also, avoid storing private keys or recovery phrases online.

These steps reduce risk, prevent costly mistakes, and make it easier to resolve issues if a transaction needs support.

RECOMMENDED: An In‑Depth Review of Buying XRP on eToro

Best Wallets for Storing XRP In Singapore

Choosing the right wallet is crucial for security, control, and how you plan to use your XRP.

There are several types of wallets you can use:

- Custodial wallets

- Non-custodial wallets

- Hardware wallets

Custodial Wallets (Exchange Wallets)

These wallets are provided by exchanges. The platform holds your private keys, making it easy to trade or sell quickly, but you don’t fully control the XRP yourself.

Good for short-term trading or small amounts you plan to use soon.

Pros

- Very easy and quick to use

- No need to manage private keys

- Integrated with trading features

Cons

- Exchange holds your keys (less control)

- Higher risk if platform is hacked

- Not ideal for long-term storage

Recommended:

- Wallets on MAS-supported exchanges you use for trading (like eToro or Binance).

Non-Custodial Hot Wallets (Mobile/Desktop)

You control your private keys and manage XRP directly on your device. These wallets are online (“hot”), making them good for everyday transfers, quick access, and XRPL features like DEX interactions.

Pros

- You control the keys

- Good for frequent use

- Often free and easy to set up

Cons

- Online connection means more risk than hardware

- Must securely back up your seed phrase

Recommended:

- Xaman (formerly XUMM) – XRP-native, strong XRPL support

- Trust Wallet – simple, multi-asset mobile wallet

- Exodus or Guarda – great for multi-coin portfolios

Hardware (Cold) Wallets

These store your XRP offline on a physical device.

Cold wallets are the safest choice for long-term holding or large amounts, as they keep private keys offline and protected from online threats.

Pros

- Highest security (offline keys)

- Ideal for large or long-term holdings

- Works with XRPL tools

Cons

- Additional cost to buy device

- Requires careful backup of recovery phrase

Recommended:

- Ledger (Nano X, Nano S): top hardware choice for XRP holders

RECOMMENDED: How To Buy Ripple (XRP) In The USA: Everything You Need to Know Before Getting Started

Crypto Regulation in Singapore

Singapore has one of the clearest crypto regulatory frameworks in Asia. The Monetary Authority of Singapore (MAS) regulates crypto platforms under the Payment Services Act, covering digital payment tokens like XRP.

Exchanges that serve Singapore residents must meet strict KYC, AML, custody, and risk-management standards. This directly affects which platforms can offer SGD deposits, withdrawals, and trading features locally.

Between 2024 and 2025, MAS and major platforms clarified how crypto services operate in Singapore. Ripple expanded its regulated presence in Singapore in late 2025, strengthening institutional and payment-related use of XRP.

For retail users, this means better access to compliant exchanges, but also product limits – some platforms restrict derivatives, leverage, or certain services for Singapore accounts.

Crypto tax treatment follows IRAS guidance and depends on activity. Long-term personal investing is generally not taxed, while frequent trading or business use may be. Keep detailed transaction records to stay compliant.

RECOMMENDED: Top 10 Richest XRP Whales: Who Owns the Most XRP in 2025?

Fees, Spreads & Tax Considerations

The cost of buying XRP in Singapore depends on the exchange, payment method, and how you place your trade. PayNow and FAST deposits are often free on local exchanges, though some banks may charge a small transfer fee.

Card deposits are faster but usually cost more, often in the 2%–4% range depending on the platform.Spot trading fees typically fall between 0.1% and 1%.

Fees are lower on order books and higher on instant-buy features, which include a built-in spread. For small purchases, spreads can significantly raise the effective price compared to using a limit order. XRP withdrawals usually have a flat fee in XRP, plus a minimum withdrawal amount.

While XRP Ledger transaction costs are very low, each new wallet must keep a 1 XRP reserve, which reduces the amount you can move.

For tax, IRAS assesses crypto based on activity. Long-term personal investing is generally not taxed, while active trading or business use may be.

Security Checklist & Common Pitfalls

Keeping your XRP safe starts with basic account hygiene. Always enable two-factor authentication (2FA) and use a strong, unique password stored in a reputable password manager.

Where possible, whitelist withdrawal addresses so funds can only be sent to approved wallets. Before moving large amounts, send a small test transaction to confirm everything works.

For self-custody, store your recovery phrase offline on paper or metal. Never save it in cloud storage or take photos. Watch out for phishing emails, fake apps, and impostor “support” messages – only use official websites and never share private keys or 2FA codes.

With XRP, always include the correct destination tag or memo when sending to exchanges. Missing tags can delay or complicate fund recovery.

RECOMMENDED: 5 Reasons to Buy XRP

FAQs

How much XRP do I need to activate a wallet?

The XRPL requires a 1 XRP base reserve to activate an address. That amount becomes a locked reserve on-chain and is not spendable.

Can I buy XRP on eToro in Singapore?

Yes. eToro lists XRP and supports Singapore deposits and purchases; check eToro’s regional help pages for deposit limits and withdrawal rules.

How long do deposits and withdrawals take?

Card deposits are usually instant. Bank transfers typically post in 1–3 business days. Crypto withdrawals depend on queueing and the exchange’s processing policies; expect at least one business day for manual checks in some caseKeeps.

Do I pay tax when I buy XRP?

Tax depends on your activity. IRAS distinguishes personal investing from trading or business income. transaction records and consult a tax adviser for your situation.

What if I forget my wallet seed?

If you lose the seed for a non-custodial wallet, you lose access to funds. Hardware wallets and secure offline backups are the only reliable recovery strategy.