XRP’s price momentum, institutional demand, and potential ETF approval point to strong upside, but legal and market risks remain.

At around $2.17 today, XRP is testing a consolidation breakout after hovering between $2.06–$2.18. Renewed institutional interest, ETF optimism, and on‑chain developments spark a key question for investors: is now a good time to buy?

Momentum & Technical Dynamics

Over the past week, XRP has lifted ~13% from mid‑June lows and retested the $2.18 breakout zone—a level that had served as resistance multiple times. A bullish shift in hourly and 4‑hour charts (momentum crossovers, rising volume) confirms this breakout.

Still, technical indicators show neutral to slightly bearish sentiment: Changelly notes a 47% bearish reading and analysts warn resistance lies between $2.22–$2.30.

A pullback to $2.06–$2.11 support remains a risk, but if momentum holds, higher levels await.

Macro & Institutional Catalysts

Institutional flows are driving current strength—on June 16, XRP jumped following broader crypto gains as U.S.–China tensions revived safe‑haven buying.

According to Bitget, XRP could reach $5 by year‑end if this trend continues. A crucial catalyst is the pending spot‑XRP ETF: Polymarket places the odds at ~88–98% for approval in 2025, with Franklin Templeton’s decision expected June 17.

Meanwhile, Ripple’s $1.25B Hidden Road acquisition and RLUSD integration could channel institutional volumes—and burns—supporting price.

Forecasts & Risk Overview

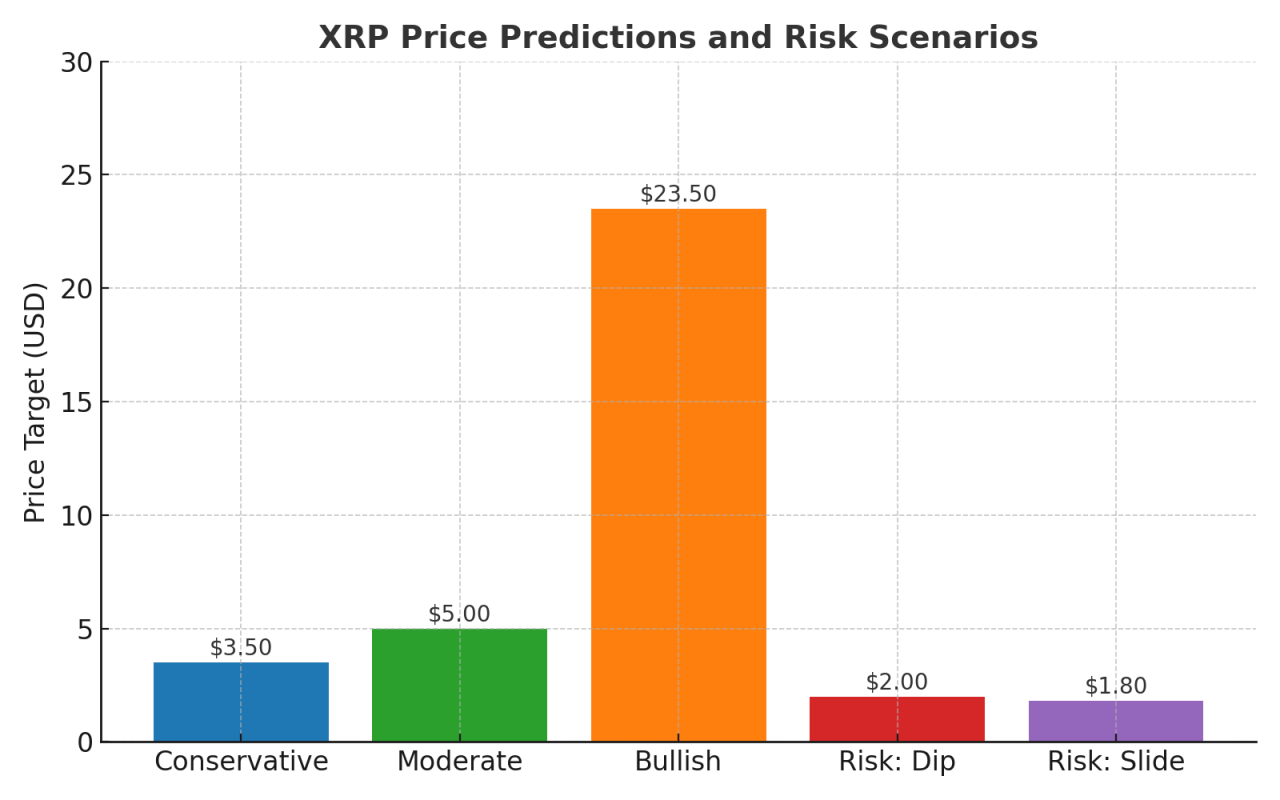

Analyst targets range from a conservative $3–$4 up to ultra‑bullish $20–$27 on ETF approval. Even moderate scenarios foresee $5 by end‑2025 if ETF and legal clarity converge.

Yet, risks linger: Changelly projects a potential dip ~5.4%, possibly near $2.00, while unresolved legal motives or macro shocks could trigger a slide toward $1.60–$2.00.

Academic models consistently show crypto assets, including XRP, are difficult to forecast reliably thanks to market randomness.

Conclusion

XRP’s current setup offers an intriguing entry: a technical breakout, strong institutional tailwinds, and the ETF narrative align. That said, downside scenarios remain plausible if catalysts fail to materialize.

For medium‑term investors with a higher risk tolerance, accumulating near $2.20–$2.30 could be a calculated wager—but safeguard positions with stop‑losses around $2.00 and monitor developments closely.

Our latest crypto alerts – instantly accessible

This is how we are guiding our premium members (log in required):

- The Alt Season Charts (June 15th)

- Another Test of 106.1k, Is This THE Big One? (June 8th)

- How Much Longer Do We Have To Wait For Alt Season 2025? (June 1st)

- The Bitcoin vs. Altcoin Divergence (May 24th)

- Is A Massive Breakout Coming? (May 17th)

- Top Altcoin Picks in the Strongest Emerging Narrative (May 9th)