XRP offers institutional rails and broad liquidity. BlockDAG sells presale upside but carries high execution and delivery risk.

This article compares XRP vs BlockDAG: a long-running payments token, and an active presale Layer-1. We will discuss measurable adoption, technical claims and who each coin actually serves.

The goal is to give investors clear, data based distinctions so they can choose between established infrastructure and speculative presale exposure.

RELATED: Which Crypto Is More Likely to Be a Millionaire Maker? XRP vs. Avalanche

XRP vs. BlockDAG: Quick Overview

XRP is a top-three cryptocurrency with broad liquidity and a large circulating supply. As of mid-September 2025, XRP trades around $3.02 with a market cap of about $180 billion and a circulating supply of 59.7 billion tokens.

Ripple maintains enterprise products and connects banks and payment providers through RippleNet, while the XRP Ledger runs a public mainnet used for settlement and token projects.

BlockDAG, marketed as BDAG, sits in an extended presale phase. The project promotes a hybrid block plus DAG design, mobile mining and staged presale pricing. BDAG’s current reach is primarily presale participants and marketing partners, not broad commercial usage.

Both attract very different investor types.

RELATED: Which Crypto Is More Likely to Be a Millionaire Maker? XRP vs. Solana

XRP vs. BlockDAG: Utility And Real-World Adoption

XRP has concrete production use cases, most visibly On-Demand Liquidity, which uses XRP as a bridge asset to move fiat between corridors without pre-funded local balances.

Ripple lists numerous real customers and case studies that report live ODL or RippleNet integrations for remittances and business payouts, showing practical, revenue generating deployments by payment providers and regional banks.

The XRP Ledger itself advertises low fees, sub-second finality and more than a decade of mainnet operation, which supports predictable settlement work at scale.

BlockDAG claims future utility through EVM compatibility, mobile miners and planned CEX listings, and it has published audit reports for specific contracts. Those items reflect project intent and selective audits, not broad live adoption.

Until BDAG proves sustained mainnet traffic, confirmed exchange liquidity and independent protocol stress tests, its real world footprint stays concentrated among presale backers and promotional partners. That gap is material.

RELATED: Which Cryptocurrency Is More Likely to Be a Millionaire Maker? XRP vs. Remittix

XRP vs. BlockDAG: Technology And Transaction Speed

XRP uses a validator consensus protocol that finalizes ledgers in about 3 to 5 seconds and charges vanishingly small fees for routine transfers.

Ledger metrics and analytics show regular daily volumes in the millions, with Q1 2025 averages above 2.1 million transactions per day and published capacity estimates up to about 1,500 tps, evidence of a production system that handles payments at scale.

BlockDAG presents a hybrid block plus DAG architecture and advertises parallel processing, mobile mining and a roadmap toward EVM compatibility.

The team has published Halborn and CertiK assessments for token and vesting contracts and the project cites large presale uptake.

Those items matter, but independent protocol stress tests, live mainnet throughput reports and broad third party benchmarks remain limited.

Until sustained, public mainnet traffic and independent performance studies appear, BlockDAG’s throughput claims should be treated as theoretical rather than proven.

RELATED: Which Cryptocurrency Is More Likely to Be a Millionaire Maker? XRP vs. Cardano

XRP vs. BlockDAG: Risk And Investor Profile

XRP suits investors who want established-network exposure with measurable liquidity.

A large market cap and active order books reduce execution risk, and a recent US court resolution of the SEC dispute, including a settlement and the dismissal of final appeals, removed a major regulatory overhang.

Structural risk remains, because Ripple holds sizable token reserves in escrow and releases up to 1 billion XRP per month, a cadence that can produce supply pressure when markets soften.

BlockDAG offers a high-risk, high-upside profile.

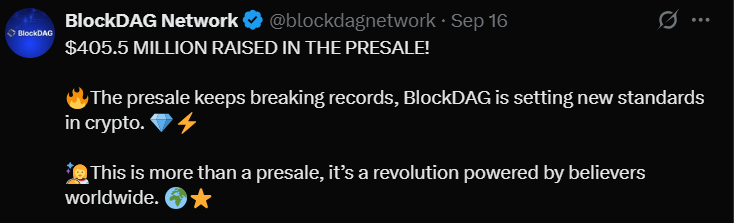

The project runs an active presale that has raised hundreds of millions and publishes Halborn and CertiK audit reports for contract code.

At the same time, observers note launch delays, mixed Trustpilot feedback and independent cautions about presale mechanics, and presale allocations stay illiquid until centralized listings.

For practical portfolio rules, use XRP for larger, risk-aware allocations and reserve only a very small speculative stake for BDAG, because presales often produce binary outcomes.

RELATED: Which Cryptocurrency is More Likely to Be a Millionaire Maker? XRP vs. Bitcoin

XRP vs. BlockDAG: Which Has More Millionaire Potential?

Quick math shows the difference. XRP trades around $3 with a market cap near $180B. A 100× price rise to $300 would imply a market cap about $18T, an outcome that requires mass adoption and trillions in new capital.

RECOMMENDED: Can XRP Make You a Millionaire? Here’s What You Should Know

By contrast BlockDAG sells in presale at $0.0013, with over $400M raised and a 50B presale allocation.

If BDAG lists at $0.05, that is roughly a 38× return from $0.0013, and a $0.50 listing would be about 385×.

So, can BlockDAG make you a millionaire? Presale returns can create millionaires from small stakes, but they depend on listings, liquidity, honest execution and timing, outcomes that remain far from certain.

RELATED: Which Cryptocurrency Is More Likely to Be a Millionaire-Maker? XRP vs. ETH

XRP vs. BlockDAG: Key Takeaways For Investors

Choose XRP for broad liquidity and institutional rails, supported by deep markets and a resolved SEC case that lowers regulatory tail risk.

Choose BlockDAG only for a very small, speculative allocation, because its presale offers large theoretical upside but carries execution, listing and liquidity risk after repeated delays.

Allocate size to match your liquidity needs and perform due diligence.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here

Which Crypto Should You Invest In Right Now?

For alerts on the key crypto assets that are primed for investment right now you should consider Join the original blockchain-investing research service — live since 2017.

InvestingHaven alerts come from a proprietary 15‑indicator methodology built over 15+ years of market experience.

You’ll be following the service that identified major turning points through crypto winters and bull runs alike

Act now and see why thousands trust us to deliver signals before markets move.

This is how we are guiding our premium members (log in required):

- Is A Trendless Crypto Market Good or Bad? The Current and Emerging Winners Look Awesome. (Sept 7th)

- BTC Testing Long Term Trendline. Here Is Short and Long Term Guidance. (Aug 26th)

- Crypto – To Break Out Or Not To Break Out? (Aug 23rd)

- What Happened This Week? Leading Indicator Analysis and 7 Token Charts. (Aug 16th)

- Crypto Shows More Resilience Than Expected. A Bullish Impulse May Be Underway. (Aug 9th)

- Prepare To Buy The Dip In Crypto (Aug 2nd)