Cryptocurrencies, once the the most volatile asset in global markets, are now among the least volatile market. This lack of volatility started after the hyper-volatile weekend (June 18th and 19th). Case in point: Ethereum’s chart which we’ll feature in this blog post. Is this good or bad?

A more in-depth view on the question “is this good or bad” is what we share in our next crypto investing research alert which will be shared in the premium service today.

In this blog post we share a few highlights without lots of detail.

First of all, as per our crypto research alert, we always look at cryptocurrencies in a top-down approach. The first thing we ask ourselves is what crypto leading indicators are suggesting.

One of those leading indicators is the USD. While the USD is insanely strong lately it might also be topping. That’s because of several reasons, one of them the EURUSD pair which is shown in today’s post Leading Indicator For Global Markets Setting A Secular Bottom.

More and detailed leading indicator analysis is shared in premium service.

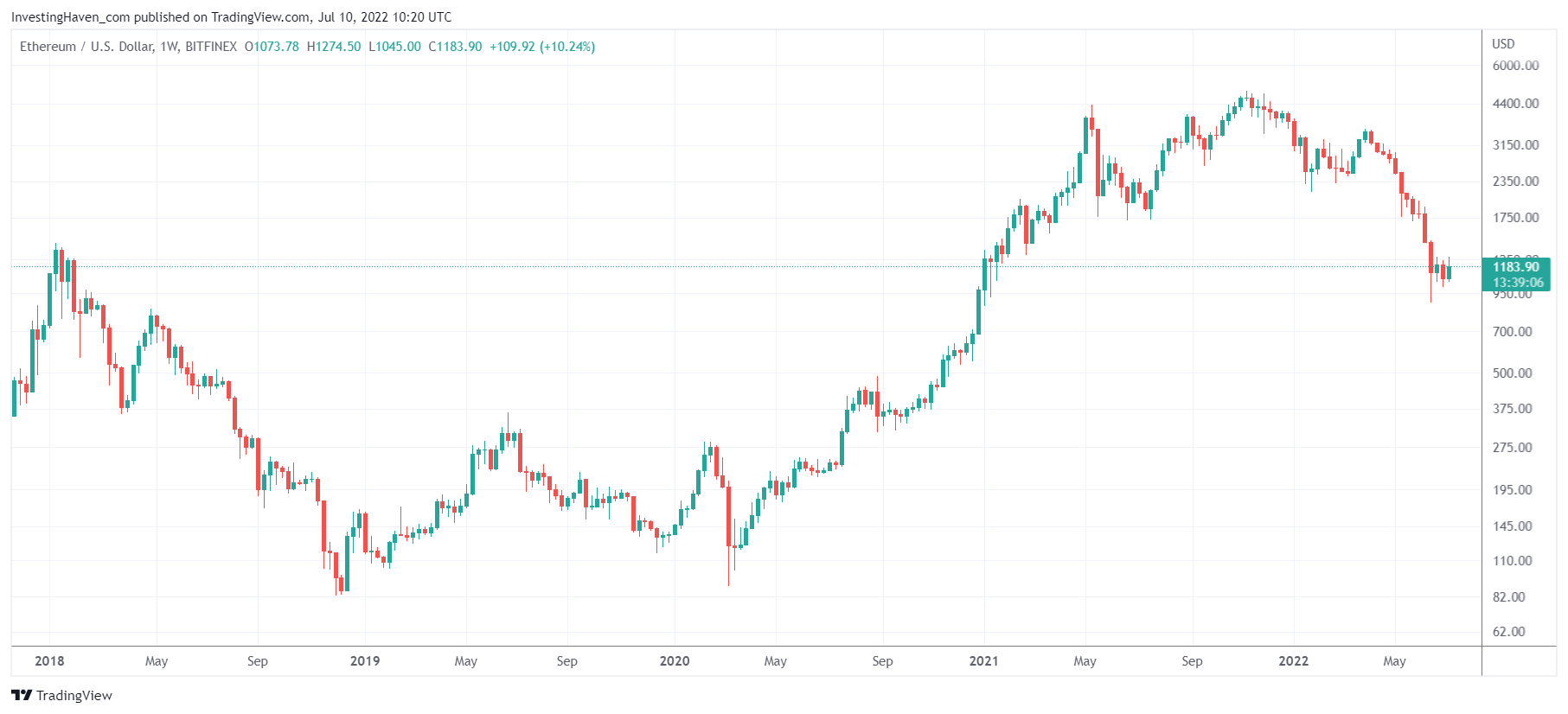

In the meantime, we see the ETHUSD chart flattening. IF (and that’s a big IF) the USD is setting a turning point it should support cryptocurrencies. That’s because both markets are inversely correlated. In that scenario we see a double or triple bottom type setup unfolding on the ETHUSD chart.

If we zoom out, we can see how ETHUSD has been falling for 11 straight weeks. This probably qualifies as the longest decline ever in ETH.

The last 3 weeks show a stabilization with tiny weekly candles. The lack of volatility is also visible on the weekly chart.

Note that ETH is stabilizing right at those 2018 highs, between 1100 and 1400.

Here are 2 trends that might influence ETH this summer: a Nasdaq bounce and EUR bounce. IF (again, a big IF) the Nasdaq and the EUR will bounce from here, we expect a bounce in crypto which should create the center let leg of what could eventually become a W reversal. The 1700 to 2200 area should be a reasonable target.