It has been rough in markets. There is a high probability this is coming to an end now. The Euro, a global leading indicator touched secular support, on Friday, in early trading. Remember, we don’t look at the Euro an FX trading instrument but a leading indicator that influences inter-market changes (the USD is influencing other markets in the opposite way).

We said in our US Dollar Level To Watch that the area that really matters is between $105 and $105.78. The USD index (DXY) closed the week at 106.89. Although this is 1% above the area we indicated, we don’t consider it a confirmed breakout because (a) we have only two full candles above 105.78 and (b) the long term EURUSD pair chart structure which we’ll feature in the next paragraphs.

For a more in-depth analysis on DXY and why the USD printed a turning point on Friday we suggest to read our latest Momentum Investing research material published on Friday pre-market. We feature a viewpoint about DXY based on time/price harmony that makes the case for a turning point in the USD.

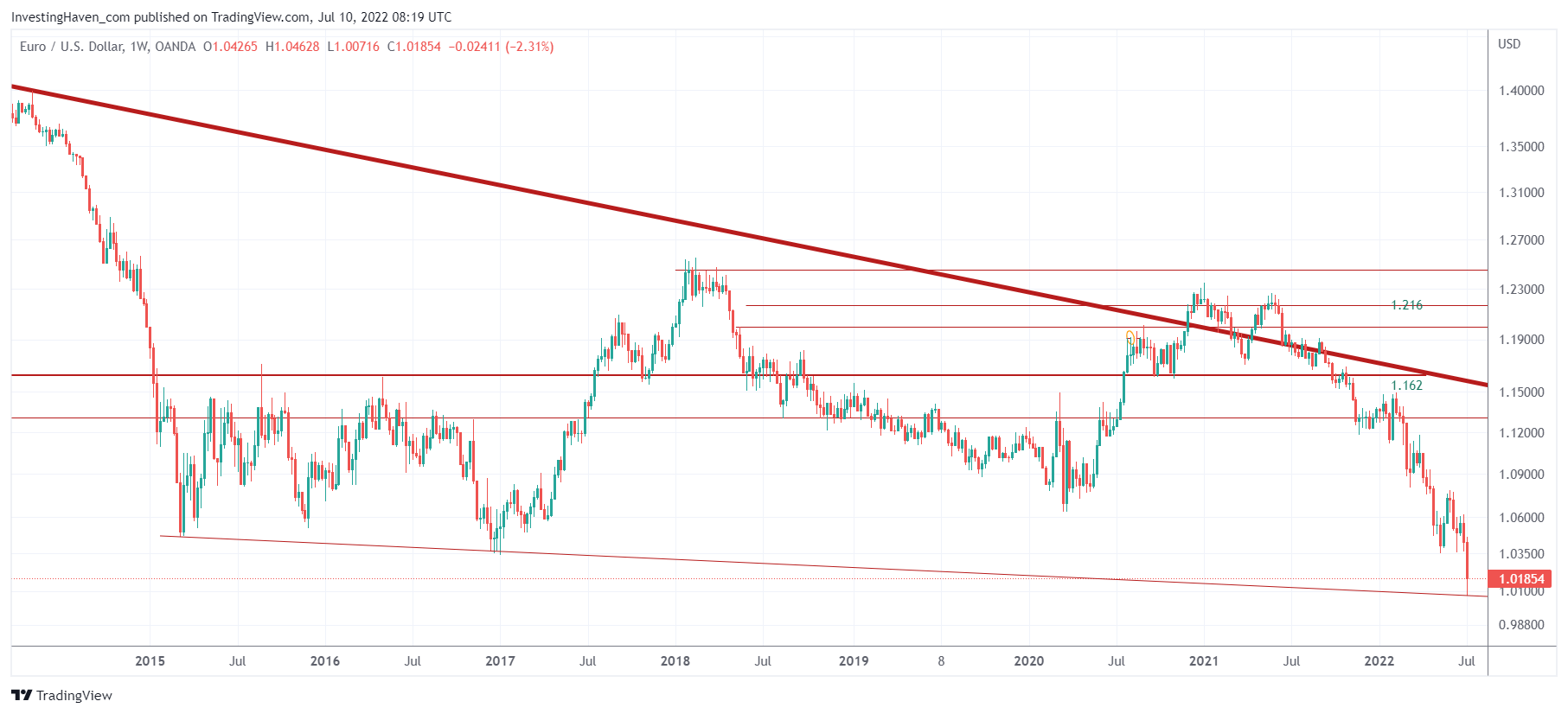

That said, if we flip the view and look at the EURUSD pair, weekly chart, we see a pretty dramatic test of a secular trendline.

The challenge with the EUR and the USD as a leading indicator is that there are 5 ways to look at the same leading indicator: the EUR, the USD, the EUR index (EXY), the USD index (DXY), the EURUSD pair.

With the EURUSD pair touching a falling trendline that goes back to 2015. The touch of this support line occurred on Friday, July 8th. The same day, the USD went to 107.62 and the EUR to 101.22. Time and price are in harmony but in order to ‘see’ this you need a much more detailed view (which is beyond the scope of this blog post).

We expect a consolidation in this area, a retest of the lows at a certain point later this year, with the potential of a V-shaped bounce in case the June CPI numbers (scheduled to be published on Wed July 13th) will be suggesting that monetary tightening will decelerate.

In our Momentum Investing updates we track the turning point scenario of the USD very closely, both in our weekend analysis and mid-week alerts.