In this article, we focus on 10 markets that we predict to develop a bullish trend in 2025. We cover stocks, obviously precious metals and a few select commodities. Here are bullish market predictions for 2025.

Additionally, we indicate that the most intense periods of 2025 will be:

- February 2025.

- Mid-March till mid-April 2025.

- May 2025.

- Autumn 2025 (TBC).

We expect strong moves to develop in those 3 to 6 weeks periods. However, it’s hard to predict which moves in which sectors exactly.

Our expectation: it will feel chaotic because different segments will go up and down quickly, in short-lived moves.

Note – We exclude crypto from this article. While very bullish crypto, it’s a separate asset class, not in scope of this article. We have published many crypto forecasts, and suggest to start here: crypto predictions 2025.

1. Epic sector rotation set to dominate 2025

Sector rotation has been the dominant trend in markets since the turning point October 13th, 2022.

Trends have been developing in specific sectors, mostly short-lived, with trend continuation after a few months.

This dominant market trend is set to continue to dominate markets in 2025.

- Intermarket analysis and sector reviews will remain a success factor in 2025.

- It might not feel like a bull market in 2025 – it will be a bull market looking at the data though.

Investing strategies should factor in sector rotation.

2. S&P 500 forecast: higher in 2025

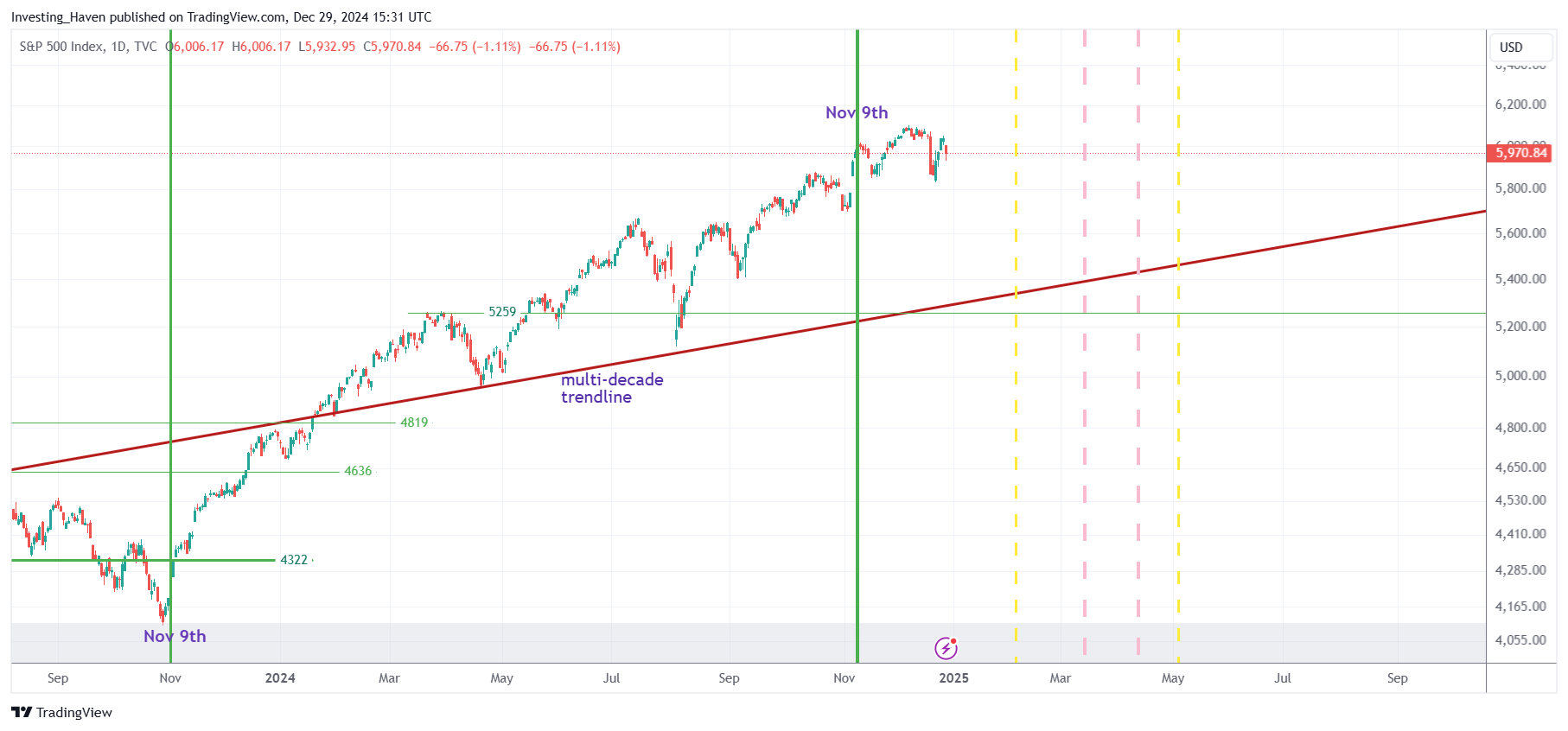

Source: S&P 500 Forecast For 2025.

The long term and medium term S&P 500 chart structures show a dominant bullish pattern.

Moreover, future earnings combined with economic data and consumer spending underpin a bullish outlook for the S&P 500 (consistent with forecasts from multiple market research agencies).

This justifies a bullish S&P 500 forecast for 2025. That’s why we believe the S&P 500 will move in a range between 5,350 and 6,350 points in 2025.

While the S&P 500 should do well, juicy opportunities should be presented in the mid-cap space which is set to benefit from improving market breadth!

S&P 500 prediction 2025 – The S&P 500 chart suggests that stocks might get very intense (potentially bullish) in February (first yellow line), neutral in the period mid-March to mid-April, super intense in May (unclear which direction). A potential summer or Autumn dip might bring the S&P 500 closer to the long term rising trendline.

3. Dow Jones predicted to rise in 2025

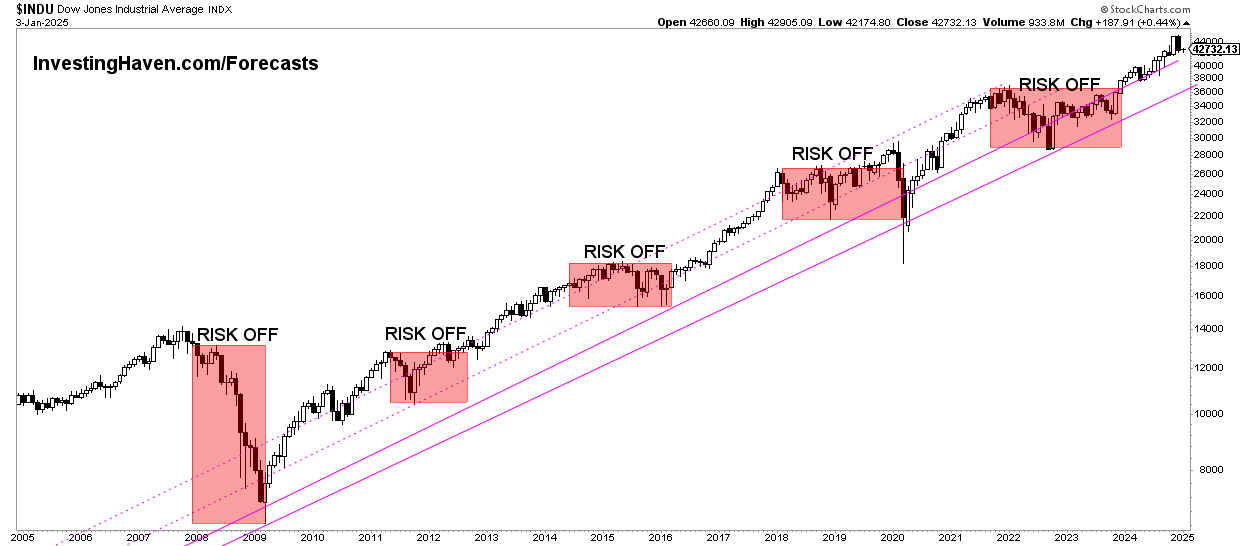

Source: Dow Jones Forecast For 2025.

The Dow Jones is predicted to be directionally bullish.

Our Dow Jones forecast 2025 is a trading range between 38,000 and 44,000.

Large caps will benefit from rising future earnings. Moreover, a gradual decrease in inflation combined with current interest rates benefit large caps.

Stocks ended the last regular trading week of 2024 on a strong note, reflecting price action over the year.

4. Nasdaq to continue its bull run in 2025

Source: Bullish Nasdaq Prediction 2025 & The 20-Year Nasdaq Chart.

The Nasdaq Index has been leading the charge in 2023, until early July 2024. Since then, the Nasdaq has been lagging.

In 2025, the Nasdaq is predicted to continue resuming its leadership position. The Nasdaq bull run is set to continue.

The Nasdaq is forecasted to move to the 22,220 area in 2025, based on its 20-year chart pattern.

The long term Nasdaq charts are absolutely phenomenal, worth checking out by clicking the above mentioned hyperlink.

5. Nikkei 225 predicted to be very volatile in 2025

Source: Japanese Nikkei 225 Index Historic Chart.

The Nikkei 225 is expected to become very volatile, especially in the 2nd half of 2025. This is one of the more unusual forecast among our 10 market predictions for 2025.

The Nikkei 225 historic chart over 50 years shows a giant secular pattern while the 25-year chart highlights a decision time window.

The decision window of the 50-year Nikkei 225 chart is completing in the first months of 2026. This means that 2025 will be a year in which the market will look for resolution of this gigantic pattern.

Our Nikkei 225 prediction is centered around the idea that chart dynamics will dominate in 2025.

6. Gold predicted to exceed $3,000 in 2025

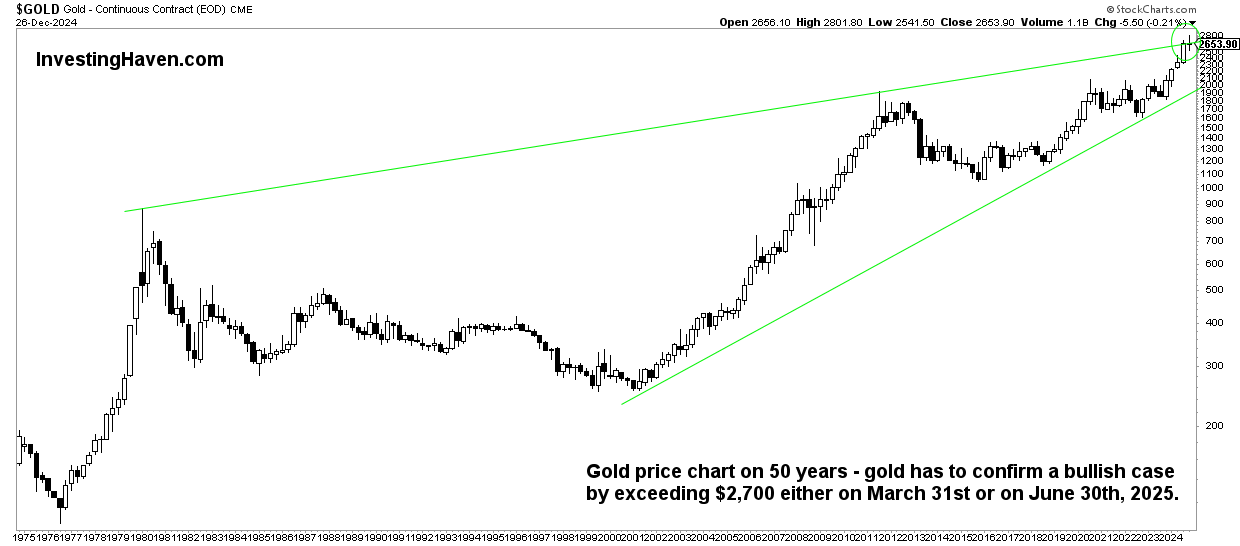

Source: Gold Price Prediction 2025.

Gold is forecasted to move closer to, and even temporarily exceed, 3000 USD an Ounce.

The price of gold might approach $3,000 in 2025 and exceed $3,000 in 2026. Eventually, gold could approach $5,000 by 2030.

The gold prediction suggests that dominant dynamics in the gold market will be monetary easing, a weak USD, gold secular chart dynamics. Because of this, the gold price is set to move higher in 2025.

The long term gold chart makes it clear – the ultimate and final gold bull market confirmation will be in once gold exceeds $2,700 an Ounce (not when fear kicks in). That’s when the potential rising wedge on the long term gold chart will be invalidated, the cup and handle formation since 2013 becomes the leading dominant bullish pattern. We believe this will happen at some point in 2025.

7. Silver predicted to test former ATH in 2025

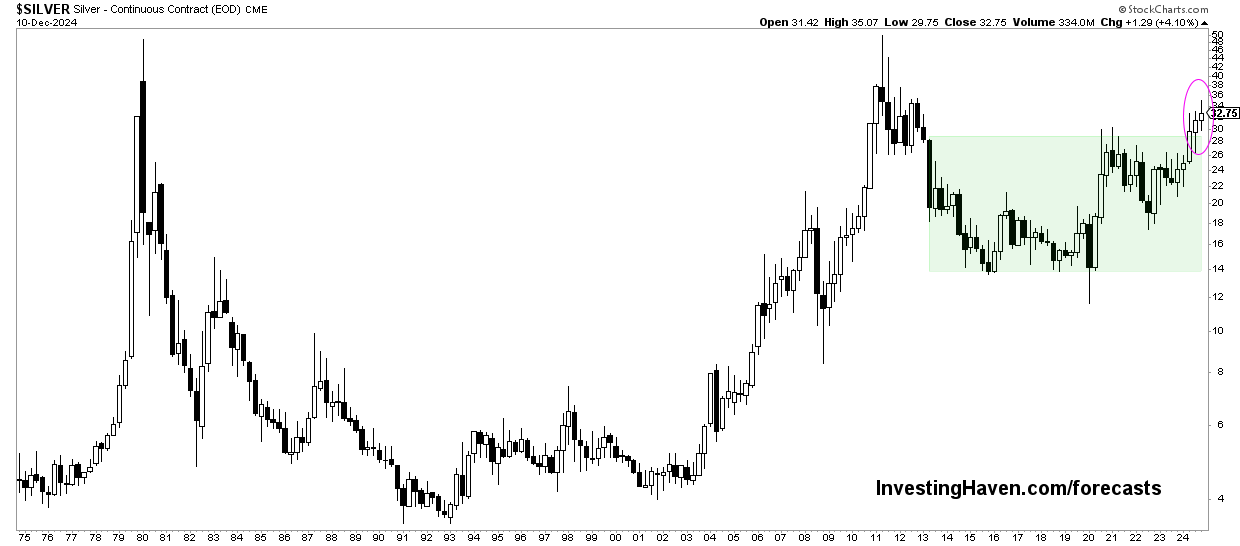

Source: Will Silver Hit $50 An Ounce in 2025? and Silver Price Prediction 2025.

2025 will likely be the year in which silver will approach its former ATH.

We explained the drivers for this bullish thesis here: 5 reasons to believe silver is the opportunity of the decade. Moreover, shorter term, we emphasized silver’s massive upside potential, backed up by leading indicator analysis.

Silver can and will hit $50 an Ounce, the only question is WHEN. On September 18th, 2024, silver confirmed its short term breakout which implies that silver is on its way to $50, probably in early to mid-2025.

The price of silver is working its way higher currently, in a structure characterized by several layers of resistance.

So far, silver has shown its ability to penetrate all those layers, one by one, at a slow pace.

This silver trend is set to continue in 2025 is the basis of our bullish silver forecast.

Readers should keep a close eye on the long term oriented posts in the $silver cash tag, filter out short term oriented info though.

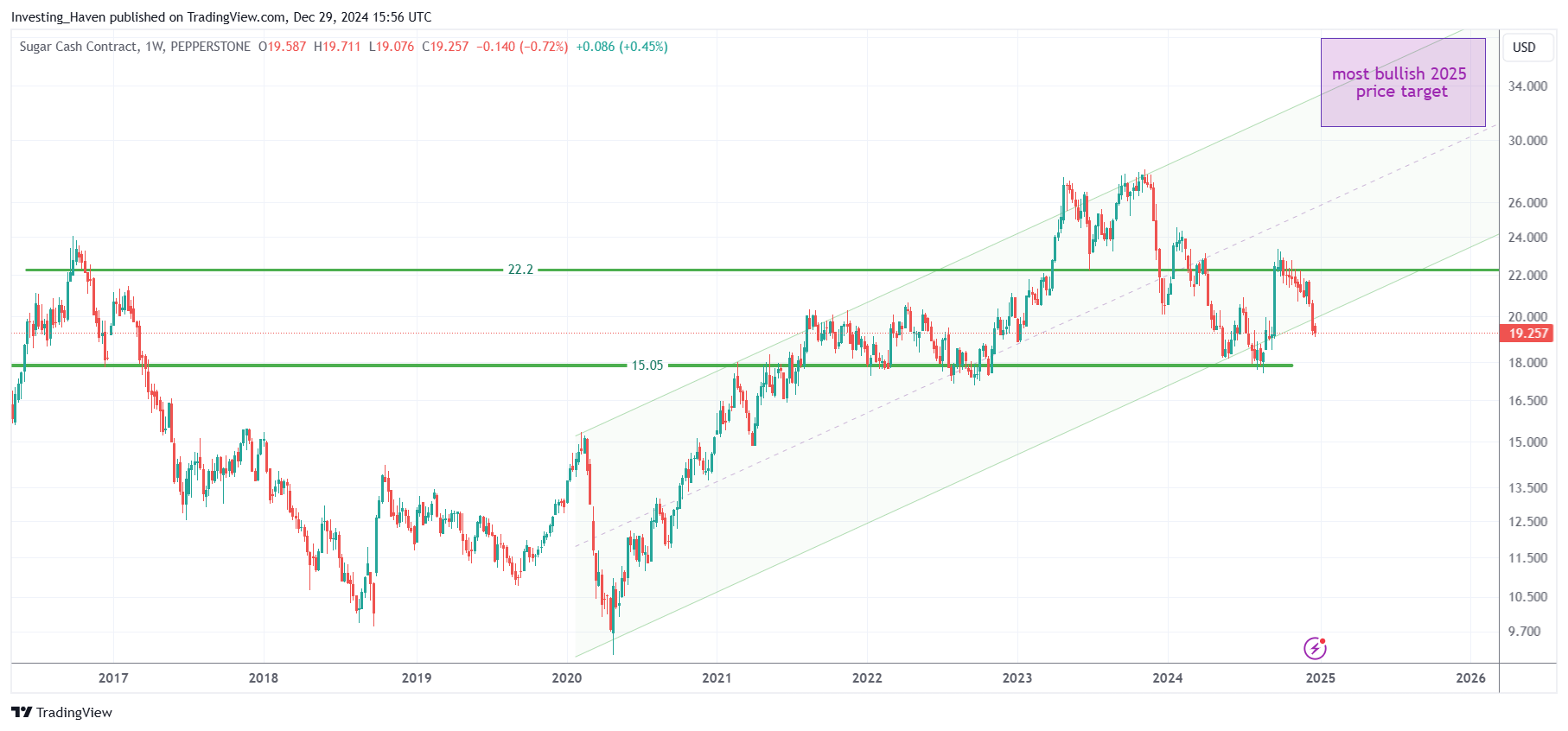

8. Sugar predicted to strongly rise in 2025

Source: Sugar Price Forecast 2025.

A rise of 50% in the price of sugar? Is this realistic.

Oh yes, for sure. This is what we wrote in our most recent sugar forecast update:

On September 20th, 2024, sugar confirmed our bullish silver forecast 2025 after it bounced sharply from its critical $18 cents per pound level. A rise in the price of sugar to $36 cents in 2025 is likely.

The sugar chart combined with its fundamentals paint a bullish picture for sugar in 2025. If this long term rising trend channel holds, we expect sugar to create a bullish W pattern between 2024 and the first half of 2025, suggesting a move to the top of the channel in the 2nd half of 2025.

9. Coffee predicted to consolidate in 2025

Source: Coffee Price Prediction 2025.

In September 2024, we wrote that “the price of coffee is expected to steadily rise in 2025.” Since then, the coffee price went up 50%. Our bullish coffee price target got already hit right before the start of 2025.

The most bullish scenario suggests $3.40 per pound.

This bullish outlook is supported by solid coffee fundamentals which has proven to be a very reliable leading indicator and strongly correlated to the price of coffee over the years.

10. Lithium forecast a major bottom in 2025

Source: Lithium – A New Booming Trend As Of 2025?

We predict that the lithium market will start working on a nice long term bottom in 2025.

This should present investors with a long term focus with nice entry opportunities, maybe even ahead of 2025, provided spot lithium does not move lower from here.

We will update these 10 market predictions for 2025 on a quarterly basis. We encourage readers to sign up to our premium services, particularly gold & silver as well as our crypto research, for very specific market insights and timely alerts.