Platinum surged in 2025 as supply tightened and industrial demand picked up across key sectors. Strong investor interest added extra fuel to the rally.

Platinum shifted from years of weak performance to one of the strongest gains in the precious metals market this year. Prices climbed as supply shortages grew and buyers returned to the market, creating steady momentum throughout 2025.

RELATED: Platinum, Gold, Palladium & Silver Dominate YTD Performance

Platinum Price Performance And Market Momentum

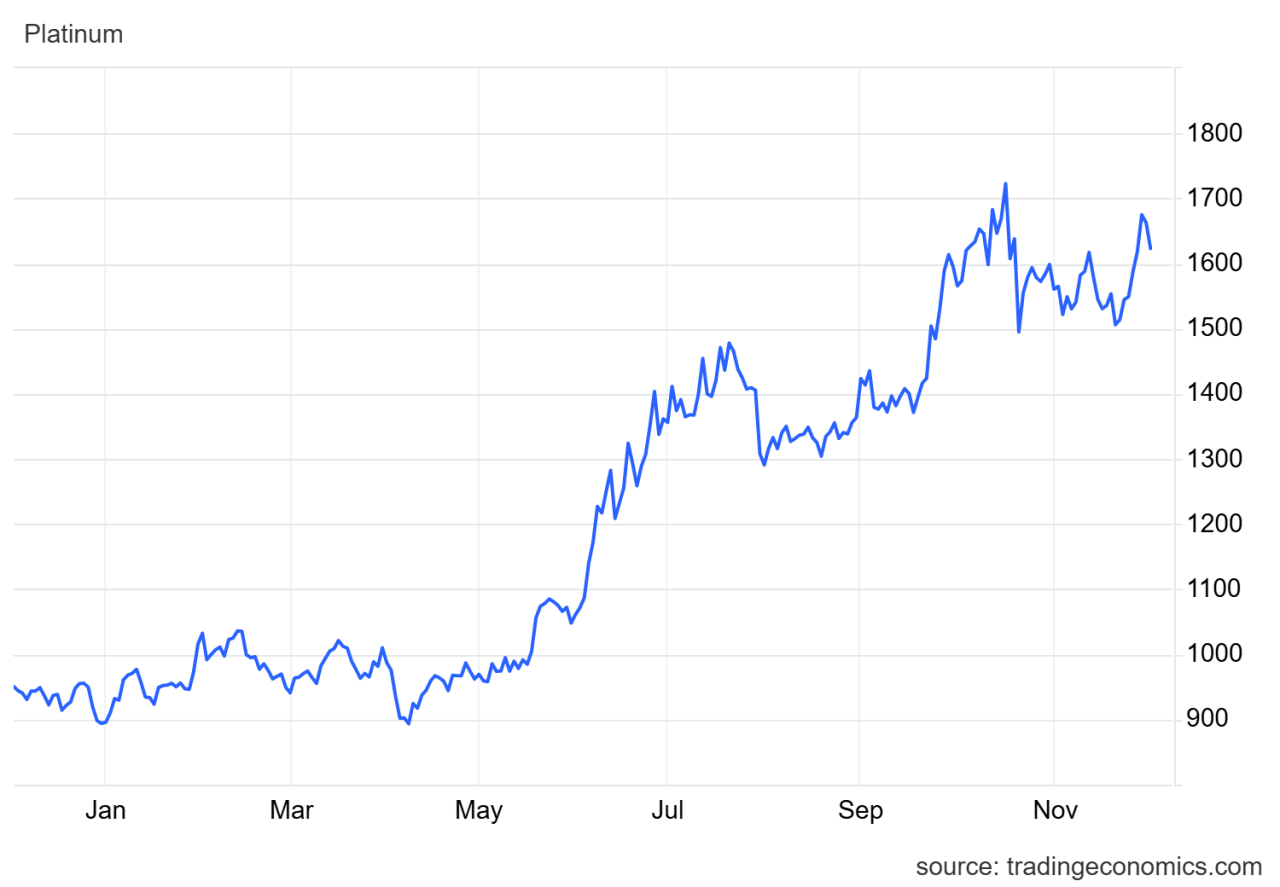

Platinum rose about 60% to 80% year to date, breaking through important resistance levels and reaching multi-year highs.

These price moves encouraged more investors to enter the market, which added to the strength of the rally. Falling inventories in major hubs and rising ETF activity supported the uptrend, while short covering helped push prices even higher during sharp trading sessions.

RECOMMENDED: Why Silver and Platinum Are the New Strategic Metals of 2025

Tight Supply, Mining Output And Recycling

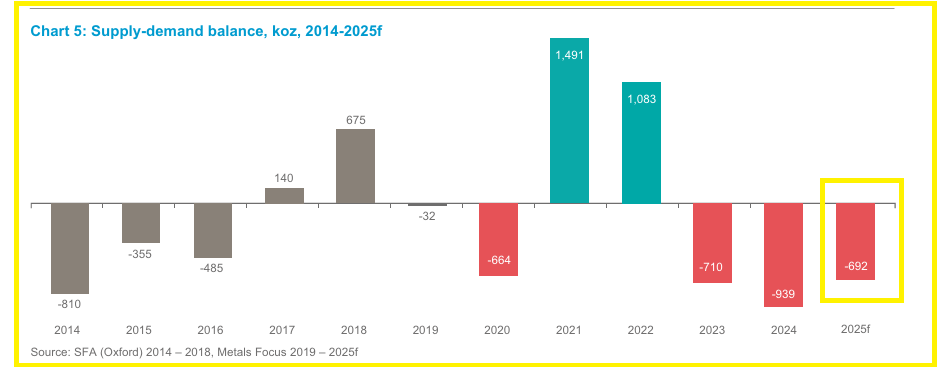

The market faces a large Platinum supply deficit in 2025, with estimates between 692,000 and 848,000 ounces. Primary mine output fell by a few percent from last year, and recycling volumes stayed weak.

These supply issues come at a time when new mining investments remain limited, so production may stay tight for several years unless major projects move forward.

ALSO READ: Platinum’s Breakout: Is Platinum the Next Major Precious Metals Rally?

Demand Drivers: Autos, Jewelry And Investment Flows

Platinum industrial demand increased as some automakers raised platinum use in hybrid vehicles, shifting away from palladium in certain applications. Jewelry demand improved slightly, adding steady physical consumption.

Investors also played a major role as ETFs and physical buyers increased their positions, which added more weight to the rally and helped hold prices at higher levels.

RECOMMENDED: A Platinum Price Prediction For 2025

Conclusion

Platinum’s 2025 performance points to tight supply, stronger industrial demand, and active investor participation. The trend can continue if these conditions hold, although faster BEV adoption or weaker economic data could change the outlook.

Keep an eye on updated deficit numbers, changes in auto sales, and inventory levels to understand where the market is heading next.

Looking for clarity in the gold & silver markets?

Our premium members already have it.

InvestingHaven’s Gold & Silver Premium Alert Service delivers clear, data-driven forecasts built on nearly 20 years of precious metals expertise.

What you get:

-

Weekly gold & silver trend analysis using leading indicators (CoT, USD, yields, COMEX data).

-

Turning-point forecasting across multi-timeframe charts.

-

Actionable insights on GDX, GDXJ, SIL, and SILJ.

-

Intra-week alerts only when markets move — no noise.

Designed for serious investors who want medium- to long-term guidance, not short-term trading hype.

Join today and get the gold & silver roadmap trusted by disciplined investors worldwide.

Read our latest premium alerts:

- This Is Why Precious Metals Investors Should Be Watching The USD (Nov 23rd)

- Precious Metals – The Candles Are Clear (Nov 15th)

- Gold, Silver, Miners – The Message of the Charts (Nov 8th)

- What’s Next For Precious Metals? (Nov 2nd)

- The Expected Pullback Is Here. How Much Downside Is There In Precious Metals? (Oct 25th)

What Our Members Say

“I have to say — your gold and market analysis is INCREDIBLE. The timing of your pullback forecasts has been spot on. People forget that even the strongest trends need healthy corrections!”

“The way you distinguish between accumulation moments and profit-taking moments has helped me tremendously. You've been right so many times — it’s honestly impressive.”

— Premium Newsletter Member

“Your team puts an extraordinary amount of work into the Gold Alerts and premium market updates. After all these years, the passion and consistency are still there. Respect.”

“Thanks to your research, I’ve become a much more patient investor. My decision-making is calmer, clearer, and more strategic — and the results show it.”

“Looking at gold, silver, and the S&P 500 from a long-term perspective has reduced so much stress. Your approach consistently outperforms short-term trading — the difference is night and day.”

— Gold Alert Subscriber

“I really appreciate the clarity and wisdom in your gold and market commentaries. The way you simplify complex trends has helped me understand the big picture like never before.”

— Long-Time Member