Rare earth metals have been a very lucrative investment a few years ago. They did recover well after the Corona crash. We have a bullish rare earth metal stocks forecast for 2021. We see a 50% upside potential in rare earth metal stocks in 2021, we add this as another bullish 2021 forecast in our series of global market forecasts.

As explained by Reuters, rare earth elements are used in a wide range of consumer products, from iPhones to electric car motors, as well as military jet engines, satellites and lasers.

Although they are more abundant than their name implies, they are difficult and costly to mine and process cleanly. China hosts most of the world’s processing capacity and supplied 80% of the rare earths imported by the United States from 2014 to 2017. In 2017, China accounted for 81% of the world’s rare earth production, data from the U.S. Geological Survey showed.

There is a dominance by China when it comes rare earths production.

And there are constant tensions with China.

Moreover, commodities as an asset class are in a new uptrend, after having been ignored by investors for some 7 years in a row.

That combination makes for a great case for rare earth metal stocks to flourish at “a” certain point in time in 2021. This is, combined with the chart, the simple yet effective basis for our bullish rare earth metal stocks forecast for 2021.

It is though to easily track individual prices of rare earth metals, as inputs for rare earth metal stocks.

Very recently, in November of 2020, the prices of all major Chinese-sourced rare earths were spiking, but especially those used in magnets. That’s what Mining.com reported. In particular, they refer to a research note from BMO Capital Markets mentioning neodymium, which is the most common rare earth used in making magnets, which rose by 27% since early in November, up over 50% in 2020. Several other key rare earths also increased in value last month, including dysprosium (+17%), gadolinium (+9%) and terbium (+27%).

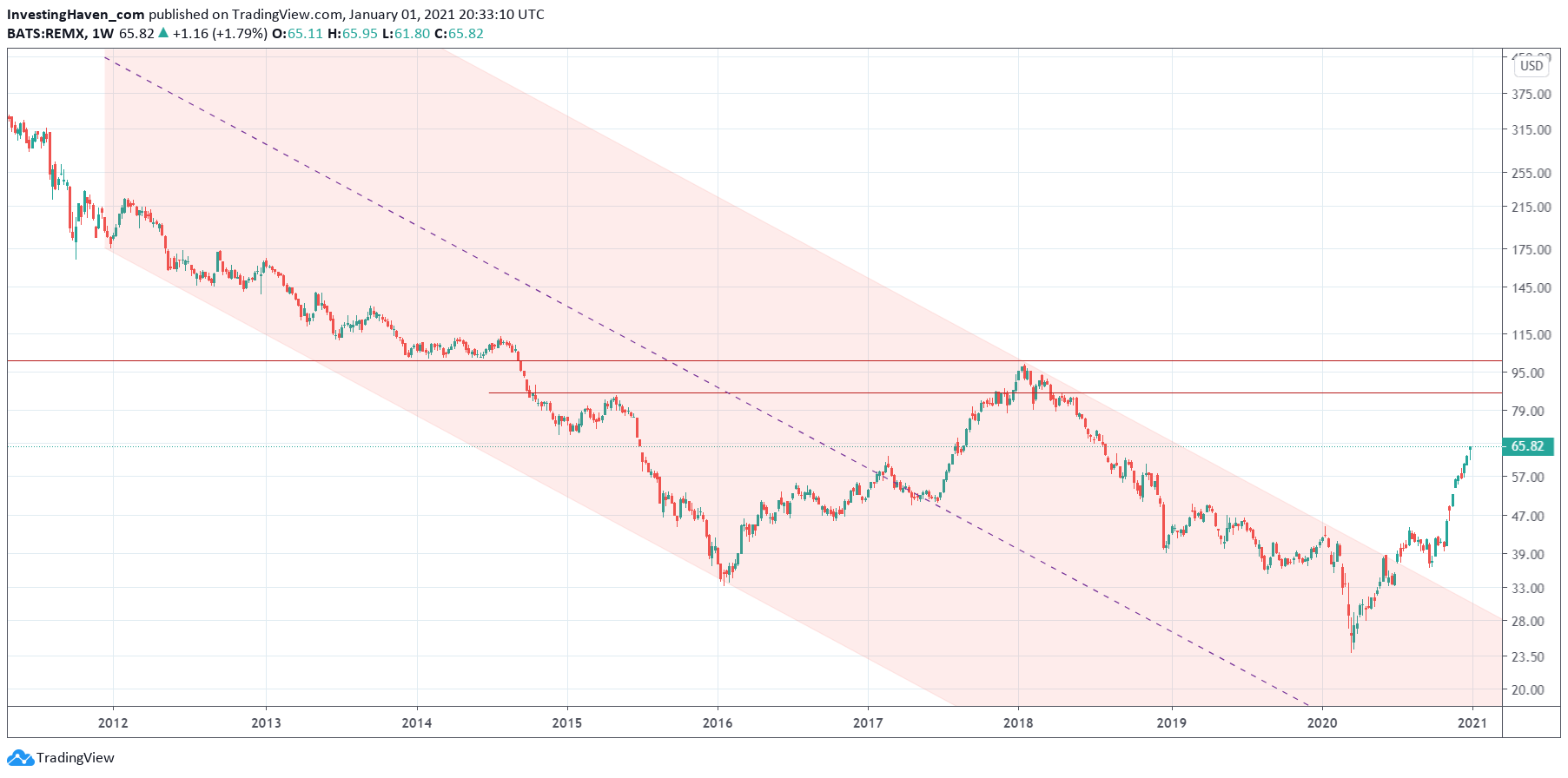

Interestingly when we look at the rare earth metal stocks chart, the long term chart on the weekly timeframe, we see that the long term bear market transitioned into a new bull market somewhere around summer of 2020.

The above chart clearly suggests a very long term bullish W reversal that will bring the REMX ETF back to 95 points in 2021. And this is a very simple yet effective ‘tool’ which we can trust for our rare earth metal stocks forecast for 2021.

A consolidation at that point with a break above 100 points will be ultra bullish for 2021 and/or 2022.

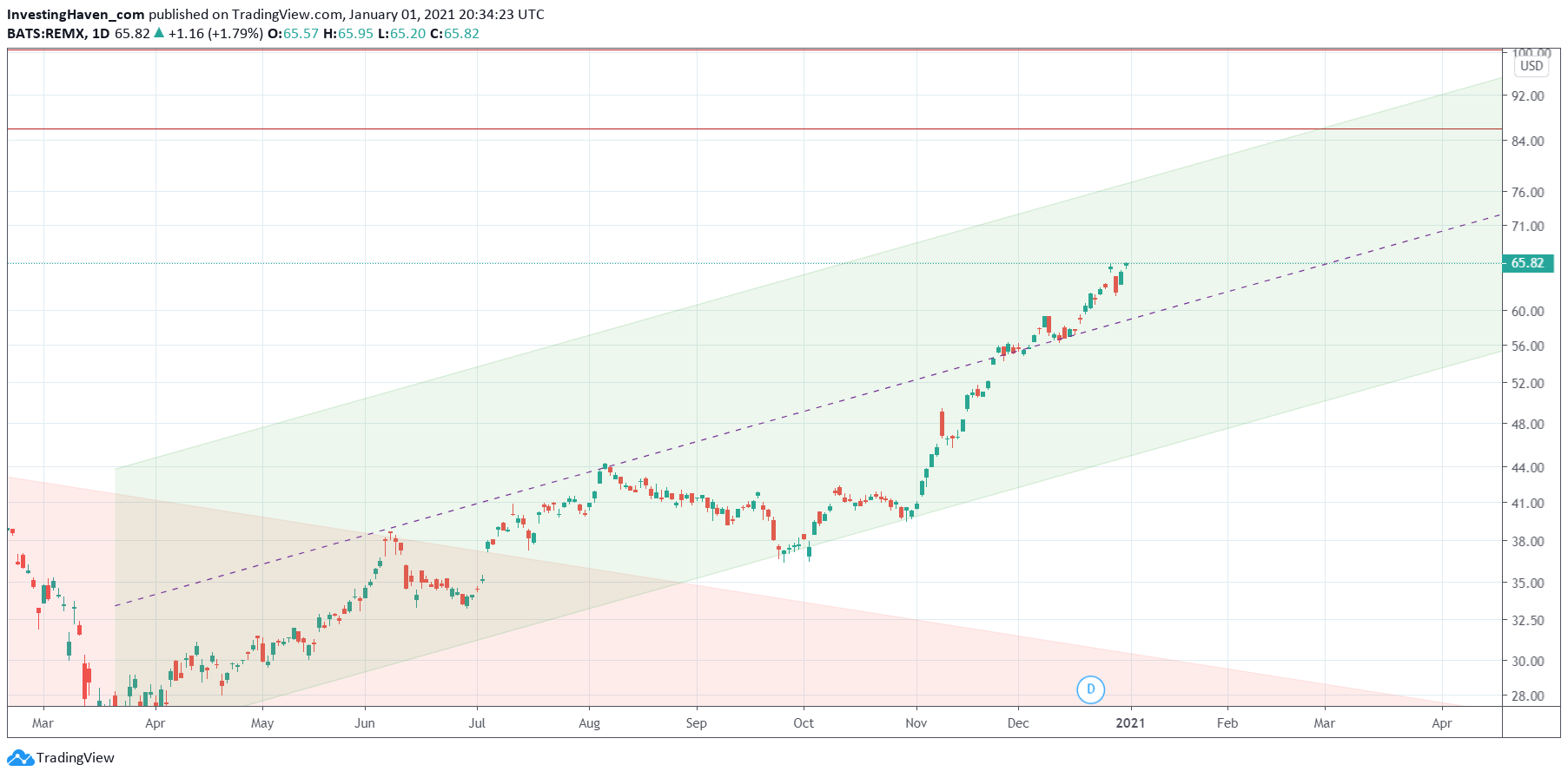

The close up of the rare earth metal stocks chart shows the new bull market, and the acceleration took place in November, as per the prices increases explained on the Mining.com article above.

This daily rare earth metal stocks chart below suggests higher prices in 2021, but also suggests great entry points if and when a retracement would occur.

We will be focused on the above chart, combined with the REMX ETF holdings (individual stock charts) to identify an attractive entry point in one or two individual rare earth metal stocks in 2021, particularly in our Momentum Investing portfolio.

Enjoying our work? We invest in market segments in which momentum is brewing, and we do so with carefully chosen positions which we hold from a few weeks to a few months. Our Momentum Investing portfolio was up +95% in 2020. We are interested in commodities stocks, and rare earth metals are also on our watchlist. Whenever we believe the time is right + entry prices are attractive, we will take a (small) position in a rare earth miner in 2021.