The fear for a global recession was dominant for a long time. The consensus view was that a recession would lead to a market crash. Interestingly, while all indicators are bullish for markets for a few more quarters, fear remains dominant. While fear has eased in recent weeks, with the S&P 500 index clearly pointing to new ATH, fear was dominant until very recently. Will the widely expected recession finally hit markets in 2024? The answer is NO because the recession is here, nearly complete now. It was a rolling recession which went over different segments of the market and economy, one by one. The rolling recession is not entirely over, not yet, it is hitting commercial real estate now and softly the automotive sector.

We are almost inclined to ask “which recession?”

All jokes aside, we have said, repeatedly, that the recession had already hit the market and the economy, but it had a different shape than what most were expecting: a rolling recession in the economy which translated into epic sector rotation in markets.

A recession in 2024?

Fear is one of most important drivers of investors.

The other one is disappointment.

Both are part of the same family – emotions that heavily influence decision making.

The third one is bias which is the result of narratives. Media plays a very important role in creating narratives.

On February 7th, 2023, Forbes published this article: The former top economist for Merrill Lynch says that stocks could plunge another 30%: ‘The recession’s just starting’.

Talking about a narrative – the fear for a recession to hit the economy and push markets much lower turned into one of the strongest narratives we have observed in the last few decades.

No offense against the writer, nor against the forecaster, but these fear-mongering headlines have been dominating the psyche of investors since early 2022 in a very negative way, very negative.

What the vast majority of writers, analysts and investors forgot is that a recession can be spread out over time, hitting different sectors of the economy and the market at different points in time. A rolling recession, as per Yardeni. In our own words – unusual sector rotation, a topic that has been dominant in our writings (also premium services research) for 18 months.

The single biggest risk for markets in 2024

With that said, are we 100% sure that there will not be a recession in 2024?

We would say that the probability is low, and that the single biggest risk for investors and markets is determined by monetary policy makers.

We are going to be blunt – we are not afraid of the market nor the economy, we are concerned about tunnel vision of policy makers at the Fed and ECB. We have no trust in their work, simply because their decisions are lagging. Their decisions are lagging because the data sets they use and their way of working/thinking/operating is lagging.

The market, on the other hand, is a forward looking entity. It sees the data and anticipates what will come.

Let’s not forget – the Fed was very late in hiking rates, creating the perfect environment for a total blow-up with a simple trigger (which happened to be war that, in the end, had nothing to do with world markets, it was an engineered situation, visibly and clearly).

Similarly, policy makers continue to sing the same old song of ‘higher for longer’, seemingly unaware of their lagging viewpoint and decisions.

Here are 2 indicators that we will be watching to understand whether and, more importantly, when exactly, the market is going to force the Fed and the ECB to lower rates.

First, we expect that Yields will suddenly drop at a certain point in 2024, presumably around the summer, in a way that will catch policy makers by surprise. The month we expect this to occur is August of 2024, subject to change, as we get closer to that point.

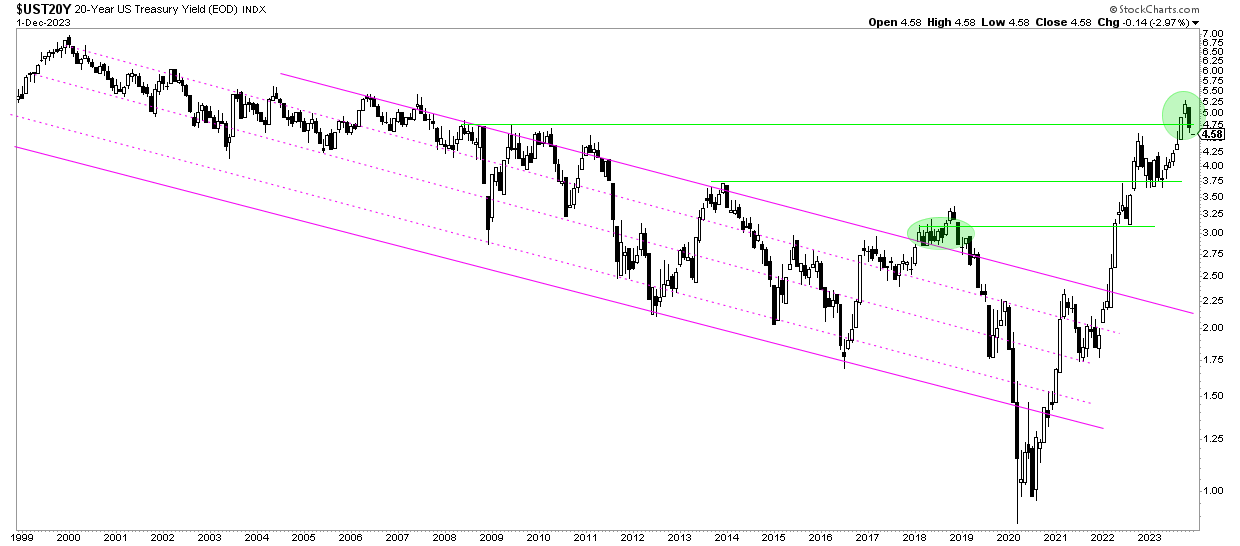

Below is the historical chart of 20-Year Yields, over 25 years. Without any doubt will we see a fast decline in Yields, and the Fed will be late to anticipate. Think of the regional banking crisis of March 2023, but then an event on steroids that the Fed won’t be able to control as fast as they did back in March.

One thing we do know from experience – fast rising or fast falling rates are a trigger for turbulence.

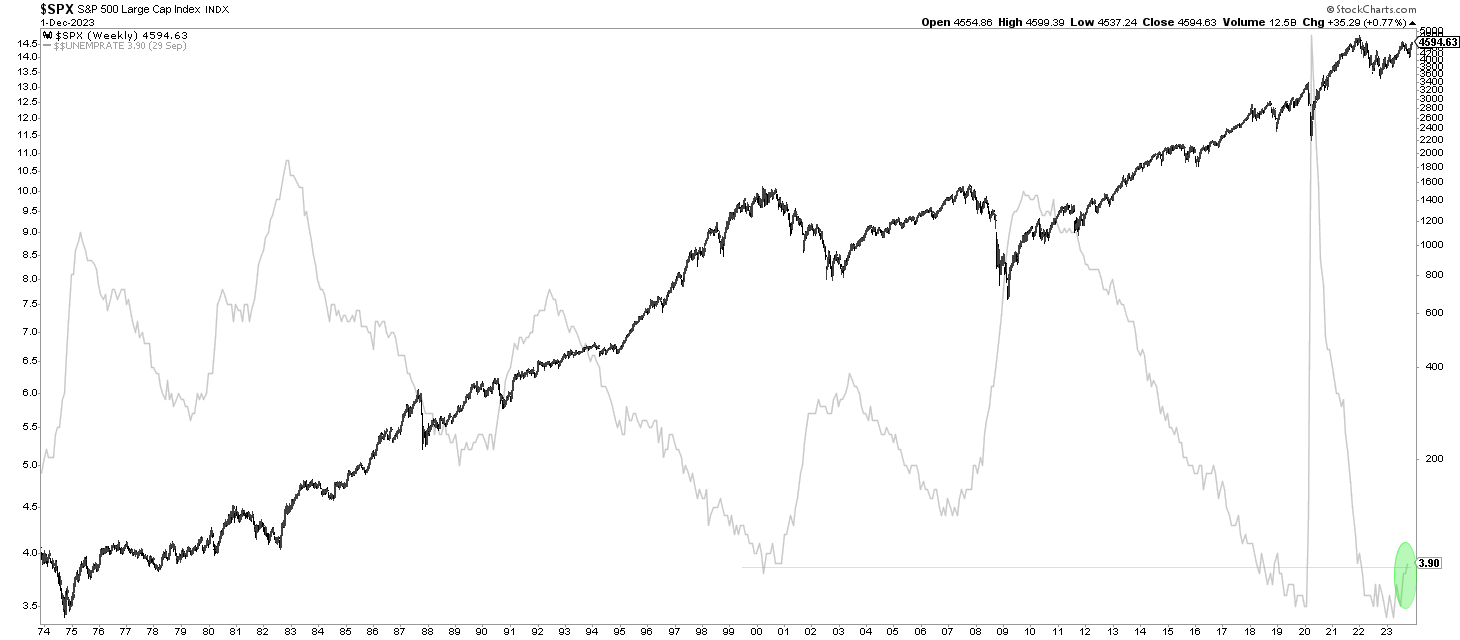

The other indicator we will be watching is the unemployment rate.

Below is the 50-year correlation between stocks (SPX) and the unemployment rate, negatively correlated. The Fed did a phenomenal job of rising unemployment, they are also proud about it (impossible to understand, it is what it is). While the unemployment rate is still at an absolute low on a 3-year basis, it is on the rise. If the Fed is not going to quickly tune their tone of voice and monetary decisions, unemployment might pick up to the extent that it will directly impact consumer spending which might eventually lead to a recession.

The single most important indicator for investors in 2024

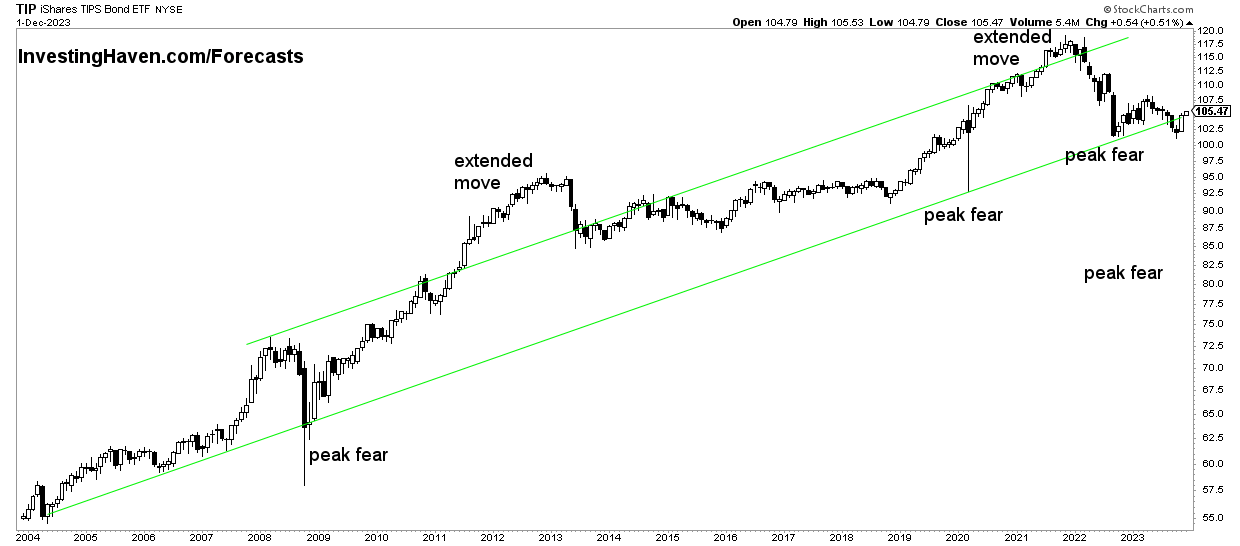

With the risk of repeating ourselves, and sounding like a broken record, we will be tracking inflation expectations (TIP ETF) to understand the high level direction of the market as well as spotting turning points in 2024:

Which Is The Single Most Important Indicator That Investors Should Track In 2024?

TIP ETF represents the expected rate of inflation. If markets are in a state of balance, there is some mild inflation which the market calculates based on the expected Fed Funds Rate (2-Year Yields) and the current interest rates.

How does this translate to chart patterns?

Very simple, this balanced state is respected if TIP ETF moves in the long term chart pattern. In other words, we don’t want TIP ETF to fall below its 10-year rising channel for more than 3 months.

The chart says it all:

How do we help investors?

Very simple, by offering market analysis and spotting trends, high level trends but also sector specific trends. We do so in the premium service Momentum Investing. Our timeframe is medium to long term.

For short to medium term oriented investors, we offer detailed SPX analysis, both price and timeline analysis. We enrich this with detailed gold and silver price analysis. More about this service in SPX, Gold & Silver Price.

For those that prefer to focus on other things in their life, we offer a passive income service in auto-trading mode.