We consider our annual silver price forecast one of those important forecasts because of our track record in forecasting silver prices. According to our latest silver forecast as well as our gold forecast we predicted a new bull market, and it was an accurate forecast. However, this is not a raging bull market yet, it is the first stage of a bull market and it might accelerate to a second stage in 2021. We did forecast a silver price of $22/oz for 2020, and our forecast was spot-on. Silver even exceeded our silver price forecast. We expect price north of $28/oz in 2021. The prerequisite is that gold moves above 1925 USD/oz for 3 consecutive weeks, this might happen early on in 2021 or late. We also need to see a strong Euro, essentially the Euro bull market has to be there. Our 2021 forecast is bullish.

[Thorough update on 10.25.20. Please scroll down to find the most up-to-date silver forecast for 2021.]

[Post Corona Crash Update posted on 08.08.20. Please scroll down to find up-to-date silver price charts and insights 4 months after the Corona crash lows.]

[Corona Crash Update posted on 03.20.20. Please scroll down to find silver price forecast insights after the Black Thursday and Black Monday crashes in March of 20′.]

Introduction

As a first general thing we have to point out a very common misconception. Investors tend to think that silver is bullish most of the time. Nothing is further from the truth.

The important misconception is that silver is exceptionally bullish. Most of the time it is bearish or neutral. However, those few times that it turns bullish it does so on steroids. “Once bullish, extremely bullish,” is what characterizes silver.

This is another illustration of Tsaklanos his 1/99 Investing Principles: it is only 1% of the time that silver is wildly bullish. The remaining 99% of the time silver is flat to bearish.

Why This Silver Price Prediction?

What we are really (only) interested in is to catch these major moves in silver. That’s the reason we we will continuously update this silver forecast throughout 2021.

We are on the lookout of markets that become a multi bagger in 6 to 9 months time. It is our official mission. We call it our Mission 2026, and we even have a target for this: we want to turn $10k into $1M the latest in 2026 by outstanding forecasts and perfectly timed trades.

Based on the elements in this article we conclude that the likelihood of silver setting some spikes in 2021 is high. Timing will be crucial, and precision will be of the highest importance!

We strongly recommend readers to check in often, and follow all our articles and forecasts.

Our Silver Price Forecast for 2021

Let’s start with the conclusions of our silver price forecast for 2021. Readers who don’t want to understand our underlying forecasting method can ignore the rest of the article.

Silver is a new bull market, period.

Based on the long term charts which show silver’s dominant patterns we expect this new bull market to continue for some 8 years. That’s the same time the bear market took to complete.

InvestingHaven’s research team is the first one to publish a new rising channel on silver’s price chart. It is the core of our silver predictions for 2021. This goes to the core of forecasting: seeing what others cannot see!

We look at leading indicators in the COT report and inflation indicators to get a sense of the timing of the spikes in 2021.

Our Silver Price Forecast for 2021

Based on the leading indicators and more importantly the chart setup we see the following silver price forecast for 2021.

This is our forecasted silver price for the coming years. Prices reflect silver's spot price.| Year | Silver price forecast | Conditions | Invalid |

|---|---|---|---|

| 2020 | Mildly bullish, spike at $22 | Dollar soft, gold strong, inflation bottoms | Silver falling back to its breakout level at $15 |

| 2021 | Bullish, spike at $30 | Dollar soft, gold strong | Silver falling back below its breakout level of $17.25 |

| 2022 | Neutral or even temporarily bearish | N/A | N/A |

Silver Forecast as per Gold’s Bullish Forecast

We explained in our gold forecast that gold now confirmed its bullish trend for 2021. Consequently silver follows gold’s path higher!

Some say this is due to fear, other due to political and other tensions. Whether it is COVID or anything else. It all doesn’t matter.

We say all this is b*****t because markets move higher if and when they are ready to go higher. The news is just the ‘excuse’. Without that news event there would have been another ‘alibi’ to move higher around the same time period.

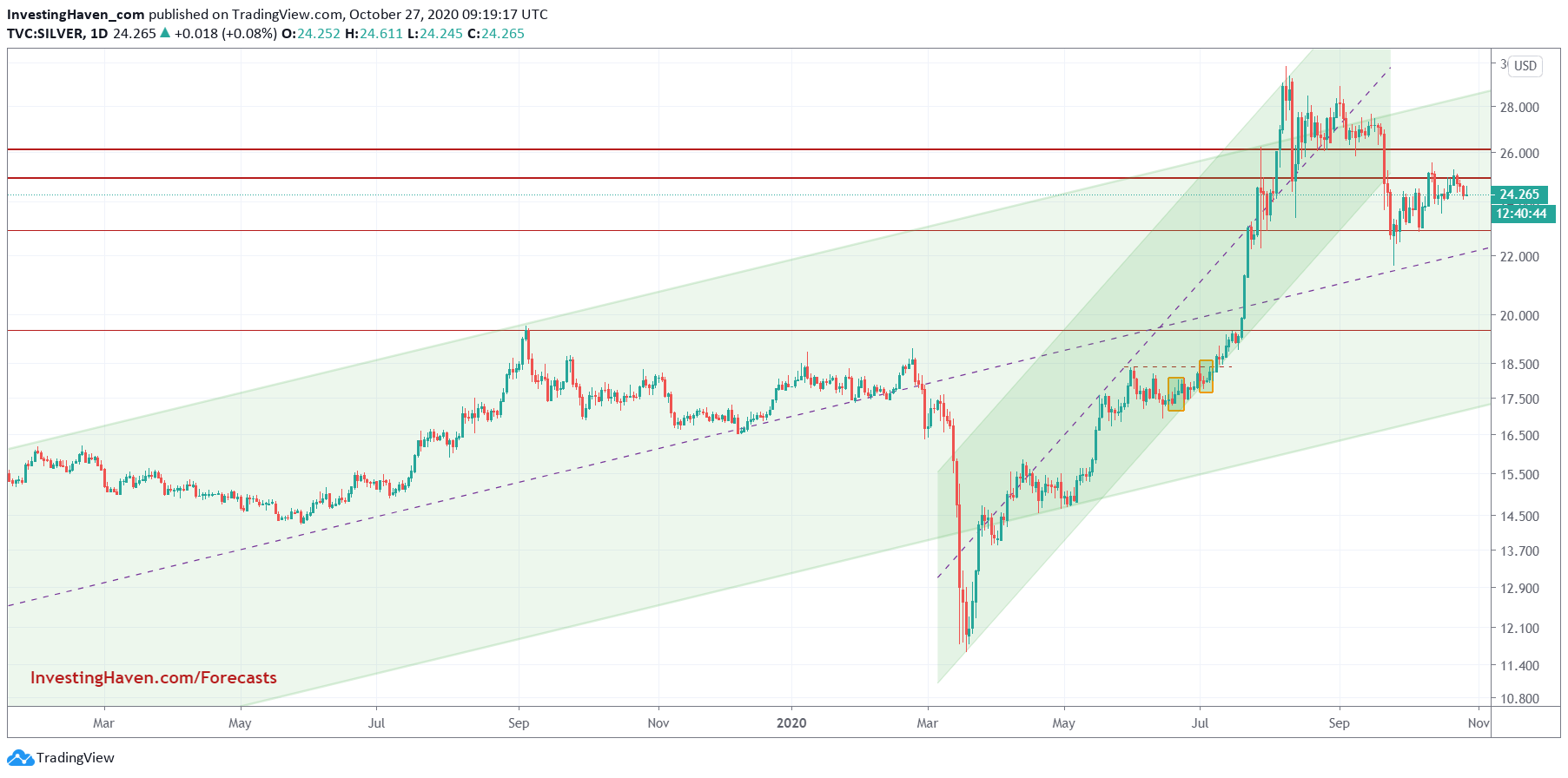

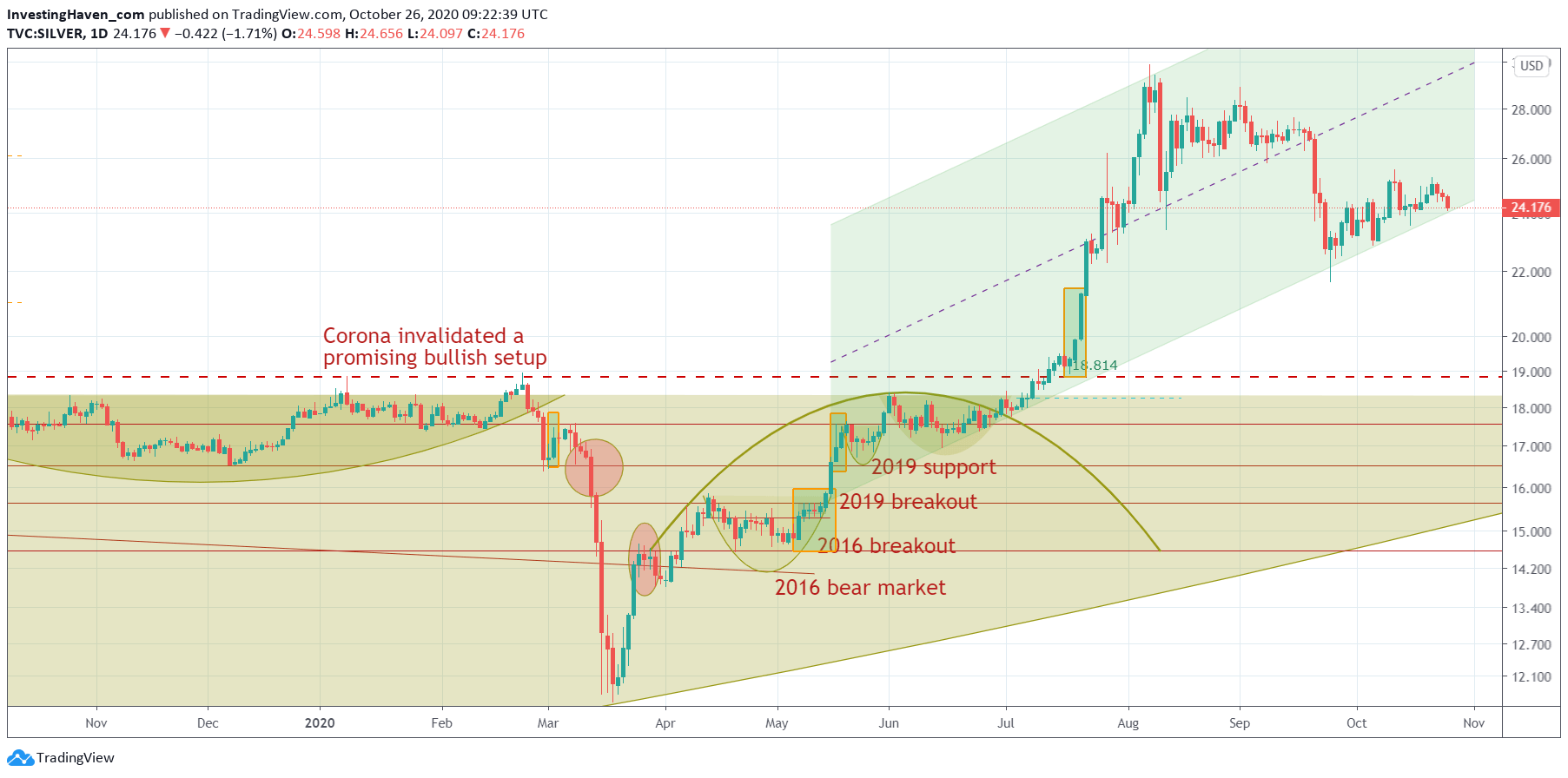

Similar to gold we see a new bullish pattern is born on silver’s chart: the green channel on below chart. Needless to say this is a very bullish ‘event’.

It is clear that silver has risen too fast too high, so it needs to take a breather.

Whether silver will get bullish again at the start of 2021, around summer time or the end is something that nobody can really forecast. That’s why you need to track the week-by-week, and month-by-month progress.

What’s important to note is that silver is moving in this new channel, so we can reasonably expect that the support levels will provide some good ‘reason’ to bounce. The three support levels to watch:

- The horizontal lines in red on below charts: 23 USD (approx), 19.50 USD (approx).

- The median line of this long term green channel.

- Ultimately, support of this long term green channel.

Ed. note: Sign up to our ‘momentum investing’ premium service to known when we believe it is time for gold and/or silver trades. Note that we took a silver trade in 2019 that delivered +80%, one in December/January that delivered 4%. Throughout 2020 we took several gold and silver mining trades, they were all absolutely perfectly timed and delivered some really good results (with the exception of the gold and silver miner in Oct of 20′). We are sure a new silver opportunity is underway, so stay tuned with our momentum investing premium service which covers among many other markets also the silver market.

Chart update: 10.25.20

Leading Indicators for our Silver Price Predictions

We have been successful forecasting silver prices in recent years.

To illustrate this we go back to April of 2017 where our silver price forecast was published on MarketWatch: Silver has peaked for the year. We were spot-on. The set of circumstances were not in favor for a strong year in gold nor silver.

In May of 2019 however we were very vocal and convinced about a gold and silver price breakout, and said so in Why gold’s a ‘bargain’ at less than $1,300 an ounce which was published on MarketWatch. Even Barron’s picked up our forecast, and featured it on May 3d: How Gold Could Stage a 20% Rally This Year.

Those silver price predictions are accurate because silver has a number of reliable leading indicators for its future price.

One very reliable leading indicator is the inverted Dollar correlation, though this is a directional indicator. It works on a secular level, not on a day-to-day level. This is an important misconception for many investors!

Similarly, the inflation vs deflation indicator works in a similar way.

One of the most reliable leading indicators for the future price of silver is the silver futures market COT report.

The way to understand this indicator is that it signals a bottom or top when hedge funds have extremely low or high positions. The shape of the subsequent change in net positions is what helps understand whether there is a bull market or bear market in the price of silver.

We look at all those leading indicators, combine it with silver’s chart patterns, and use this as the input for our concrete silver price prediction.

Note that articles like the ones outlining 10 reasons to invest in silver have no added value as leading indicators. It is nice entertainment but be sure that silver price forecasting has nothing to do with inventories, cheap vs expensive arguments, etc. Similarly, whatever hedge fund or financial institution being bullish on silver has no value when it comes to silver price forecasting.

Leading Indicator: Silver COT

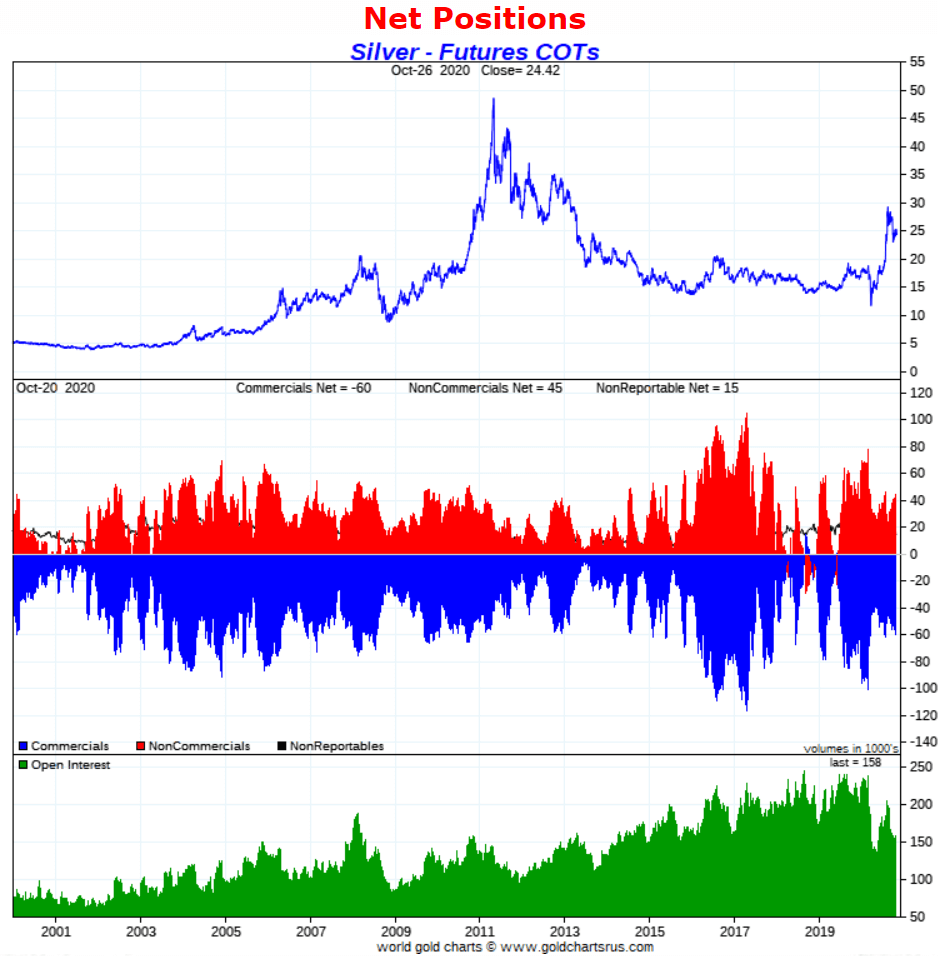

When it comes to the silver COT report we look at extreme net positions of non commercials. Every time non commercials are in the 60,000 to 80,000 contracts net long it tends to signal a major peak in silver’s price.

When it comes to the extreme low level of net long contracts by non commercials we see 2 potential scenarios:

- Either their positions drop close to zero. This comes with a serious price drop. It tends to happen in a silver bear market.

- Either their positions drop but remain significantly positive as the price correction ends. This tends to happen in a silver bull market.

After silver’s major peak in 2011 we saw many drops of silver’s price close to zero for both non commercial and commercial traders. The ultimate test for 2021 will now come soon, and we expect silver’s price correction to come with a significantly higher number of contracts for traders.

All data points mentioned above are visible in the center panel of below chart.

Chart update: 10.25.20

Interestingly, by looking carefully at the above chart along with our commentary, we conclude that silver’s futures traders are nowhere near extreme levels at the time of printing this chart. This means that a consolidation may be in the cards, but that the upside potential is significant.

This chart is not a timing indicator though, we need chart patterns for timing suggestions.

Leading Indicator: Silver to Dollar inverted directional correlation

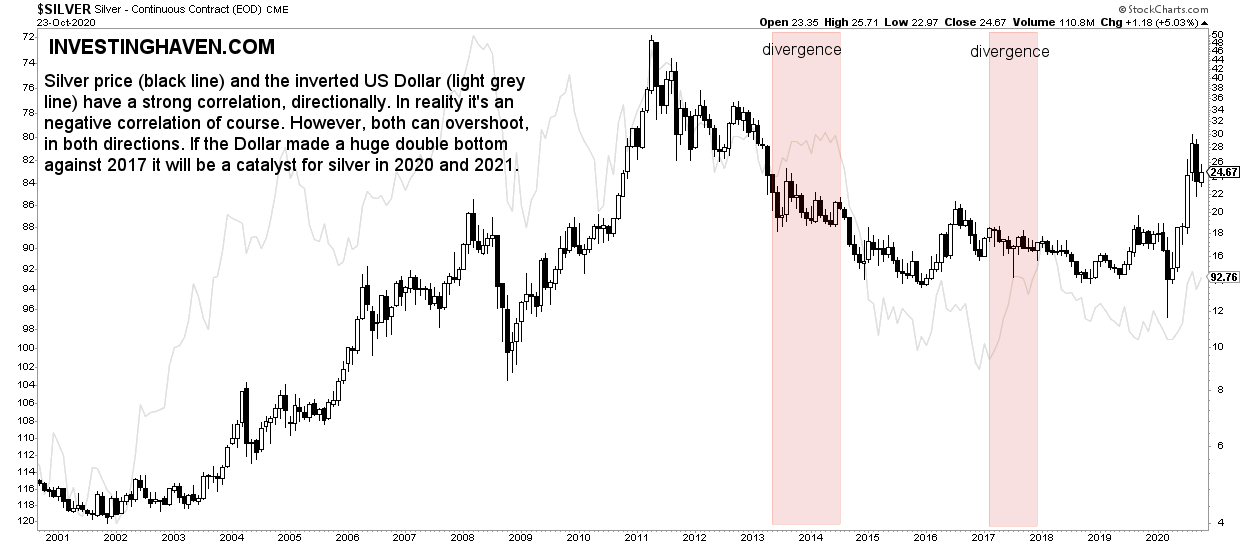

The 2nd leading indicator for silver’s future price is the Dollar inverted correlation.

The next chart shows the Dollar in light grey, but it is inverted. That’s because it is easier to follow the correlation.

In the last 2 decades the silver price chart has tracked the price of the Dollar (inverted) with just 2 exceptions (2013/2014 and 2017). Those exceptions only tended to last 9 months.

That’s exactly why our point is that both markets track each other (inverted) directionally.

Right now we tend to see a wide range in which the Dollar trades. As long as the Dollar remains in this range it will not hinder silver to move higher, every time the other leading indicators are supportive. That’s the way to read this chart and make it insightful for silver’s future price.

Leading Indicator: Silver to Inflation directional correlation

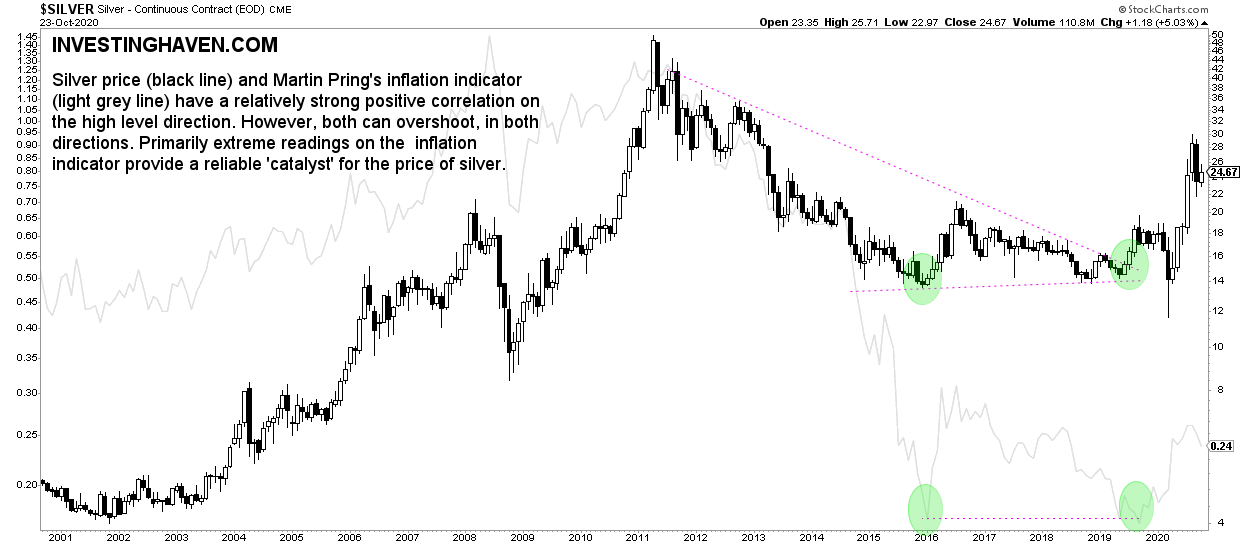

The next leading indicator appears to be highly reliable in forecasting the price of silver.

In particular the inflation / deflation indicator from Pring appears to have a very strong positive correlation with silver. Again, this is a directional indicator, and we look at the secular trends (not the day-to-day or week-to-week trends).

The inflation / deflation indicator in light grey on below chart is in the process of setting a major double bottom. Look at the two green circles at the bottom.

Note how this double bottom did coincide with the test of secular support in the price of silver. Almost at the same time did the inflation indicator and the price of silver bottom.

Whether the recent silver price breakout is forecasting inflation to go up, or vice versa, does not really matter. At least, that’s what we believe.

What matters to us is that both markets bottomed, and that silver already broke out in the meantime. With this it ended its 8 year bear market, almost in the same week after it peaked in 2011 (first week of May)!

The price of silver is in a new bull market, period.

The only question that matters is how fast silver will rise. Given the fact that it is in a new bull market, early stage, it will go up slowly. The acceleration phase follows later.

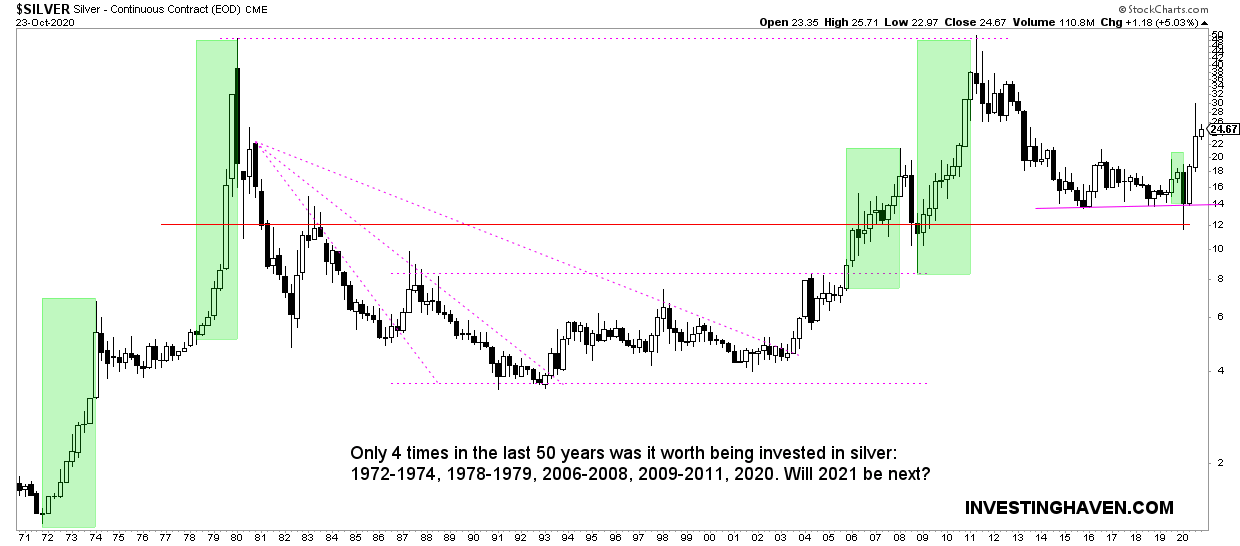

The Longest Silver Price Chart (50 years)

If we continue the rationale from the previous sections we can see a beautiful setup on the longest chart timeframe. This may feel too classic, and as many silver investors nowadays prefer to look at the silver price on the shorter term charts. But remember the dominant trends are only visible on the longest timeframes so serious investors always have to respect the top down approach when it comes to silver price analysis.

Below is the 50 year silver price chart. This a quarterly (!) chart so it is meant to read the most dominant trends.

We believe this chart contains a wealth of insights. It is especially useful for our silver price forecast for 2021.

Let’s review them one by one:

- The recent silver price breakout is meaningful. Hence, we expect this to morph into something powerful, even though it will need some time.

- The 8 year decline since the peak in 2011 looks like a mini version of the decline that followed the peak of 1979. We see this giant bottom formation between 1979 and 2011. The pattern in the last 8 years looks like a minified version of it.

- Consequently we can expect silver to take another 8 years to peak again at $50, where it will set a triple top. This will clear the way to move higher. That’s certainly not for 2021, no matter if some analysts tend to be overly bullish. ‘It ain’t gonna happen’ that fast!

- In the last 5 decades investors wanted to be invested in silver only 4 times (green shaded areas)! That’s right, there is a lot of talk about silver’s profit potential. But the upside potential should not be mixed up with the time duration in which it rises. High potential, but most of the time bearish or flat, and only exceptionally bullish. “Once bullish, extremely bullish,” is what characterizes silver.

All that said we don’t expect one of those giant moves to take place in 2021.

We have to point out one thing as we talk about only a few really big moves. It is a common pitfall to hit one of those moves, and then fall in love with silver. This is dangerous. As per the unusually successful investor Stan Druckenmiller:

It is not whether you are right or wrong that is important, but how much money you make when you are right and how much you lose when you are wrong.

Don’t argue on silver, but ensure you get the investment right.

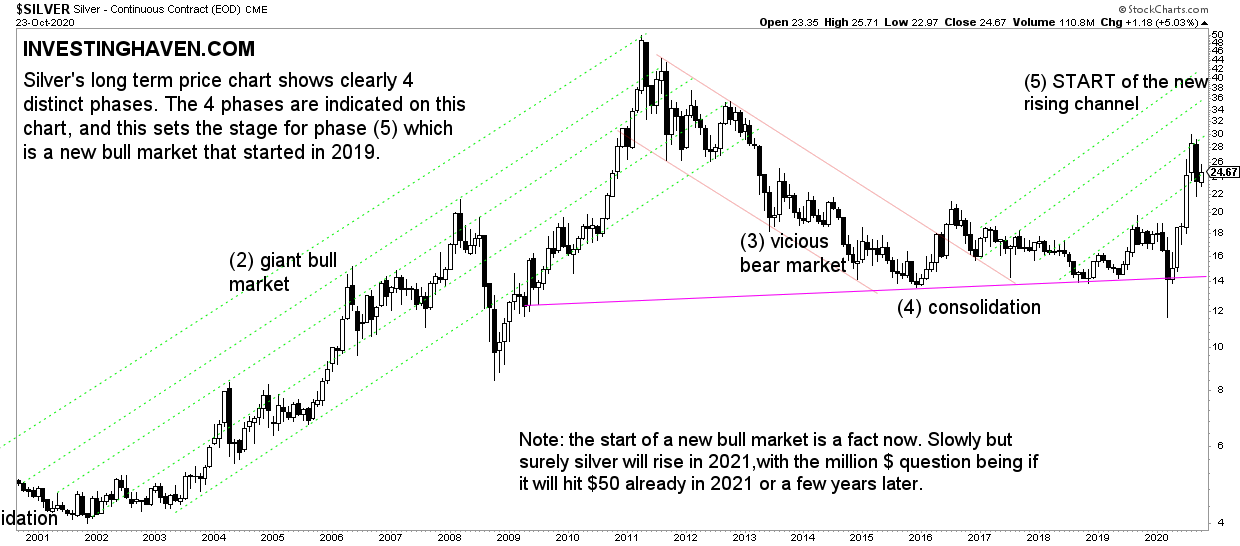

We have to zoom in to get some more meaningful insights for price targets in 2021. For this we look at the monthly chart on 20 years, see below.

Silver Chart and Price Targets

Let’s now combine the findings of our leading indicators, the observations on silver’s long term chart above (50 years) with the monthly silver chart on 20 years.

Here it becomes interesting.

We are on record forecasting a new rising channel, one that is indicated with the green dotted lines on below chart.

As silver ended its 8 year bear market it started an 8 year bull market, is our long term silver forecast. This will not be 8 straight years of double digit or even triple digit rises. Things will start slowly, only to accelerate later on.

The new rising channel points nort of $30 in 2021 as a top. Note that these values represent spikes, and prices will retrace after hitting those peaks.

Our #silver price forecast for 2021 is bullish with a price target above $28. Going forward silver will continue to trade above $20, and gradually above $30 as of 2021. Click To Tweet

The leading indicators, especially the inflation indicator as well as the COT report in the silver market will determine when those spikes to our price targets will take place.

In 2021 we expect one or two bullish moves, when the COT report shows that the non commercials stop decreasing their net long positions. Similarly, inflation expectations should be on the rise in that same time period. It’s the perfect recipe for a strong move in precious metals, especially in silver.

We keep a close eye on the flipside of this bullish story. Bearish momentum will pick up once silver falls back below $16 in which case it will fall to $14 again. Not likely to happen, but the flipside always has to be considered by investors!

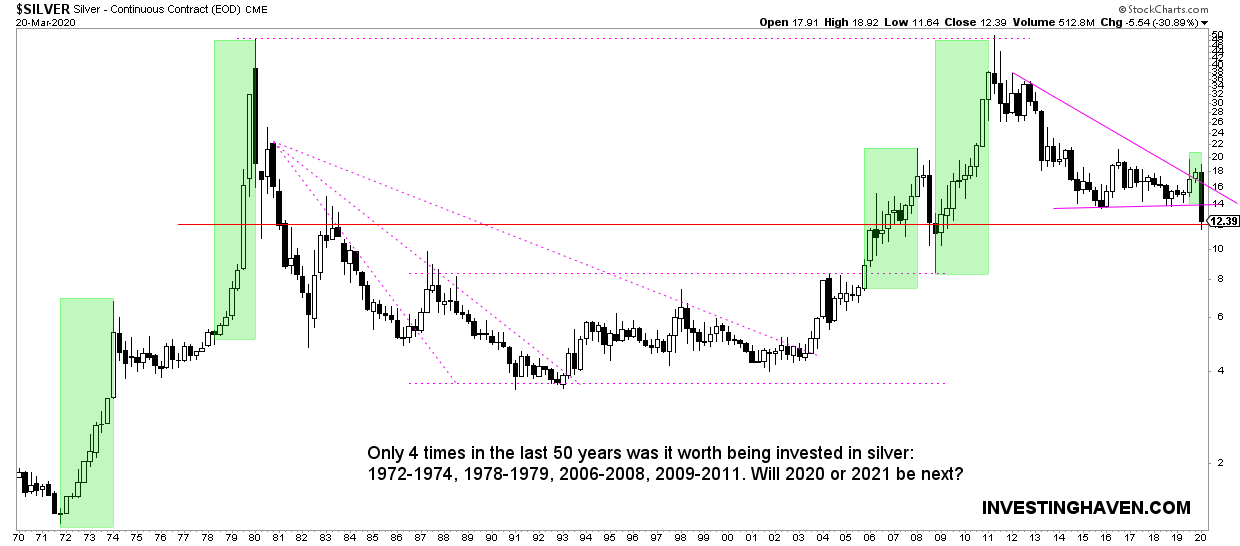

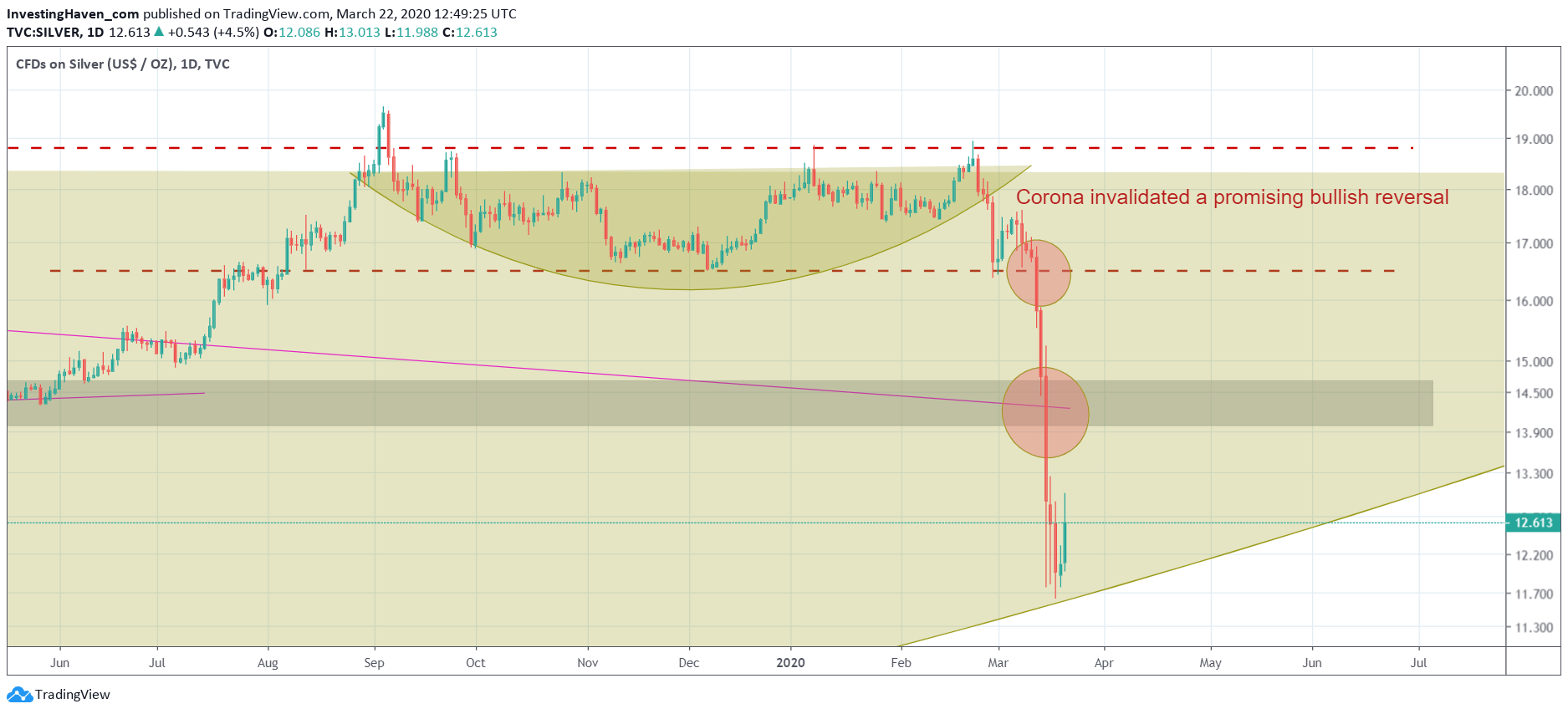

Corona Crash Update on 03.22.20

This paragraph and below charts contain an up-to-date version of the long and short term silver price charts. We wrote this update on March 22nd, 20′, at the depth of the Corona crash.

First the 50 year silver price chart.

The silver quarterly chart now has this huge ugly candle in the first quarter of 20′.

However, silver stopped falling really at support that goes back to 2008, and that’s also resistance in 1982. In essence silver’s 12 USD is the breakout point after the 2 decade long giant reversal. This is a promising thing.

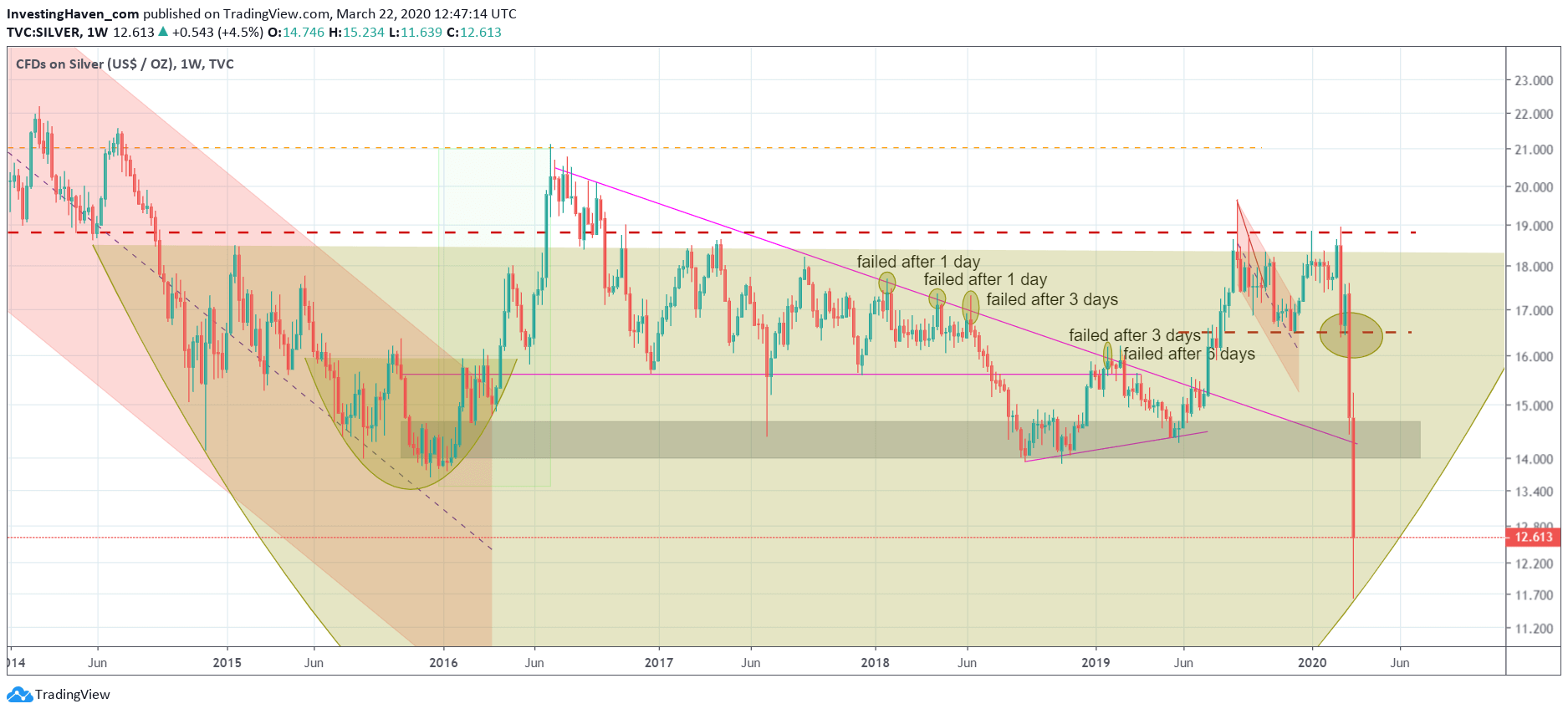

Next is the 7 year chart.

With silver’s recent crash there is clearly damage on this timeframe of silver’s price chart.

However we believe what we read into this is a giant reversal that connects the Dec 2014 sell off with the recent lows. This should have a good outcome even though there is resistance to overcome at 14 USD.

Last but no least the daily chart.

This is a close up that shows how fast this decline happened. The 2 red circles are critical price levels, and they were violated in less than 5 trading days. Never seen, unimaginable, but true.

The 14 USD will act as resistance in the short to medium term, but silver clearly will rise back to 16.50 and ultimately 18.50.

We believe that our 2021 silver price forecasts may be delayed with one year.

We believe that our 2021 silver price forecasts may be delayed with one year.

However, silver investors should keep a close eye on 14.50 as well as 16.50 USD. The pace at which both these 2 levels will be cleared will inform is whether our silver forecasts will be delayed or not.

Best case scenario the 14.50 and 16.50 get cleared fast, and our silver price forecasts are still intact.

Post Corona Crash Update on 08.08.20

This paragraph and below charts contain an up-to-date version of the medium term silver price chart. We wrote this update on August 8th, 20′, 4 months after the Corona crash.

The daily silver price chart is truly phenomenal.

July of 20′ marked the start of a giant breakout, and giant rally.

As seen on below silver chart the rally was very aggressive, presumably too fast / too high.

After almost touching 30 USD it is clear that silver needs a break here.

As per our gold forecast, and the monetary inflation chart in that article, we believe gold will move higher medium term and silver will do so as well.

Our silver price forecast needs an update, as our 2021 silver price forecast got crushed already in August of 20′.

Results of our previous Silver Predictions

As said before we have a track record of forecasting gold and silver spot prices. The table below is based on the forecasts made in prior years, both on our own website in the public domain and even on financial mainstream sites.

This is an overview of our silver price forecasts from last year. We publish these forecasts many months prior to the year that we forecast. Prices reflect silver's spot price.| Year | Our silver forecast | Lows Highs | Forecast accuracy |

|---|---|---|---|

| 2017 | Neutral, price target of $15 | 14.41 18.65 | Spot-on |

| 2018 | Neutral, no breakdown | 13.91 17.68 | Spot-on |

| 2019 | Bullish with price target of $20-21 | 14.30 19.64 | Spot-on |

| 2020 | Bullish with price target of $22 | 11.65 29.64 | Spot-on |

| 2021 | Bullish with price target of $37 | 21.42 30.37 | Missed |

Silver Predictions by other Analysts

Interestingly, quite some silver price predictions have been published by analysts in the field. Most of them have a similar price target, there is only one from First Majestic Silver’s CEO that looks really unrealistic.

And, no, this is not about daily silver price news which is just that … news (illustration). We collect real forecasts, predictions, that are meaningful … because most silver news is rather meaningless to investors.

We will update this list of silver price predictions throughout the year!

This is an overview of forecasted silver prices for 2021 by other analysts. We don't support these forecasts, we just share them to illustrate how other analysts think about a silver price forecast for 2021 and beyond.| Year | Analyst | Silver price prediction |

|---|---|---|

| Silver price forecast 2021 | InvestingHaven's research team | North of $30 |

| Silver price forecast 2021 | Goldman Sachs | $40 |

| Silver price forecast 2021 | Metals Focus | Well above $30 |

| Silver price forecast 2021 | Citi | $40 |

| Silver price forecast 2021 | Capital Economics | $27 |

| Silver price forecast 2021 | JP Morgan | Trend down |

| Silver price forecast 2021 | Tradingeconomics.com | $22.47 |

| Silver price forecast 2021 | Silver Phoenix | $29.82 |

| Silver price forecast 2021 | CIBC | $32 |

| Silver price forecast 2021 | Nasdaq.com | Above $60 |

| Silver price forecast 2021 | Hubert Moolman | $50 |

| Silver price forecast 2021 | AUDtoday.com | $39.63 |

| Silver price forecast 2021 | Scotiabank (on Forbes.com) | $17.50 - 21.00 |

| Silver price forecast 2021 | Wallet Investor | $26.5 |

| Silver price forecast 2021 | Dollarrrupee.in | Approx. 760 Rupees |

| Silver price forecast 2021 | Johann Wiebe, Thomson Reuters | None yet |

| Silver price forecast 2021 | EB Tucker, director Metalla Royalty & Streaming | None yet |

| Silver price forecast 2021 | Commerzbank | None yet |

| Silver price forecast 2021 | Degusa | None yet |

| Silver price forecast 2021 | Keith Neumeyer, CEO of First Majestic Silver | None yet |

Detailed Follow Up on our Silver Forecast (free forecasting email newsletter)

We absolutely recommend to subscribe to our free newsletter in order to receive future updates. We publish updates on our silver forecast. But we also do publish other forecasts.

We continuously, throughout the year, publish updates on our annual forecasts. Any revision in our forecast are published in the public domain and appear in our free newsletter. Therefore, the only way to track the pulse of markets and stay tuned with our forecasts is to subscribe to our free newsletter >>

Must-Read 2021 Predictions from InvestingHaven’s Research Team

We absolutely recommend to read the following predictions as they are highly informative and very well researched.