Growth stocks have been beaten down in the last 4 to 5 months. Many value stocks did well, some did very well. In our Momentum Investing long term stock tips we saw insanely bullish performance of our lithium and cobalt top picks, in the value segment. The million dollar question is whether we have a ‘new normal in markets‘ or whether this was a temporary blip in growth stocks? As per our forecast based on the 100 year Dow Jones chart we believe that not only value stocks should do well in 2022 but most stocks should do well, also growth.

In looking for the answer to the question value vs. growth we noticed a few really interesting things.

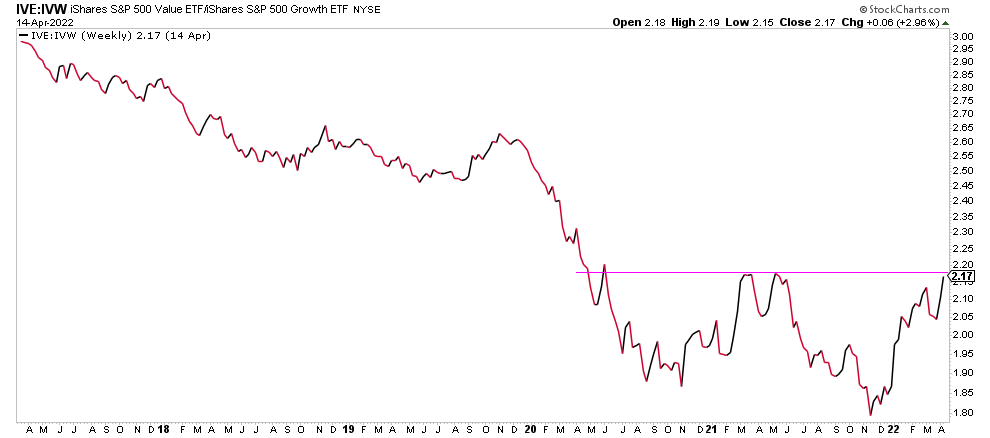

First, the ratio value vs. growth is setting a huge W reversal. One important note: ratio charts should be taken with caution. They are not as perfect as individual stock charts or sector charts. Still, the bullish reversal is really clear on this chart. The last hurdle to overcome, which might prove to be a big hurdle, to be seen, is the current level. Yes, in a way we are at a critical juncture right now.

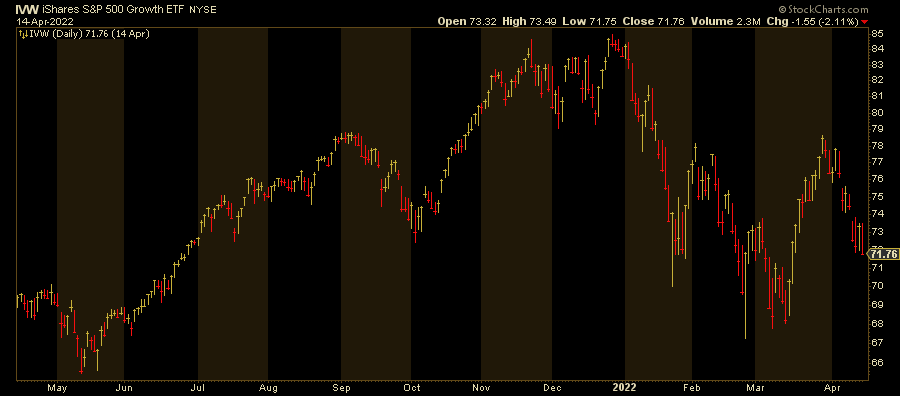

If we look at growth stocks, separately, on 12 months, we can see another critical juncture. This chart is setting up to become an inverted head & shoulders chart, which has a strongly bullish outcome. The alternative is a big breakdown. The Nasdaq has the exact same setup. Interestingly, next week will be resolution time. Yes, we are at a critical juncture right now.

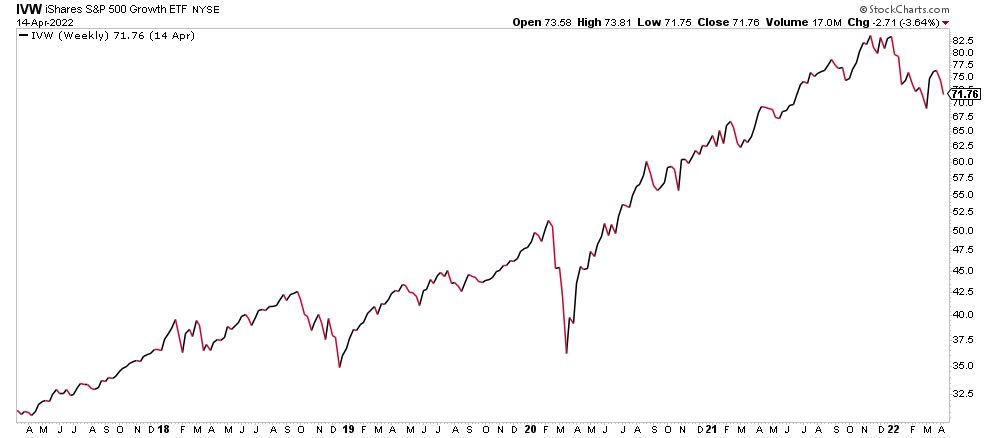

The 5 year chart of growth puts the potential head & shoulders vs major topping pattern into perspective. Whatever the outcome will be, it will be big, in either direction. We will get a first clue next week, and a final confirmation in max 3 weeks from now!

There is more interesting insights.

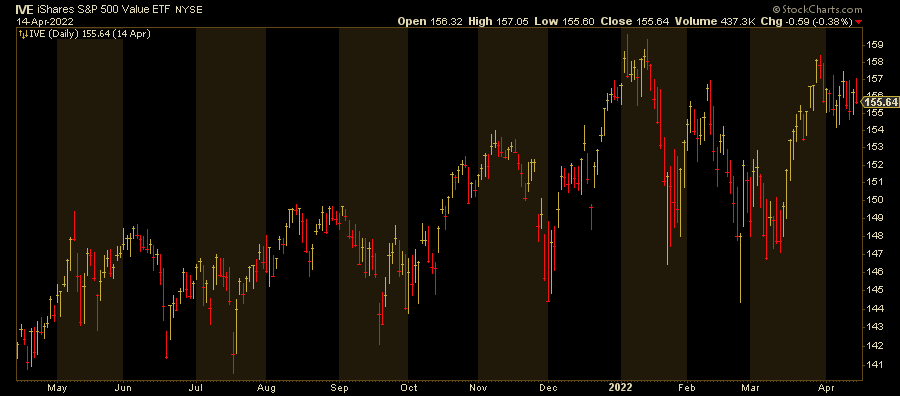

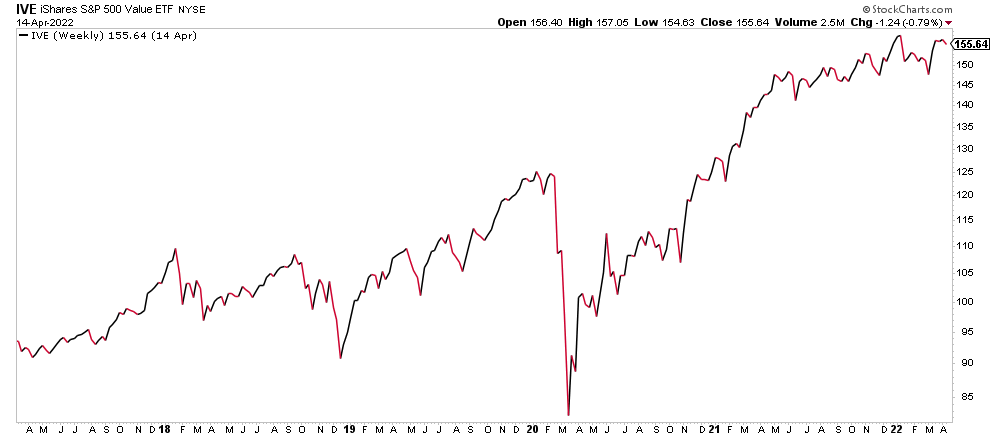

Value stocks are showing a head & shoulders pattern, one that started in October, so it’s wider than the one in growth stocks. Here as well: resolution time is here. This segment either moves higher and turns this bearish setup into a bullish breakout, or the recent highs qualify as a secondary top.

The 5 year chart has a topping pattern look. However, any move higher would qualify as a breakout and could be the start of a new leg higher.

The answer to the question value vs. growth will be solved shortly, it’s a matter of a few weeks maximum.

While growth looks horrible, a closer look suggests it could be a very bullish setup.

While value looks great, a closer look suggests it could be a bearish setup.

Ultimately, both segments may move higher.

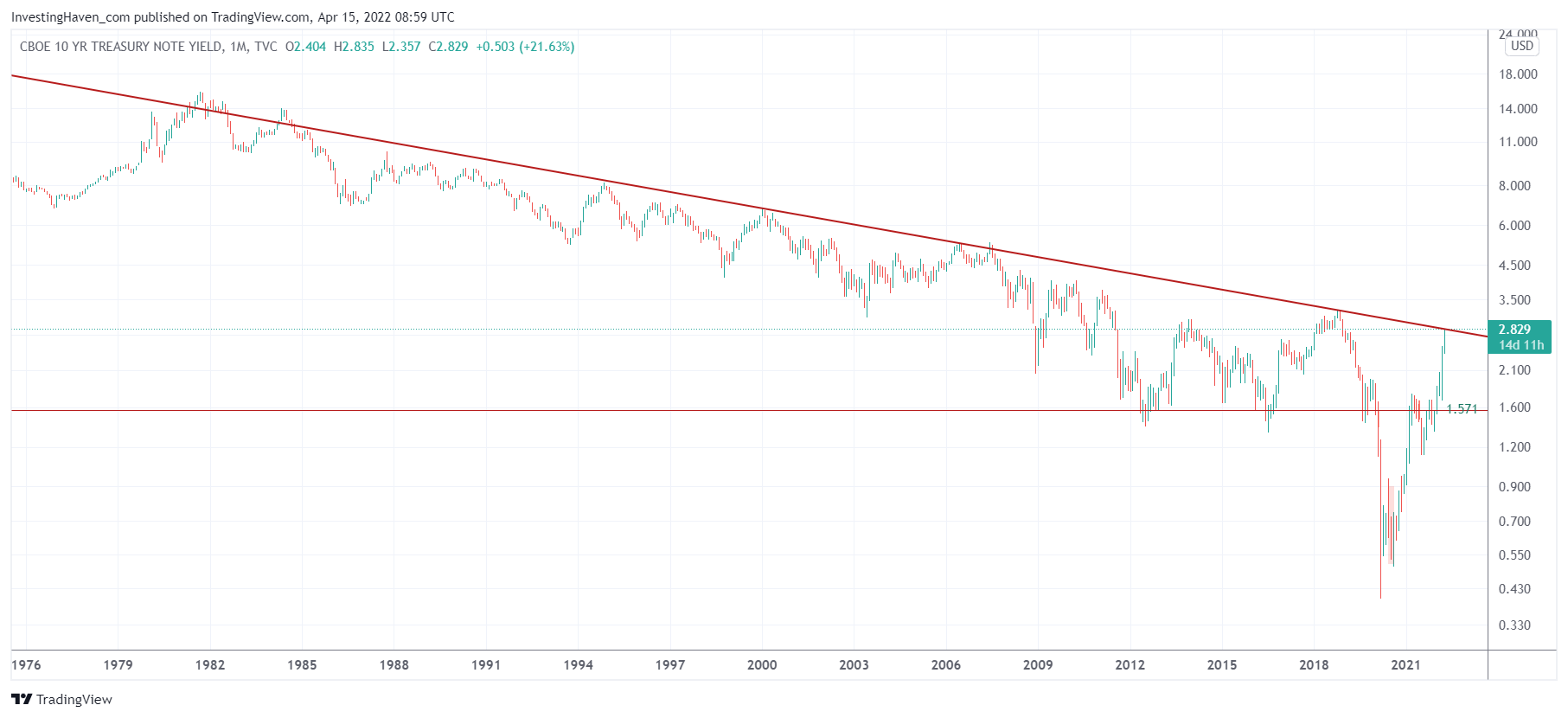

Talking about resolution time and a critical juncture in markets, here is another interesting chart, this time a leading indicator for markets: bond yields. You can see how 10 year bond yields hit a secular trendline, on Friday, after a fast rise from 1.57 to 2.82.

Any time bond yields rise fast they tend to create turmoil, this time it’s not any different.

What matters is where bond yields go from here. IF they find resistance here, it would be good for growth stocks.

Our best guess? Growth will recover, and some value segments will continue to do well. But the extreme moves which we got in both segments should turn into more ‘normal’ trends, whatever ‘normal’ means in this ‘new normal in markets‘.