Now that 2023 has proven to be resilient, investors set their sights on 2024 as another reason for concern. What is the the expected trend of the stock market in 2024, is the question that is surfacing lately. Some believe that a stock market crash is imminent, others believe it will occur in 2024. In this comprehensive blog post, we employ our data-driven forecasting methodology to predict potential market movements. Leveraging key leading indicators, including the ‘S&P 500 vs. unemployment’ and ‘inflation expectations’ charts, we aim to provide valuable insights and forecasts for the stock market in the coming year.

Although bullish sentiment has risen lately, there continues to be a strong group that believes that the stock market will crash, sooner rather than later. What is our thought about the possibility and probability of a stock market crash in 2024?

Our Forecasting Methodology

At the heart of our forecasting methodology lies a focused and streamlined approach that emphasizes simplicity and precision. We recognize that long-term forecasting often requires fewer data points rather than more, adhering to the principle of “Keep It Simple, Stupid” (KISS). Instead of inundating ourselves with an array of indicators, we carefully pick out two influential leading indicators and delve into their secular trends.

By focusing on a select few leading indicators, we can identify their long-term patterns and their potential impact on the stock market in 2024. Our commitment to simplicity allows us to neutralize noise and focus on the most critical factors that could shape market trends.

Leading indicator #1. Inflation Expectations

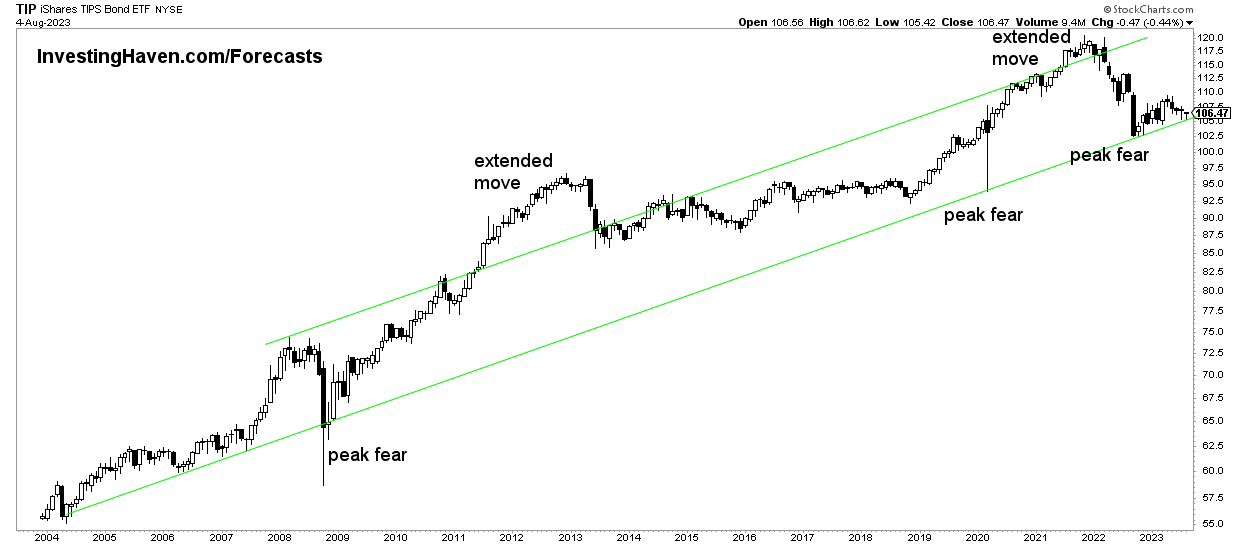

In 2024, the single most influential leading indicator will continue to be the TIP ETF weekly chart spanning 20 years, making it the central focus of our analysis. TIP ETF acts as a proxy for inflation expectations, providing crucial insights into market sentiment and potential movements.

The long-term pattern of TIP ETF could hold significant implications for the stock market’s trajectory. If the pattern remains intact, TIP ETF is likely to resolve higher, acting as a driver and leading indicator for markets and metals to follow suit in 2024. This prospect paves the way for potential growth opportunities and bullish market sentiment.

Note that, right at the start of the new year, we also identified TIP ETF as the Single Most Important Chart Of 2023. We said that the multi-decade rising trend channel should hold in order for the long term rising trend in the stock market to be confirmed. In that scenario, 2022 would qualify as a bullish reversal.

The chart reveals a striking occurrence in 2022 when inflation expectations unexpectedly crashed amid rising inflation. This apparent paradox can be attributed to inflation expectations being a forward-looking instrument. During that period, the market was preoccupied with the disinflationary monetary policy of policymakers.

What inflation expectations could, should, might be doing right now is ‘sniffing’ for signs of the Federal Reserve’s tightening cycle coming to an end. The chart suggests that the market believes monetary tightening is gradually nearing its conclusion. This perception serves as a leading indicator, potentially driving markets and metals higher in the next few months and shaping the expected trend of the stock market in 2024.

Leading Indicator #2. S&P 500 vs. Unemployment

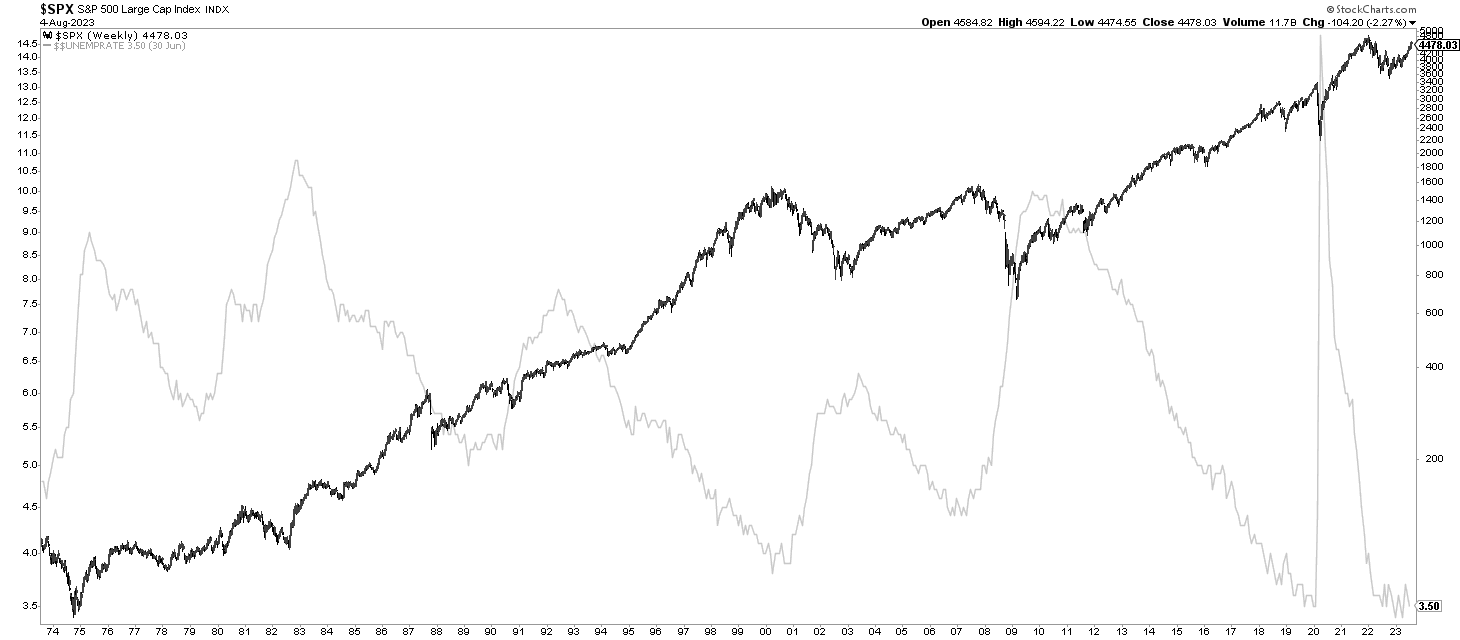

Alongside TIP ETF, the ‘S&P 500 vs. unemployment’ chart plays a vital role in our forecasting methodology. This chart showcases a compelling secular inverse correlation between stock market prices and the unemployment rate over the past 50 years.

Understanding this long-term relationship allows us to anticipate how changes in the labor market might influence the stock market’s trajectory in 2024. An anticipated decline in the unemployment rate as the economy recovers could underpin bullish market sentiment. Simultaneously, diminishing concerns over tightening monetary policies may contribute to renewed investor confidence, potentially bolstering market performance.

Stock market 2024 – timeline readings

Some observations with a high level of confidence:

- Trends in productivity, unemployment, stock market volatility, when combined, are signaling that that there will not be a stock market crash in 2024.

- Trends on secular stock market charts are constructive. This signals no market crash in 2024.

But that’s not sufficient.

We also need to look at cycles – does cycle analysis suggest a secular bearish turning point? We did not expect one in 2023, but what about 2024?

In terms of timeline, there are 3 crucial months in 2024 that we will use as additional inputs to understand the intention of the market: February, April, August. Stated differently, we will be looking at stock market prices and chart patterns, in those months, to get additional insights on the probability of a market crash in 2024.

Incorporating time in our analysis sets us apart. While most analysts solely focus on price, we consider both price and time on our charts. Sometimes, analyzing only price suffices, but timeline analysis is crucial at times. Identifying decision windows (time) reveals the market’s message (price) for sharper insights.

Conclusion: the expected trend of the stock market

In conclusion, our focused and data-driven forecasting methodology, centered around two influential leading indicators, empowers us to delve into the expected trend of the stock market in 2024. By analyzing the secular trends of both the TIP ETF and the ‘S&P 500 vs. unemployment’ chart, we gain valuable insights into potential market movements.

As we approach the exciting opportunities and challenges of 2024, prudent investors should employ a disciplined and well-informed approach. While forecasting offers valuable insights, it is essential to remain adaptable, staying informed about evolving market conditions and being prepared to adjust investment strategies accordingly. With these insights in hand, investors can navigate the complexities of the stock market in 2024 and position themselves to capitalize on potential growth opportunities in the new year.