Top metals in June: silver, gold, and platinum shine strong. Here’s what the three have in store for investors over the next few weeks.

June 2025 marks a pivotal moment in the precious metals market, with macroeconomic uncertainty, surging industrial demand, and shifting investor sentiment influencing the outlook.

If you are an investor seeking both growth and protection, three metals stand out this month based on adoption trends, technical patterns, and risk dynamics: silver, gold, and platinum.

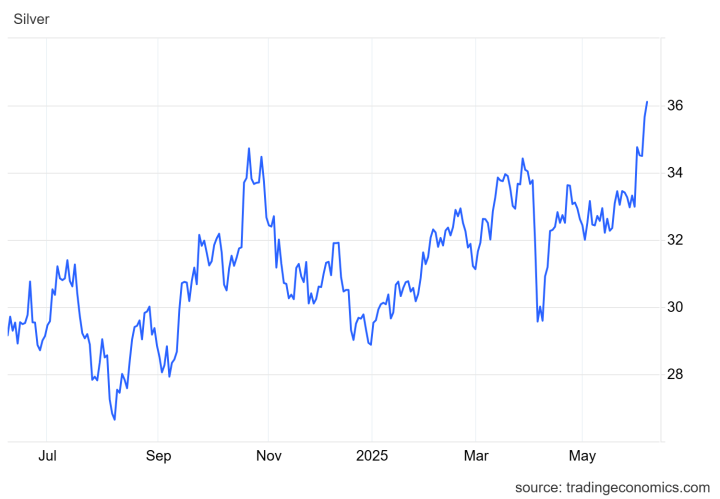

1. Silver: The Dual-Role Powerhouse

Silver prices continue to outperform expectations, recently breaking the $35/oz mark—a 13-year high—and gaining over 24% year-to-date.

From a technical standpoint, silver is riding bullish momentum, aided by a declining gold-silver ratio, now hovering around 94 from 105 earlier this year.

Fundamentally, silver is in its fifth consecutive year of a supply deficit, with industrial demand from solar panels, electric vehicles, and electronics surging. Analysts predict further upside, with some forecasting silver reaching $40–$50/oz by year’s end as industrial adoption accelerates.

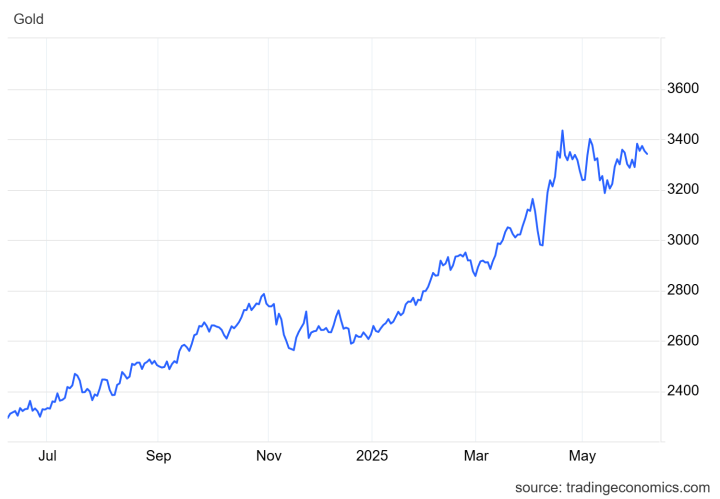

2. Gold: Safe-Haven with Institutional Momentum

Gold remains the cornerstone of financial security. Its prices have climbed nearly 29% YTD, stabilizing around $3,360/oz, with strong support near $3,200.

Its fundamentals are deeply rooted in global confidence: central banks are on track to purchase another 1,000 metric tons this year—the fourth consecutive year at such levels.

Amid dollar weakness and geopolitical instability, gold continues to draw institutional interest. Citi projects a price ceiling of $3,500, while others see further gains if the Fed signals rate cuts or U.S. economic data weakens.

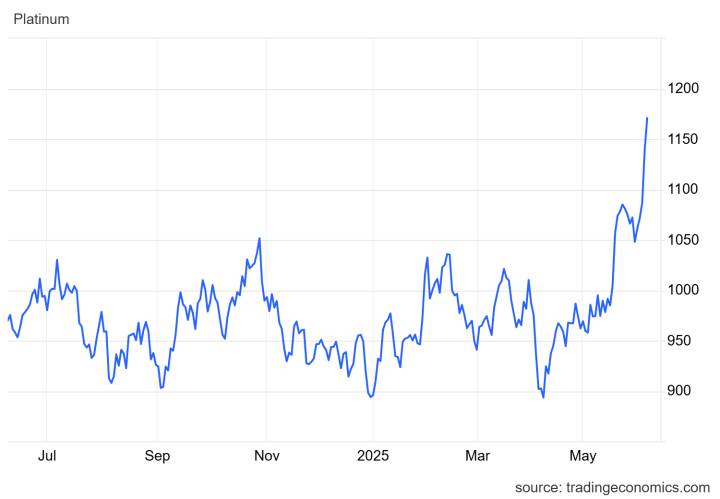

3. Platinum & Palladium: Green-Tech Leveraged

Though quieter than gold and silver, platinum and palladium are gaining ground. Platinum price recently rose 1.7% to $1,150/oz, with palladium close behind at $1,012/oz. Both metals are crucial in the green-energy shift, serving as key components in hydrogen fuel cells and automotive catalysts.

With limited supply and growing demand from the clean-tech and auto sectors, modest but steady price appreciation is expected, particularly if industrial recovery continues.

Conclusion

Each metal brings unique strengths in June: silver for its dual role in industry and investment, gold for its safe-haven appeal and central bank backing, and platinum/palladium for their role in the clean-energy future. A diversified position across all three may offer a balanced approach in today’s volatile market.

Join Our Premium Research on S&P 500, Gold & Silver — Trusted Insights Backed by 15 Years of Proven Market Forecasting

Unlock exclusive access to InvestingHaven’s leading market analysis, powered by our proprietary 15-indicator methodology. Whether it’s spotting trend reversals in the S&P 500 or forecasting gold and silver price breakouts, our premium service helps serious investors cut through the noise and stay ahead of major moves.

- Silver On Its Way To 50 USD/oz (June 8)

- Precious Metals: The Long-Term Outlook Looks Profitable, Here Is Why (May 31)

- [Must-Read] Spot Silver – This Is What The Charts Suggest (May 24)

- Gold Close To Hitting Our First Downside Target. Silver Remains Undervalued. (May 18)

- A Divergence In The Precious Metals Universe (May 10)

- Gold Retracing, Silver and Miners at a Critical Level (May 4)