KEY TAKEAWAYS

- The October CPI report on Nov 13 is the main catalyst that could decide gold’s next direction, with forecasts around 3.0% y/y.

- A softer inflation reading or dovish Fed tone could lower real yields and push gold above $4,150, while hotter data may pull it back toward $3,950.

- Watch 10-year yields, the dollar index, and ETF flows for confirmation of momentum once the CPI numbers hit.

Gold is holding around $4,000 as traders wait for the next US inflation report. This week could decide if gold breaks higher or takes a breather.

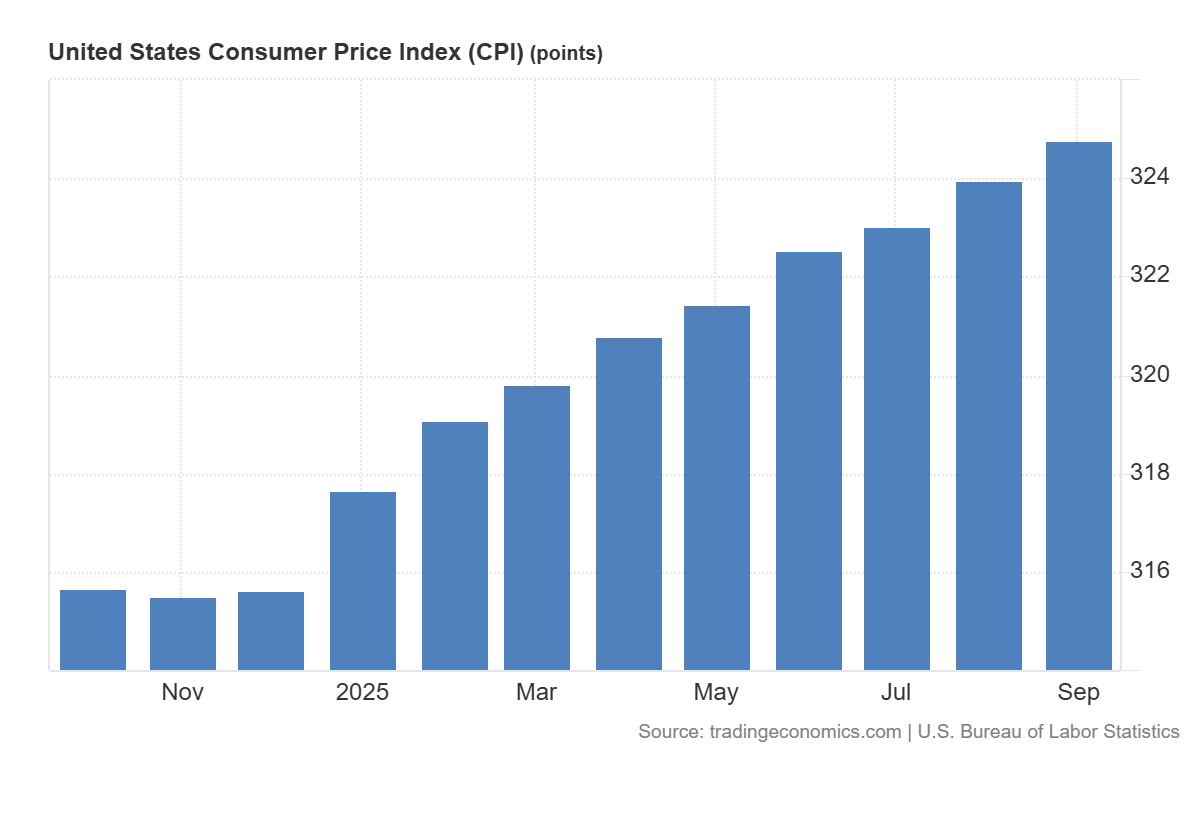

We’re heading into an important week for gold. The October Consumer Price Index (CPI) report drops on Nov 13, 2025, at 08:30 ET, and it could set the tone for the rest of November.

Gold is currently trading around $4,000/oz, and investors are on edge as they weigh inflation, Fed signals, and the dollar’s next move.

ALSO READ: Gold News: Will Rising U.S. Yields Keep Bullion Capped?

CPI Surprise Could Push Gold Higher

Market forecasts put both headline and core CPI at about 3.0% year-over-year. If inflation cools even slightly below that, we could see real yields fall and gold push through resistance. A softer number would likely fuel talk of earlier rate cuts, which is usually bullish for metals.

On the other hand, if CPI surprises to the upside, yields could jump and gold might test support near $3,950. For traders, this is a classic setup: one data point that can reset expectations and create opportunity in both directions. You should watch the initial reaction in bond yields more than the headline figure.

RECOMMENDED: How Renewed Central-Bank Gold Purchases Are Re-Shaping Prices

Fed Commentary Might Shape The Move

Several Fed officials are scheduled to speak right after the CPI release. What they say will matter as much as the data itself.

If they sound relaxed about inflation, gold could gain momentum fast. If they warn that inflation progress is stalling, that could slow the rally.

This means you should listen for tone, not just words. When Fed officials sound cautious or uncertain, it usually gives gold more room to climb.

RECOMMENDED: Smart Investors Are Buying Gold in 2025: 9 Must-Know Reasons

Key Levels And What You Should Watch

The 10-year Treasury yield, the dollar index (DXY), and ETF flows into GLD and IAU should be your main indicators this week. Technically, $4,000 remains strong support, while $4,150 is the level to beat. If yields drop below 4.3% and the dollar weakens, gold could finally break out of its range.

Conclusion

This week is all about timing. If inflation cools and the Fed softens its tone, I expect gold to push higher. But if the data runs hot, you should wait for a pullback before adding to positions.

So, stay light before the CPI print, then move quickly once yields react. Gold has been building pressure for weeks, and this might be the spark that releases it.

61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.