KEY TAKEAWAYS

- Central banks removed large amounts of gold from the open market in 2025 and continue buying.

- Gold ETFs reached record holdings, turning investor demand directly into physical purchases.

- A falling U.S. dollar and lower rate expectations improve gold’s global appeal.

- Bank forecasts now reflect tighter supply conditions, with $6,000 scenarios entering the discussion.

- Should you invest in Gold now?

Gold is climbing as long-term buyers absorb supply and investors return through ETFs. A weakening dollar adds pressure to a market where available metal is shrinking.

Gold holding above $5,000 an ounce reflects a shift that has been building for years.

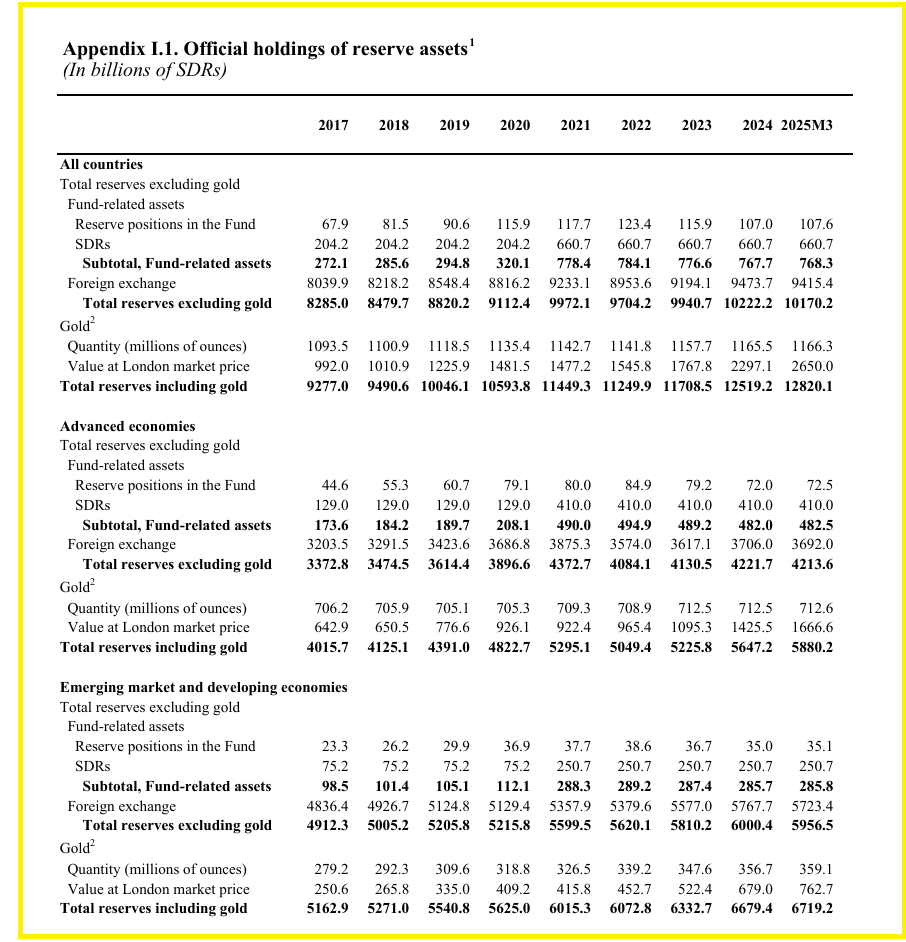

Central banks continue to add gold to reserves, ETFs keep converting inflows into physical bars, and global reserve data shows gold taking a larger role in official portfolios.

These factors do not move prices overnight, but they steadily reduce available supply. When demand rises on top of that, prices tend to adjust quickly and sharply.

RECOMMENDED: Will Central-Bank Buying Keep Gold’s Rally Alive?

Central Banks Are Locking Away Supply

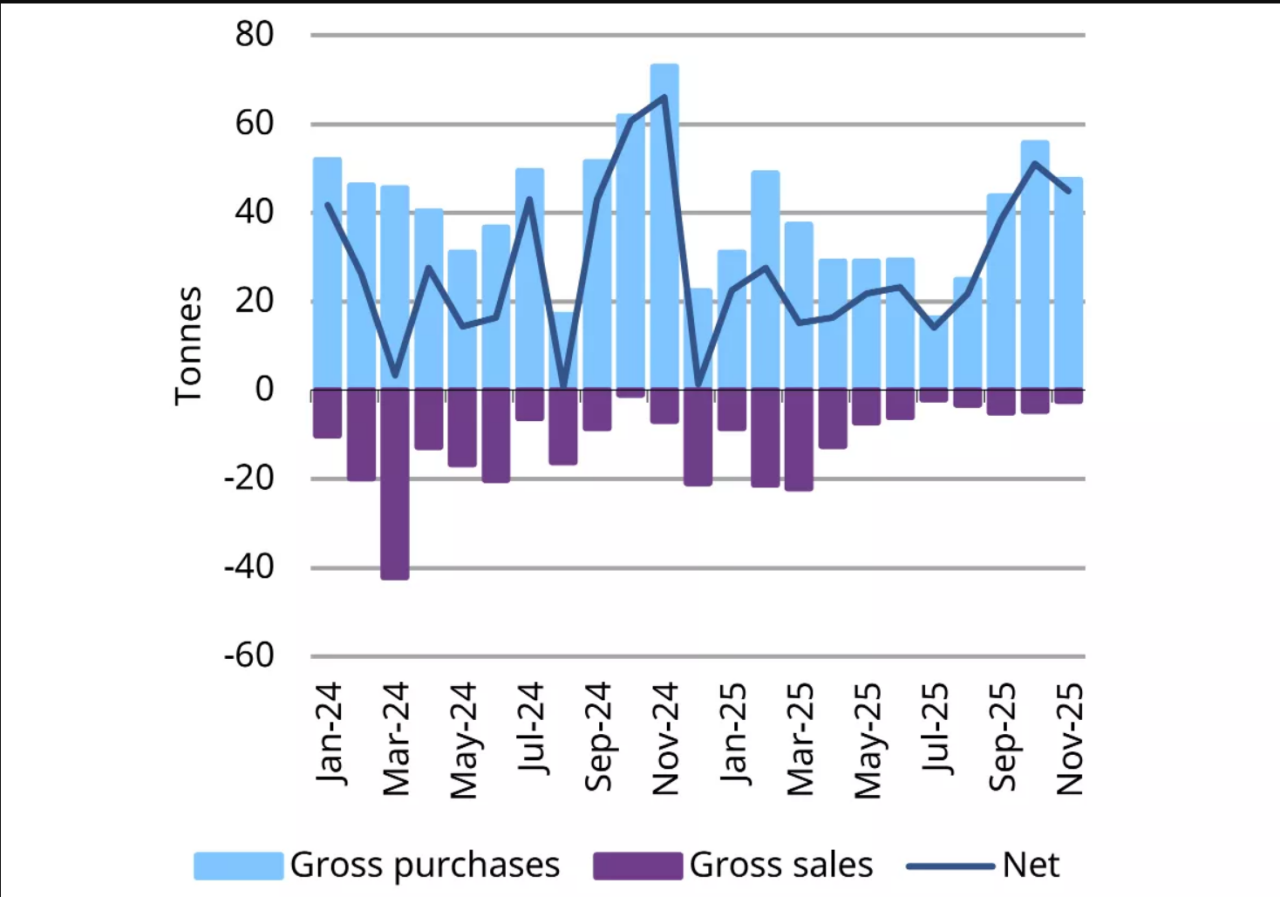

Central banks have become one of the most important forces in the gold market. In 2025, net official buying stayed well above historical norms, with several countries adding large volumes to their reserves.

These purchases are not speculative trades. Once gold enters a central bank vault, it usually stays there for decades.

World Gold Council data shows that official sector demand accounted for a significant share of total annual supply again last year.

At the same time, IMF reserve data confirms that the market value of gold held by monetary authorities rose sharply, increasing gold’s weight inside global reserves.

This behavior has a common effect. Gold that sits on central bank balance sheets is not available to meet investor demand.

As that pool grows, the market becomes tighter. Even small increases in demand can now have an outsized effect on price compared with earlier cycles.

A Falling Dollar Supports Higher Gold Prices

Gold and the U.S. dollar tend to move in opposite directions, and that pattern has returned.

Markets now expect lower interest rates later in 2026, which reduces the appeal of holding cash and supports non-yielding assets like gold.

As the dollar weakens, gold becomes cheaper for buyers using other currencies.

This is important because a large share of physical demand comes from outside the United States.

When the dollar slides, demand from Asia, Europe, and emerging markets often rises quickly.

Recent market sessions show gold strengthening alongside a softer dollar, reinforcing this relationship.

History also suggests that sustained dollar declines often coincide with strong gold rallies. If currency weakness continues, it provides a steady tailwind for higher gold prices.

ETF Buying Is Tightening The Physical Market

Gold ETFs have changed how investment demand affects prices. When investors buy ETF shares, the funds purchase physical gold to back those positions.

In 2025, global gold ETFs added hundreds of tonnes, pushing total holdings to record levels.

This process pulls gold directly out of the market. ETF buying competes with central banks, jewelry demand, and industrial users for the same bars. As holdings rise, the supply available for trading shrinks.

Retail demand can also add pressure. During rallies, demand for coins and small bars increases, and dealers often report higher premiums and slower delivery times. These signals suggest stress in the physical market.

What It Would Take For Gold To Reach $6,000

Price expectations have shifted noticeably. Several major banks now publish scenarios that place gold between $5,000 and $6,300 over the coming year.

These projections rest on measurable trends rather than optimism alone.

READ: JP Morgan Says Gold To Hit $6,300 By Year-End: Is Fiat Finished?

A move toward $6,000 would likely require three conditions:

- Central banks would need to maintain current buying levels, continuing to absorb supply.

- ETF inflows would need to stay strong, potentially adding another few hundred tonnes.

- Finally, the dollar would need to weaken further as rate cuts approach.

None of these factors is extreme on its own but together they describe a market where demand consistently exceeds new supply.

In that environment, higher prices become a mechanism to balance the market rather than an outlier outcome.

Conclusion

Gold no longer trades on fear alone. Central banks steadily remove supply, ETFs convert investor interest into physical demand, and a falling dollar improves gold’s appeal worldwide.

With these forces aligned, a move toward $6,000 shows changing market structure and it shows how tight today’s gold market has become.

Should You Invest In Gold Right Now?

Before you invest in Gold, you’re going to want to read our latest Premium Gold & Silver Investing alert. We reveal our outlook for Silver in the short and long term.

We called the rally in Gold long before it happened, and the week before the drop we suggested Gold could be primed for profit taking.

Our premium members were ahead of the curve, not panic buying or selling.

Here’s our latest premium alert: Wild Volatility Is Hitting Precious Metals. Here is How To Deal With It.(Feb 2nd)