We provided multiple times exposure to Snipp Interactive, symbol SPN.V, a mobile marketing firm based in Canada. Interestingly, after the stock got decimated, more than we expected, it is now ‘back and worse than ever’. We are very bullish on Snipp Interactive in 2018, it is a stock to buy for the long term, this is why we are so convinced.

Note that exactly one year ago we also flashed a buy on Snipp Interactive: Snipp Interactive Stock Price Almost Doubles Today. The stock was trading at similar prices as it is today. Given that its stock price has not gone significanty lower, and given the points we make in this article, we are even more bullish than last year.

Snipp Interactive stock price starting to look bullish in 2018

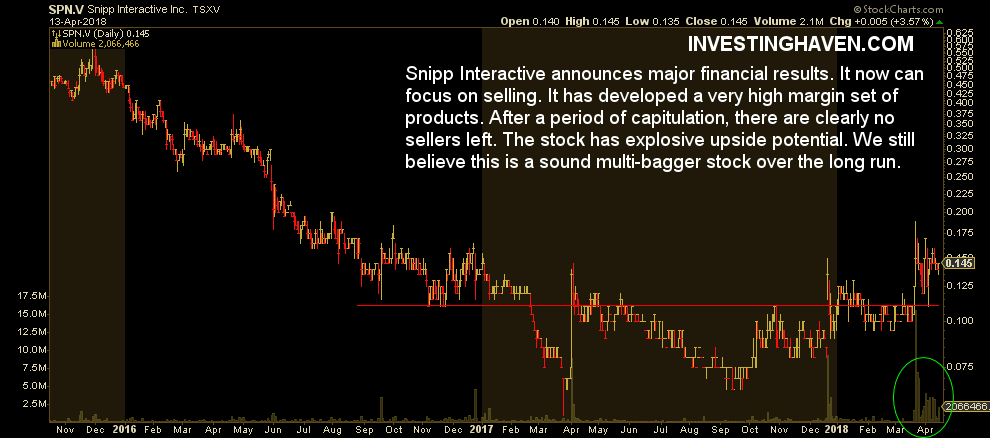

The daily chart of Snipp Interactive may not necessarily make most readers very excited, and that is fine.

However, taking a closer look at the daily chart shows some important bullish signs.

First, there is a clear rounded bottom. That is the strongest bottom formation imaginable. Likewise, a strong support level around $0.11 is now tested successfully.

Second, volume is picking up significantly in recent weeks, significantly.

The much more important findings, however, are in the financial results of last week as well as on the weekly chart of this stock, see below.

Why Snipp Interactive is a stock to buy in 2018

Let’s start with fundamentals. Snipp Interactive is a great company which is working for 2 years now on its fundamentals and financials. The results are now visible, and, combined with its chart, it is a screaming buy.

The latest financials for Snipp Interactive making this stock a buy in 2018:

- Continuing revenue increase, but, more importantly, a growing backlog of orders ($5.7M at the end of Q4 2017).

- EBITDA loss improved from $6.47M in fiscal 2016 to $1.92M in fiscal 2017, that is really significant on $12.8M in 2017.

- The company has actively worked on decreasing costs, specifically ‘Salaries and Compensation as well as ‘General and administrative expenses’

Moreover, the latest investor presentation on their site pointed out that:

- The % of revenue with recurring components went from 31% in 2016 to 47% in 2017.

- Margins improved from 66% to a staggering 77% in 2017.

- Their campaign size keeps on growing.

This is a company that is maturing is the underlying message, as a company and as financials.

On a different note, a review of their technology suggests they have found sufficient traction as a company to conclude that their technology is a continuous catalyst for growth (as opposed to stagnating technology effects which is a real risk in young tech companies).

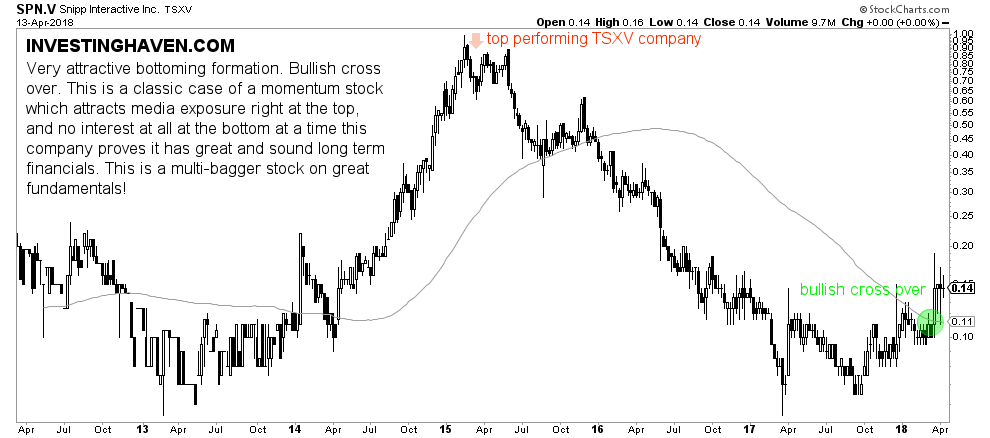

The weekly chart reveals an extremely interesting fact: after a mega-rally in 2014 the company attracted lots of media exposure. It got a nomination of a top performing TSXV company along with many other nominations. This is a contrarian indicator, and, uncoincidentally, it happened at the top of its stock price.

As it always goes investor interest got lost, and the stock price kept on crashing.

Right now, at the bottom of Snipp Interactive’s stock chart, we see continued signs of financial improvement. The economic outlook, as well as the maturity of the company, continues to improve. THIS is why we are so bullish on Snipp Interactive in 2018.

In closing, note that this is a nano cap, with market cap of $28M at the moment of writing. This is a high risk high reward play, so any position in any portfolio must be contained to 1 or 2 percent of overall holdings.