This article features what we consider the 10 most important quotes that are available in the public domain from investing guru Stan Druckenmiller. We consider these to be 10 must read quotes for any serious investor.

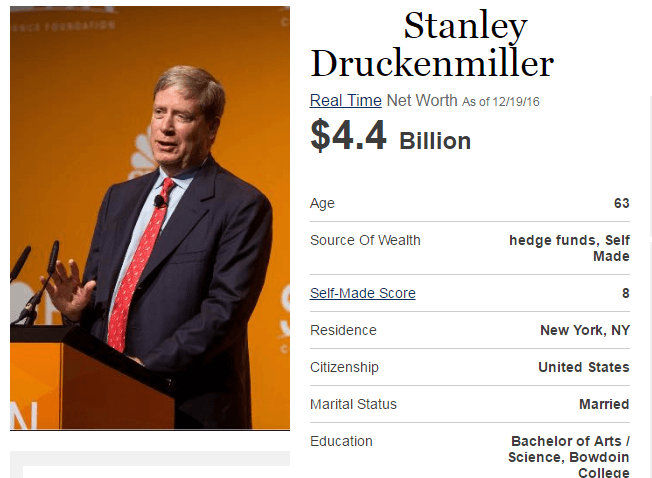

As a reference Stanley Druckenmiller did not come from rich background. He grew up in the middle class suburbs of Philadelphia. He did not inherit a fortune from his parents, he created a fortune himself!

The figures about his net worth shown below are mind boggling. Note that his $4.4B net worth was registered in December 2016.

He became famous when he ‘broke the back of the Bank of England’ by shorting the British Pound. This happened when he was working for George Soros, another billionaire investor.

What’s interesting is that the British Pound short story really reveals how both investors were thinking, and how they eventually became super rich.

Druckenmiller said that he had pitched his short idea to Soros and suggested that they put 100% of the fund in the trade. Soros told Druckenmiller that was “ridiculous” and that they should put more even more on it. “That is the most ridiculous use of money management I ever heard,” Soros said to Druckenmiller. “What you described is an incredible one-way bet. We should have 200% of our net worth in this trade, not 100%. Do you know how often something like this comes around?”

This really illustrates the thinking and investing style of Stan Druckenmiller.

Interestingly, Druckenmiller his success is in line with our 1/99 Investing Principles. In essence our investing principles are all about extreme asymmetric principles when investing in markets. Reading through the quotes in the next part of this article reveals that that’s exactly how Druckenmiller was thinking and how he operated: extremely asymmetric.

10 Must Read Quotes From Stanley Druckenmiller

Quote #1:

The first thing I heard when I got in the business… was bulls make money, bears make money, and pigs get slaughtered. I’m here to tell you I was a pig. And I strongly believe the only way to make long-term returns in our business that are superior is by being a pig.

Quote #2:

The mistake 98% of money managers and individuals make is they feel like they have got to be playing with a bunch of of stuff. And if you really see it, put all your eggs in one basket and watch the basket very carefully.

Quote #3:

The way to build superior long-term returns is through preservation of capital and home runs. When you have tremendous conviction on a trade, you have to go for the jugular. It takes courage to be a pig.

Courtesy of azquotes.com for the picture featuring this quote.

Quote #4:

The mistake 98% of money managers and individuals make is they feel like they have got to be playing with a bunch of of stuff. And if you really see it, put all your eggs in one basket and watch the basket very carefully.

Quote #5:

Working for Soros cemented Druckenmiller’s investment philosophy of “if you see it, you got to go for it.”

Quote #6:

It is not whether you are right or wrong that is important, but how much money you make when you are right and how much you lose when you are wrong.

Quote #7:

Whenever I see a stock market explode, 6 to 12 months later you are in a full blown recovery.

Quote #8:

Every serious deflation I have looked at is preceded by an asset bubble, and then it bursts.

Quote #9:

I think diversification and all the stuff they’re teaching at business school today is probably the most misguided concept everywhere.

Quote #10:

I believe that good investors are successful not because of their IQ, but because they have an investing discipline. But, what is more disciplined than a machine? A well-researched machine can make many average investors redundant, leaving behind only the really good human investors with exceptional intuition and skill.

Bonus quote, and one that is critically important because life is much more than only earning money. We are human beings after all, and give-and-take is one of the most important universal principles our there:

Once you make a lot of money, it’s incredibly enjoyable to give it away. It’s a way to satisfy the soul.

Note that we featured Stan Druckenmiller his thinking extensively in this piece on our website 10 Tips To Master Investing Without Emotions. It is a must read article for every serious investor.