As the first part of 2019 concludes we observed only a few mega opportunities, the type of really attractive profits of 100 to 200%. That’s Bitcoin (BTC) (crypto market in general) and silver miners (especially our top pick First Majestic Silver (AG)). As said in our piece How To Turn 10k Into 1 Million In 7 Years: Get-Rich-Not-So-Quick there are 3 mega opportunities per year. Hitting them is what we are committed to do, and we said so in the public domain in Forecasting The 3 Top Opportunities Per Year Becomes InvestingHaven’s Mission. What’s in store for the 2nd half of 2019? Which top investing opportunity will be the one that will double? We reveal our tips to nail it in this article. This is episode #1 of our weekly Investing Opportunities series which are all based on revealing chart secrets combined with deep market insights.

Essentially we will take the take-aways in this article to the next level: Is It Time To Buy Stocks In 2019? YES, Is What These 5 Charts Suggest.

What we want to find out is where those really juicy opportunities lie if we believe, and see continuous confirmation, that stocks will go up.

While the article mentioned before concluded on a high level that the direction of stock markets is higher, what investors really want to know is which the outperforming opportunities will be that will present themselves because of the bullish stock environment.

Before exploring that question we want to highlight one important pitfall. This is one that appears also in our 100 investing tips:

Patience is such an important virtue when investing financial markets. It takes time for good things to happen, and “it” starts (a rise or decline) things tend to accelerate in a short period of time. Therefore, ‘good things take time to happen but great things happen all at once.’

The important pitfall is that investors spot the right opportunity, but are not able to benefit from it because of impatience. This typically is caused by ‘fickleness’ which comes mostly from (1) not sufficient research (2) influenced by the endless stream of news in financial media (3) the superficial stream of social news on twitter and so on.

Be careful when changing your mind. As a general rule of thumb you should allow yourself to change your mind only once. This requires discipline, and discipline is the basis for success!

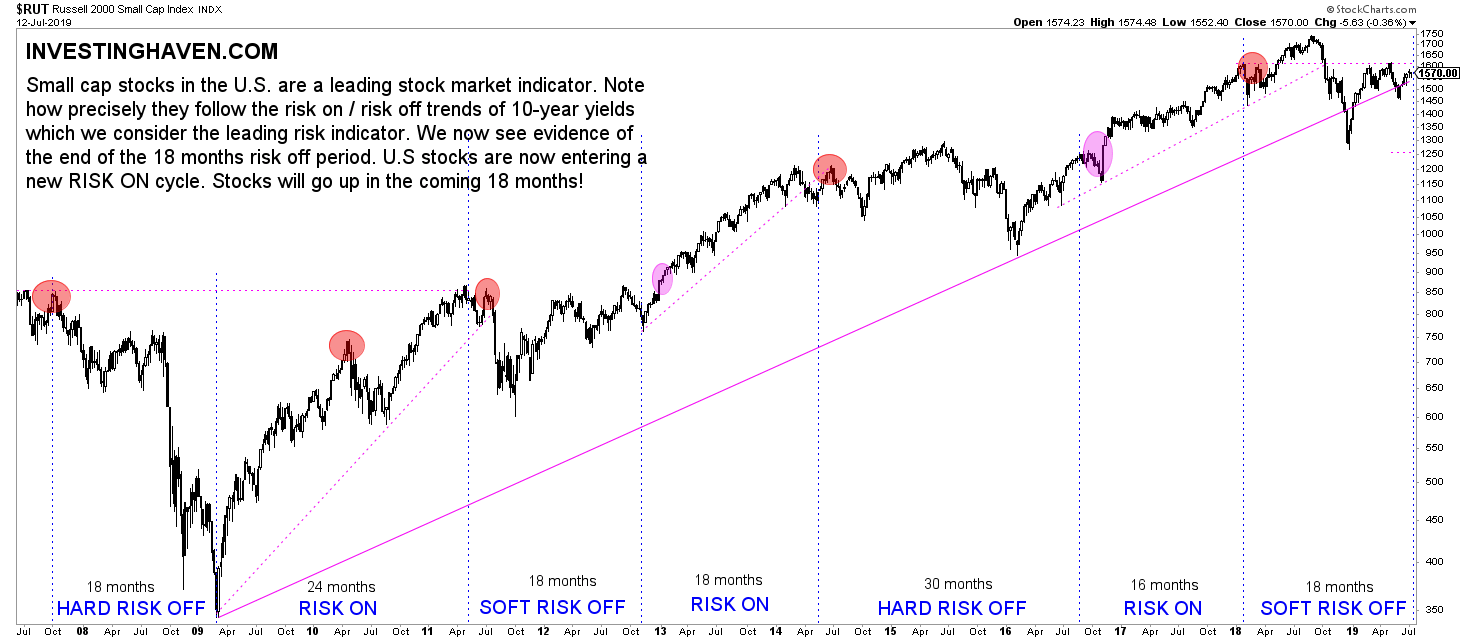

On a macro level we see that stock markets are about to start a new bull market. The chart below is the one and only chart we monitor, combined with 20-year Treasury Yields, to know if we are in a risk on or risk off cycle. We don’t look at the S&P 500, Dow Jones Industrials, etc. Again, ‘less is more’, which also applies to the volume of data points in your research.

Can it turn out differently? Yes it can, nothing is given in markets.

However, we strongly believe the correction in stocks is over, the one that created panic last year in November and December. Why do we believe so? Because of the 40% rule in Treasuries, a rule nobody else has shared in public domain ever before.

The Treasury rates, especially 20 Year rates, are the key risk indicator, combined with the Russell 2000 chart pattern. It’s a market secret, and the basis of our method. Once 20 Year rates fall 40% you can know for sure it will significantly impact stock markets. That’s what happened in 2007/2008, that’s what happened in 1987 (where the direction of yields were opposite, but with the same outcome).

On a macro level we believe the correction has run its course because the decline in rates had a relatively limited impact on the Russell 2000 in the context of its risk of cycle, as seen on below chart.

This leads us to an important insight: in the 2nd part of 2019 the really successful decisions will happen on a micro level.

Understanding how to handle the micro level decisions is what we discuss in the remainder of this article.

However, because of the high value of this we reserve this for subscribers to our ‘free newsletter’. This is premium content that we give away for free, but only after signing up to our free newsletter.

Subscribe to our free newsletter and get premium investing insights in 2019 for free. Sign up >>