As part of our 16 exclusive Investing Opportunities articles we look this week’s episode #3 to the gold market. The gold and silver market is heating up. Smart investors took positions early this year. The majority only started looking into this sector very recently. InvestingHaven followers that took positions are looking to gains of +50% in the meantime, for sure on our favorite play which we announced last year in First Majestic Silver Stock Forecast for 2019. Now the idea is to hit those few mega opportunities that come up each year with profits of 100 to 200%. This is part of our MOMENTUM INVESTING method and our mission to turn 10k Into 1 Million In 7 Years. One very important pitfall is to not get in too late, and avoid a situation of chasing prices higher which mostly results in selling with a loss. That’s why we believe it’s crucial to cover the gold market even if the current state looks ‘hot’ there are risks: which asset to pick, which ones to avoid, with or without leverage, timeframe, derivates vs. genuine precious metals stocks, etc.

It’s amazing.

Just 3 months ago we were lonely voices talking about a gold price target of $1550 as per our gold forecast 2019 published a year ago. Literally nobody was talking about gold, and we referenced the Gold News sections which were as boring as possible.

Today, we see the gold news headlines heating up with messages of gold about to rise to $2000 anytime soon.

Wait a second, on May 3d, 2019 we were featured with InvestingHaven’s research team on MarketWatch and Barron’s with this headline: Why gold’s a ‘bargain’ at less than $1,300 an ounce (MarketWatch) and How Gold Could Stage a 20% Rally This Year.

So what’s blocking investors from taking positions early on?

Intuitively we all know that getting positions early will deliver the best results. The cheaper a position, the higher the upside potential.

As per our 100 investing tips we believe media is playing a crucial role here. Most investors want a confirmation that their position is the right one.

Overly relying on media however is the worst idea ever for any investor!

The (number of) sources of information to make decisions are _not_ social media nor financial media. They are not meant to make you a better investor, they are meant to bring lots of content, that’s a big difference! Pick your sources according to the principle less is more.

Most likely this is one of THE most important obstacles to overcome! We hear this time and over again in all the emails we get from followers and members. We are thankful for the messages as it helps us understand how most people think. As said in 10 Tips To Master Investing Without Emotions the biggest enemy of any investor is … his/her own emotions!

It requires some painful experiences, and big losses, until an investor really realizes this truth!

What’s the most important thing for success is not reading a lot on social and financial media. Developing the right investing method with a solid research framework is what is crucial. This should allow to understand the market, and most importantly time the market for great entry points.

‘Timing is not the most important thing, it is the only thing.’ This implies that timing an entry point as well as exit point is by far the most important thing for an investor to do well. ‘Timing is the only thing‘ means that it is more important than reading news, analyzing fundamentals, following gurus, and so on. Excellent charting skills are a prerequisite to apply this principle!

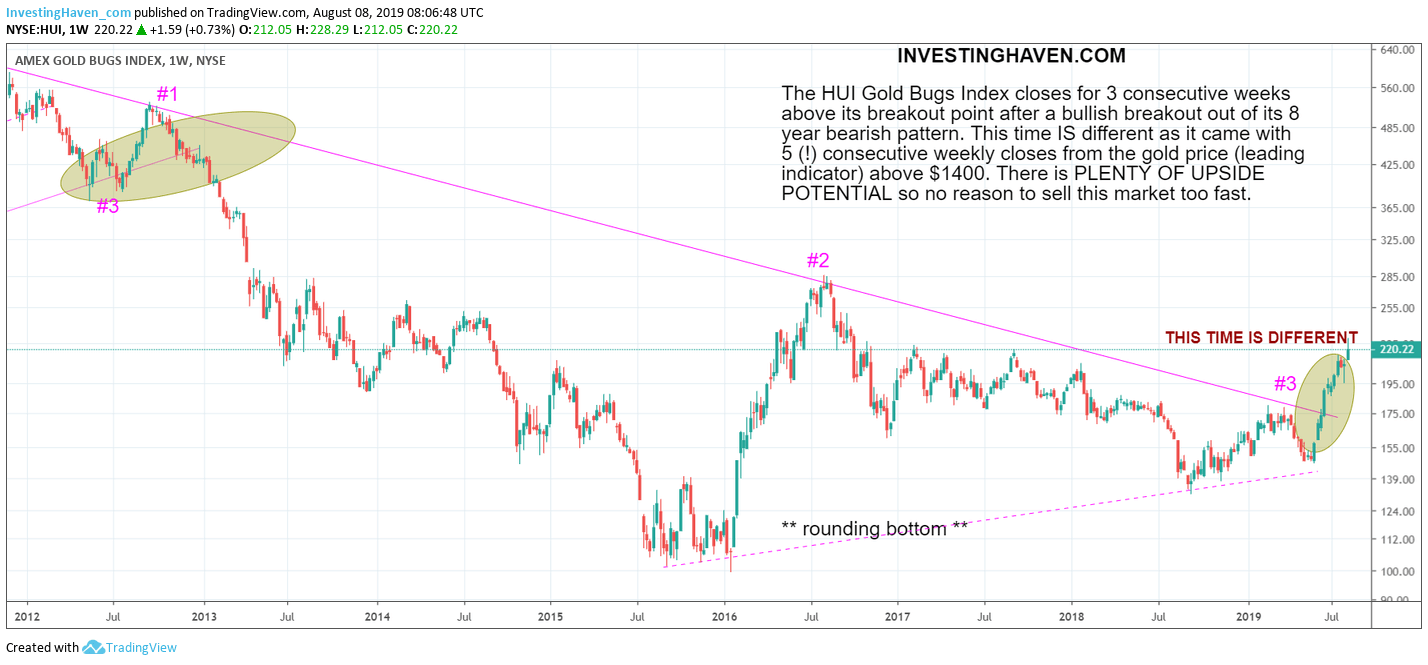

The gold stocks index HUI which we feature on below chart shows there is plenty of upside potential. Even today is not too late to get in. However, there are a few decisions to be made that should be right! In other words avoid those pitfalls.

Our focus in this piece is on what can go wrong, say risk management.

And we want to apply this to the gold market that is heating up. This is a great area for mistakes, and instead of looking at great profits in 3, 6 or 12 months from now one may look at hardly any profits or even losses.

One of them is selling too early. Strangely, we already heard 4 weeks ago investors thinking of taking profits. Sooo early in this new bull market?

If there is one thing that below chart reveals is the upside potential, certainly long term!

So how to maximize profits in this gold and silver market by avoiding mistakes is what we cover in more detail in this third edition of our exclusive investing opportunities series.

Because of the high value of this we reserve this for subscribers to our ‘free newsletter’. This is premium content that we give away for free, but only after signing up to our free newsletter. Subscribe to our free newsletter and get premium investing insights in 2019 for free. Sign up >>