As part of our 16 exclusive Investing Opportunities articles we look this week’s episode #6 into a recent correlation: Bitcoin and gold’s price seem to be positively correlated for the majority of the time in the last 12 months. Why is this important? Because investors typically tend to stress out when they miss a strong uptrend, and get in way too late. InvestingHaven followers that took positions in the precious metals market are looking to gains of +50%, and are asking when to exit gold and whether gains should flow into BTC or any other top altcoin. Now as said our mission is to hit those few mega opportunities that come up each year with profits of 100 to 200%. This is part of our MOMENTUM INVESTING method and our mission to turn 10k Into 1 Million In 7 Years. That said, we believe we should clarify whether it is first gold, then BTC, or only gold, with the aim to maximize profits in 2019 but also be well positioned as we head into 2020.

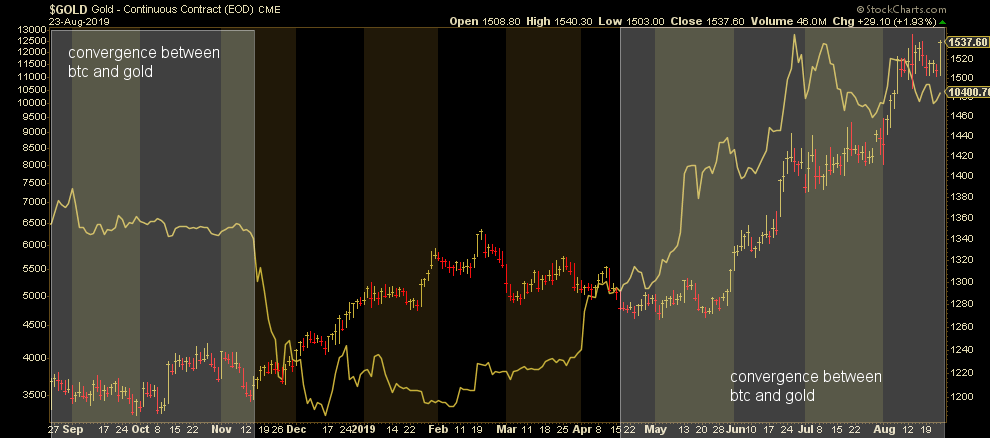

Let’s first start with the gold to BTC correlation.

The chart below makes the point. Most of the time in the last 12 months we have seen a similar direction in which both assets trended.

What this really could mean, although early to tell, is that the crypto market is maturing. Primarily the introduction of BTC futures is the reason why this is happening.

Let’s face it, until recently, it was only retail investors being engaged in the crypto market. With BTC futures it is also institutional investors, say ‘the big money’, that can get exposure to BTC.

The impact of this should not be underestimated, first and foremost when it comes to intermarket dynamics. Institutional investors are the ones defining the trends, and their capital collectively flows from one asset class to another one.

In the end all capital can be considered a finite number, but it flows from asset to asset.

With the correlation we start seeing below, and with the introduction of BTC, we will increasingly see BTC being part of this ecosystem. This also implies that we have to look at BTC as it relates to other key asset classes (stocks, gold, commodities, Treasuries, currencies).

One of the very interesting consequences of this is for crypto bloggers and social media gurus.

So far they have been able to somehow influence the crypto market. At least, that’s what they have been trying to do.

Going forward, this will not be possible. If institutional investors continue to get in, and everything has the lookings of this trend to accelerate (not slow down) for instance with the Bakkt launch date in September of 2019, the dynamics will definitely change.

That’s where we also see a new application of our 1/99 Investing Principles. Going forward, we will see 99% of media attention in crypto world that will only be able to have a mere 1% price influence.

Welcome Bitcoin to global financial markets.

With that said, how to best play the gold vs. BTC correlation?

Because of the high value of this answer we reserve this for subscribers to our ‘free newsletter’. This is premium content that we give away for free, but only after signing up to our free newsletter. We plan to send this detailed update on Monday August 26th, 2019. Subscribe to our free newsletter and get premium investing insights in 2019 for free. Sign up >>