This is episode #8 in a series of 16 Investing Opportunities articles. In this edition we focus on a very promising asset class for 2020: stocks. Stock markets, especially in the U.S. are now for 20 full months in a consolidation period. In essence, when looking at the S&P 500 it has exceeded its Jan 2018 peak only this week. Its leading indicator, 10 year Treasury rates, seem to have a major triple bottom which is what we forecasted in Global Stocks Continue To Test Secular Breakout Level In 2019. The million dollar question is which sectors exactly will be the outperformers. That’s what we discuss in this article. Not are we only suggesting what our thinking is, but more importantly we explain how to play this. All this thinking and planning is part of our MOMENTUM INVESTING method and our mission to turn 10k Into 1 Million In 7 Years. The 16 episodes of Investing Opportunities is the trial before we launch this as a regular premium service.

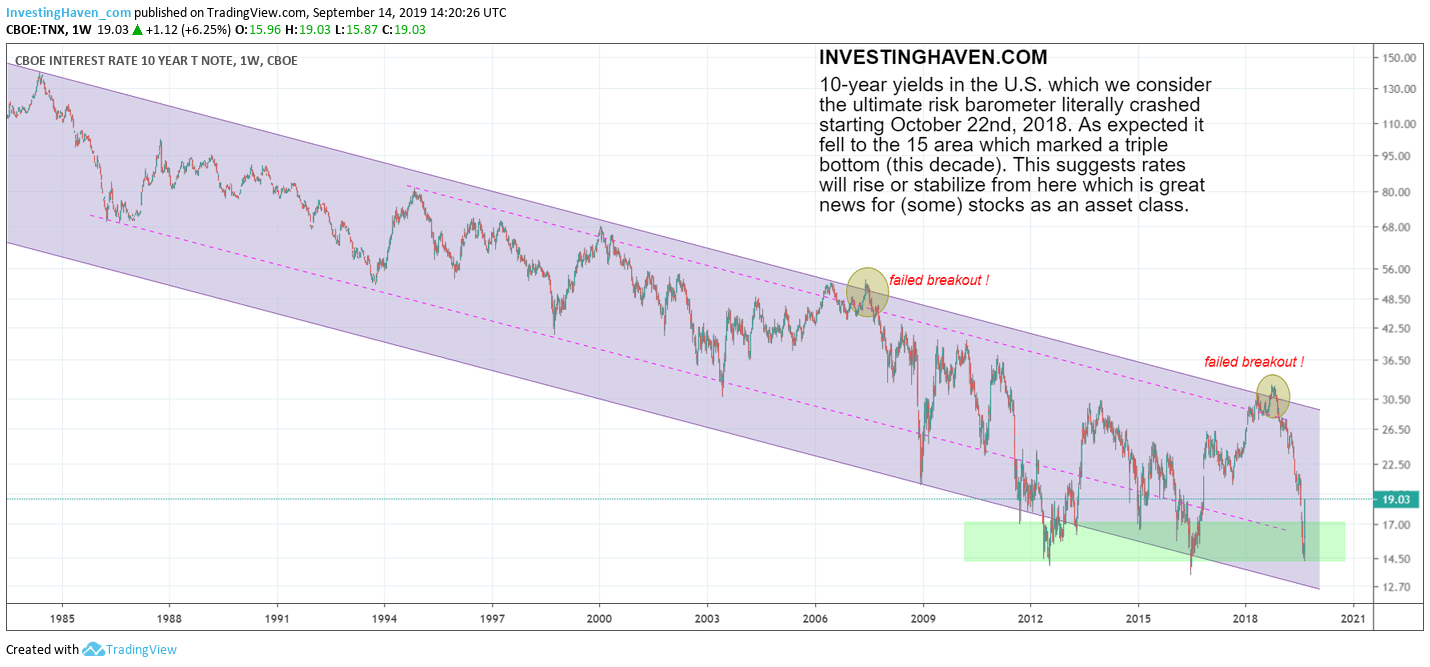

Let’s ‘start with the chart‘, which is our mantra over here at InvestingHaven as explained in our 100 investing tips.

The most important chart for our investing thesis is 10 year Treasury Yields (in the U.S.). It is embedded in this article.

What’s interesting to observe is the correlation between 10 year rates and stocks, specifically RISK ON stocks. We are talking the Russell 2000 obviously which represents small caps, and is the primary index representing RISK ON.

The Russell 2000 broke out in the first part of 2018, only to start declining sharply as of October 2018. Since then it has gone nowhere essentially even though other indexes like the S&P 500 performed better (from a relative perspective).

That’s exactly the reason why we don’t recommend to follow the S&P 500, Dow Jones Industrials or even the Nasdaq for forecasting.

What we learn from the correlation between the Russell 2000 and 10 year yields is this: as the crash of yields seems to be coming to an end now the Russell 2000 is attempting to break out of its consolidation. That’s why we have been using the number of 1625 points for almost a year now!

Once above 1625 points we have a confirmed RISK ON cycle which is great news for stocks. This is also the ultimate confirmation for our thesis that stocks will do well in 2020, but will start correcting in 2021 and accelerate the correction in 2022. That’s why we concluded Why The Next Stock Market Crash Will Be In 2022.

This is the top level conclusion, and it is part of our top-down thinking. So let’s go one level deeper.

Which sectors exactly will benefit?

Our list of potential sectors consists of semiconductors, banking stocks, uranium stocks, and MJ stocks (cannabis or marijuana).

Let’s review them one by one.

Semiconductors have proven to be among the first ones to rise again to new highs. This shows relative strength. No surprise one of our 2 potential top picks published last week to our subscribers was a semi stock.

Banking stocks are driven by rates. Rising rates are great for banking stocks. The below chart suggests that rates have upside potential, in which environment banking stocks will do well. This is an intermarket dynamic driven conclusion.

We do like uranium stocks for a totally different reason: they trade at extremes. They were literally dumped by investors in 2019. We explained this in Why Investors Should Love Market Crashes, And How To Make Money From A Crash.

The last sector is MJ (also cannabis stocks). The growth potential of this sector is enormous. It’s still an emerging sector. Moreover, since May of this year, most MJ stocks lost 50% of their value, which is a great combination: high growth potential and investors dumping the sector.

So this is our investing thesis to play the markets in the next 6 to 12 months.

However, there is more thinking required for a successful execution, and we explain this in the remainder of this article.

Because of the high value of this we reserve the remainder of this article, with actionable details, for subscribers to our ‘free newsletter’. This is premium content that we give away for free, but only after signing up to our free newsletter. Subscribe to our free newsletter and get premium investing insights in 2019 for free. Sign up >>