We have been very vocal about our bullish green battery metals outlook, with lithium and graphite as the preferred markets. We even shared tips on How To Play The Green Battery Super Cycle In 2023. As part of our graphite market research, we concluded that a supply crunch would start in 2025 approximately. Based on new data, it appears that the the supply crunch in the graphite flake market will start not later than 2024 and will start accelerating as of 2025. It will be ‘very bad’ as of 2028. Provided our no stock market crash in 2023 comes true, it will be very bullish for graphite stocks that will be producers in 2024.

Recently, we wrote Which Green Battery Metal Looks Best As 2023 Kicks Off? In that article, we looked at lithium, cobalt and nickel.

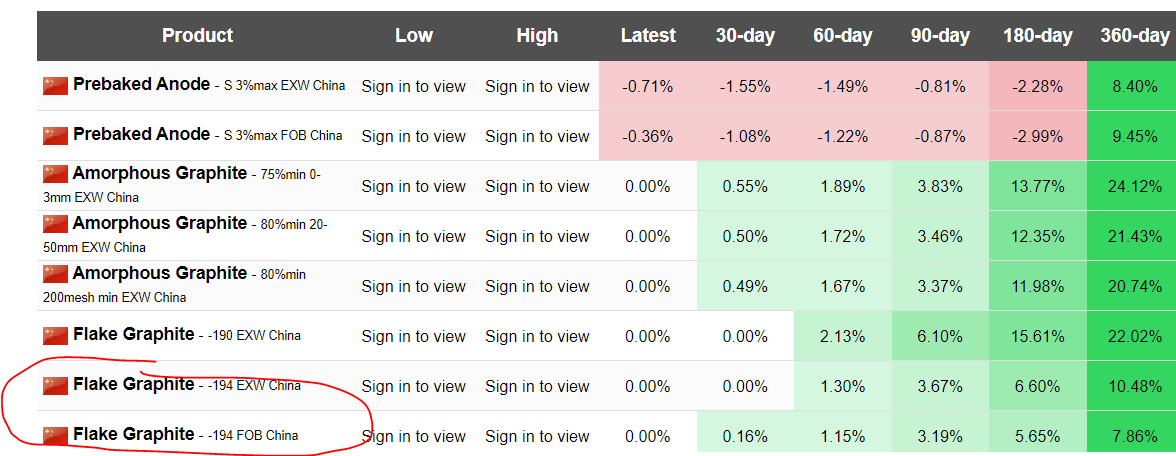

The reason for not considering graphite is that there is not one graphite spot price. The graphite market is fragmented with different prices per graphite type (there are many distinct types of graphite). To illustrate this, we include just a sample of the types of graphite that exist, adding that Flake Graphite 194 is the one that is used for EVs.

That said, what we believe is equally important is the supply/demand situation.

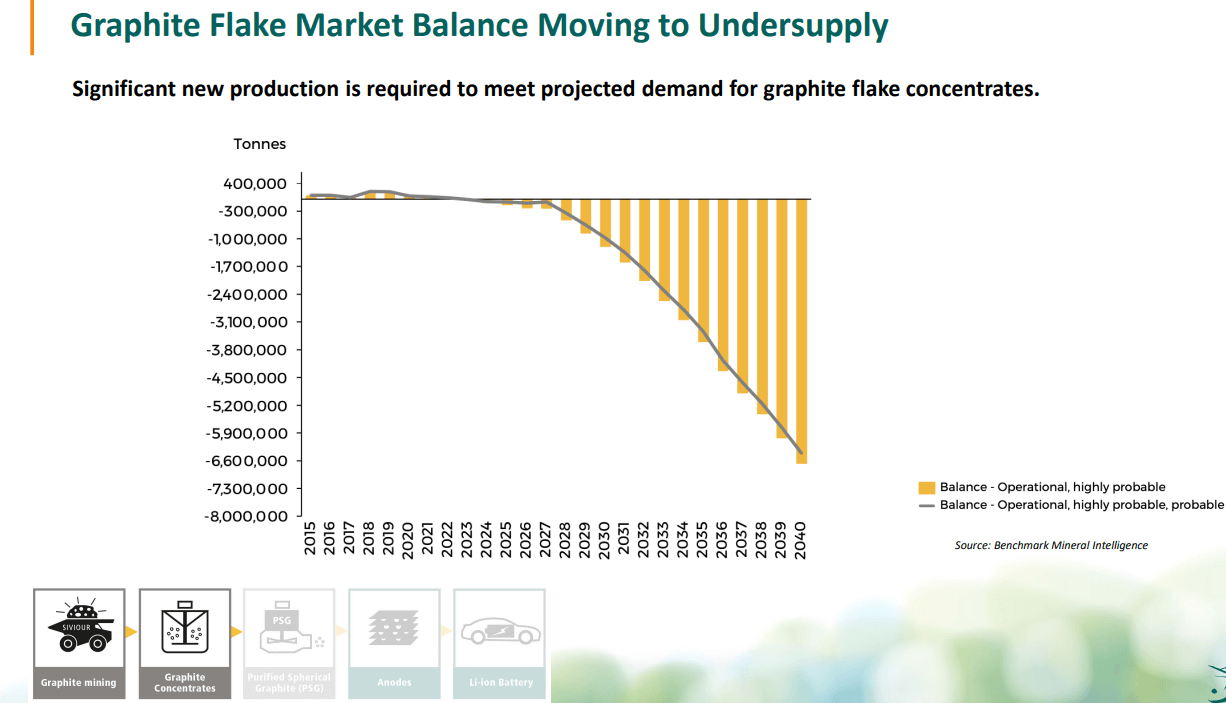

As per Benchmark Mineral Intelligence the graphite supply/demand situation until 2040 looks absolutely stunning. Graphite might qualify as the market with the heaviest undersupply in history.

Please have a look at the next chart, one visual says it all.

As seen, the supply crunch is about to kick in somewhere in 2024. It will accelerate in 2025 and become really significant as of 2028. The next decade looks horrible for graphite consumers, but presumably amazing for graphite investors.

The time to be invested in graphite is probably now, not the next decade, simply because the market will adjust to the future ahead of time. Our Momentum Investing team published a graphite stock selection, based on a very thorough analysis of the graphite market. Top Lithium & Graphite Stocks Selection >>