The market is all about anomalies nowadays. Recently, we documented 10 distinct anomalies which qualify as ‘unique events in history of markets’ in this public post The New Normal In Markets: ‘Celebrating’ 2 Years Of Historical Anomalies In Markets. It should not come as a surprise that we can add another market anomaly, one that has characterized markets in 2022: commodities have been rising simultaneously with the U.S. Dollar. This is very unusual given the strong inverse correlation and the really strong rise in both.

Again, it is not uncommon to see a mild rise in the US Dollar and a mild rise in some commodities.

However, it is highly unusual to see a really strong rise in the US Dollar and such a violent move higher in commodities.

It is equally unusual to see a sharp topping pattern in both. Whether both will confirm a top remains to be seen, the market has the last word, as always. We both look like a topping pattern.

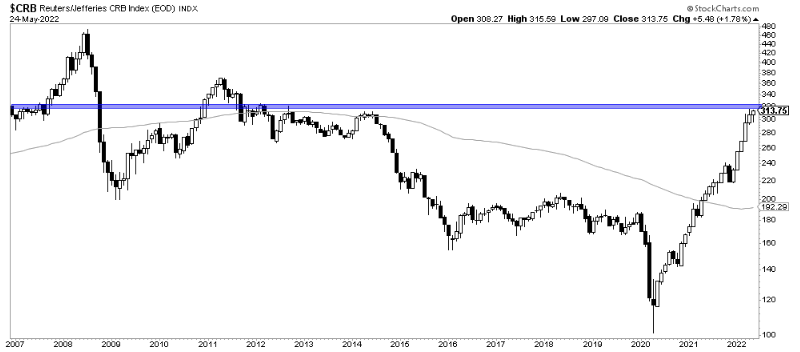

In Are Global Commodity Markets About to Make a Top? we said:

A parabolic rise in the commodities index started in 2021 and this section of the chart is extremely important to understand what might be about to happen. When a parabolic arc breaks, you can easily see a decline of 65% to 75% in the price. So unless we see a quick pullback and continuation in the uptrend, this setup if rejected at the above resistance levels could possibly signal the top in commodities and a reversal for equities.

This is the chart that came with the commentary:

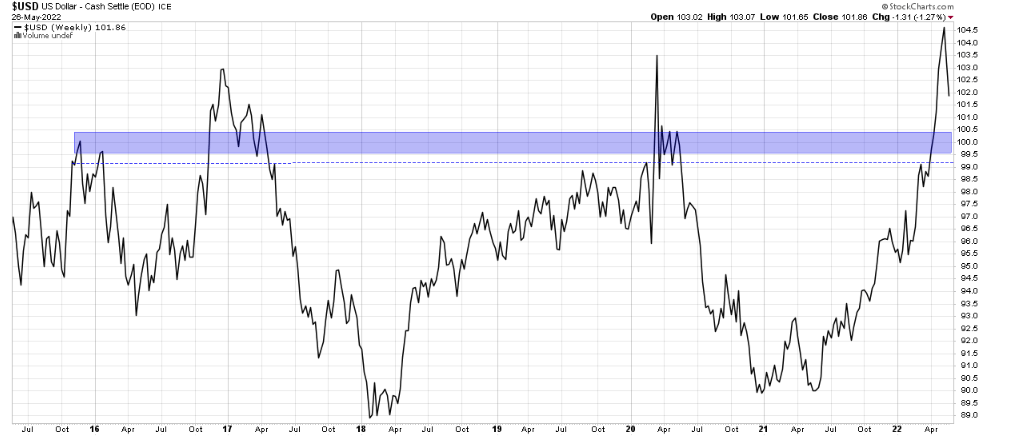

In Did The US Dollar Price Peak In May 2022? we said this:

On the USD’s long term price chart, we see a possible triple top. We also have a breakout above that $99 to $100 area. Next is probably a back test of that previous important resistance area. If it holds and becomes support, the US Dollar might go higher from there.

This is the chart that came with the commentary:

We believe it is a very complicated market situation with comes with a simple explanation.

The simple explanation is: this market is complicated.

This is not a joke, nor are we trying to act like the Oracle of Delphi.

The point is this:

- There are lots of dynamics at work in this market.

- Many of the dynamics are opposing forces.

- The market has a really hard time setting a direction, whenever a direction is set it’s short lived.

Rising commodities reflect rising inflation. However, a rising USD is deflationary.

Monetary tightening because of rising commodity prices results in strongly opposing dynamics. This creates uncertainty in the market, investors don’t know what to do. Emotional investors press the ‘sell button’, accumulate cash (which amplifies the bull run in the US Dollar as capital flows out of risk assets into ‘fiat money’) and partially hold cash / buy commodities.

However, this is not a sustainable market situation.

And that, exactly THAT, is what we are seeing now. The effect of monetary interventions start kicking in and start clearing out irrational decisions by clueless investors.

That’s why we said: it’s complicated, but in essence it’s simple. Still, not easy.

Co-authored: hdcharting