It is now clear that the stock market confirmed a double bottom in 2022. There won’t be a stock market crash in 2023. While the entire world was expecting a major breakdown and another leg lower in stock indexes, the exact opposite seems to be happening now. Thursday, Nov 10th, 2022 probably came with epic short covering. We did forecast a double bottom in markets on Oct 13th, 2022, when the S&P 500 opened at 3500 and everyone was calling for a breakdown, this is what we wrote back then The Market Will Not Move 50% Lower Contrary To What The Gurus Are Telling You. Moreover, 2023 will be really different as explained in a long series of 2023 forecasts. In this article we depict one specific chart that puts the unusual year 2022 in perspective.

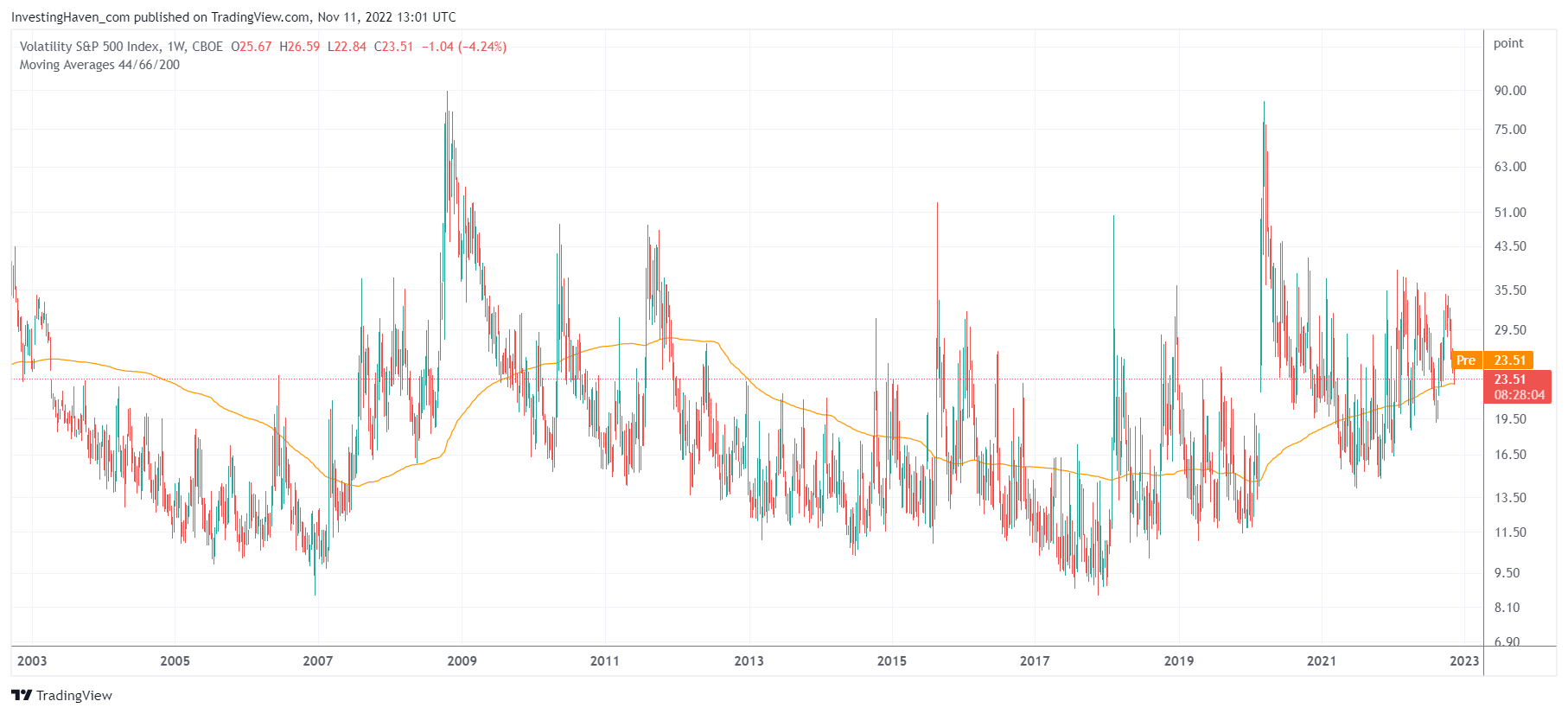

Below is the volatility index chart VIX. It is the weekly chart over 20 years.

In orange, we can find the 200 week moving average, which we only use to make our point (it’s not an indicator part of our methodology).

As seen, the market spent the entire year 2022 (with the exception of a handful of weeks) above the 200 WMA of VIX. That’s highly unusual, only the period back in 2008 was somehow comparable from that perspective.

What did not happen in 2022 is the big spike, similar to the one in 2008 and 2020.

The question is whether it is underway or whether the market avoided the big volatility explosion.

We believe the big volatility explosion will not come. That’s because inflation has peaked and leading indicators heavily reacted to this (US Dollar and the bond market).

The year 2022 was really unique in its persistent volatility levels and the epic rotation. It all happened ‘under the hood’ and most investors are wrecked, anxious after having sold at the exact wrong moment.

We believe that better times are underway. VIX is setting lower highs on its weekly chart. It might finally fall below its 200 WMA which would be great news. As said, 2023 will be really different.