With all these markets rendering green figures one is left questioning whether there still is a bear market anywhere in 2019? Our 2019 forecasts are mostly on track, with the exception of gold (GOLD), silver (SILVER) and mining stocks which visibly need more time to build up bullish energy. The answer is yes, there are a few bear markets, and one is very obvious: agricultural commodities. They certainly will not qualify as one of the top opportunities in 2019, but we keep a close eye on them for the long term. What goes down must go up again, though it may take (a lot of) time before that happens.

As per our 100 investing tips for successful long term investing:

The biggest caveat with new bull markets is that nobody talks about them. They are only visible on monthly and weekly timeframes. That’s where the ‘real market news’ is created. At the time bull markets appear in financial news and media it is already close to the end of the bull market.

Just to be clear: a bear market is a bear market until proven otherwise.

Agricultural commodities are in a bear market, period. We can dream a lot, for sure if you like this asset class, about them being in a bull market. It is not the case right, and will not be until their chart says so.

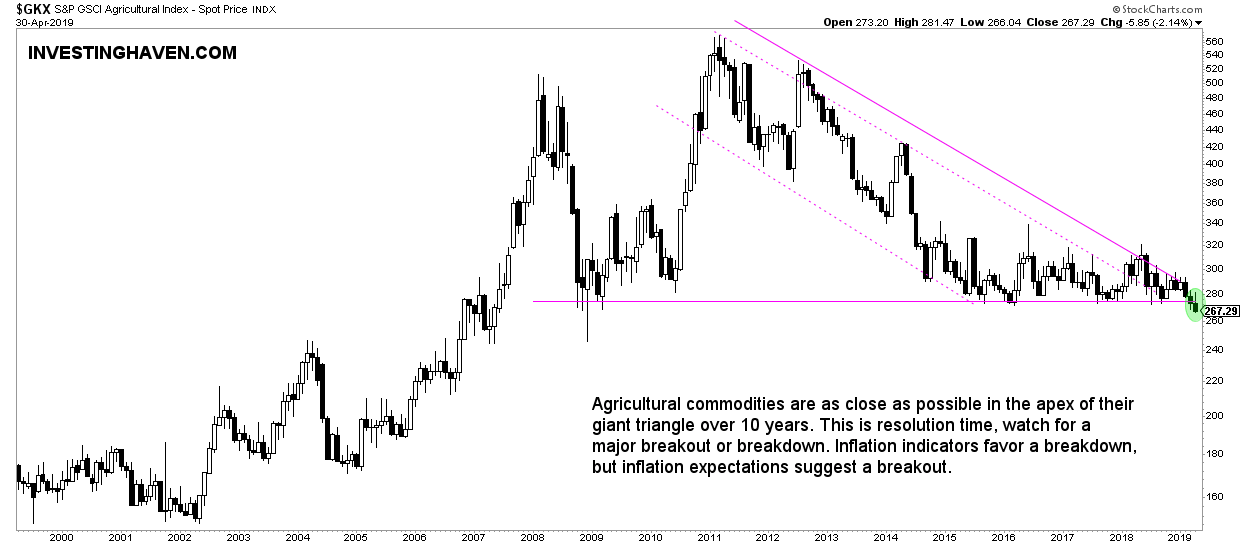

Their monthly chart outlined below shows the start of a breakdown. This means there is more selling coming unless this index is able to close the coming month(s) back above 280 points.

How much selling? The 240 area is a logic candidate to stop the bleeding. Then again we need to assess the next few months, and monthly closings.

As said by the U.S. Fed yesterday the inflation rate is quite low, below their targeted 2 pct inflation rate. Below chart combined with the gold, silver, copper charts give the same message. That’s why Treasury rates cannot rise too fast as real rates would fall even further!

It is wise to follow agricultural commodities as they are becoming a bargain for the long term. At “a” point in time they will become interesting again, not in 2019, potentially in 2020 or later. That’s when you want to apply the magic rule of “buy low sell high.”