Stocks have been very volatile since August 2nd, that’s nearly 3 full months now. It certainly does not come as a surprise that this popular fear indicator shows a reading near extreme fear, almost as if a market crash is here. The reality is that stocks are currently thoroughly testing key support levels. If these support levels hold, we believe there is enough evidence that stocks will not tank in the first half of 2024, all we need for a ‘good outcome’ is November to become a bullish month.

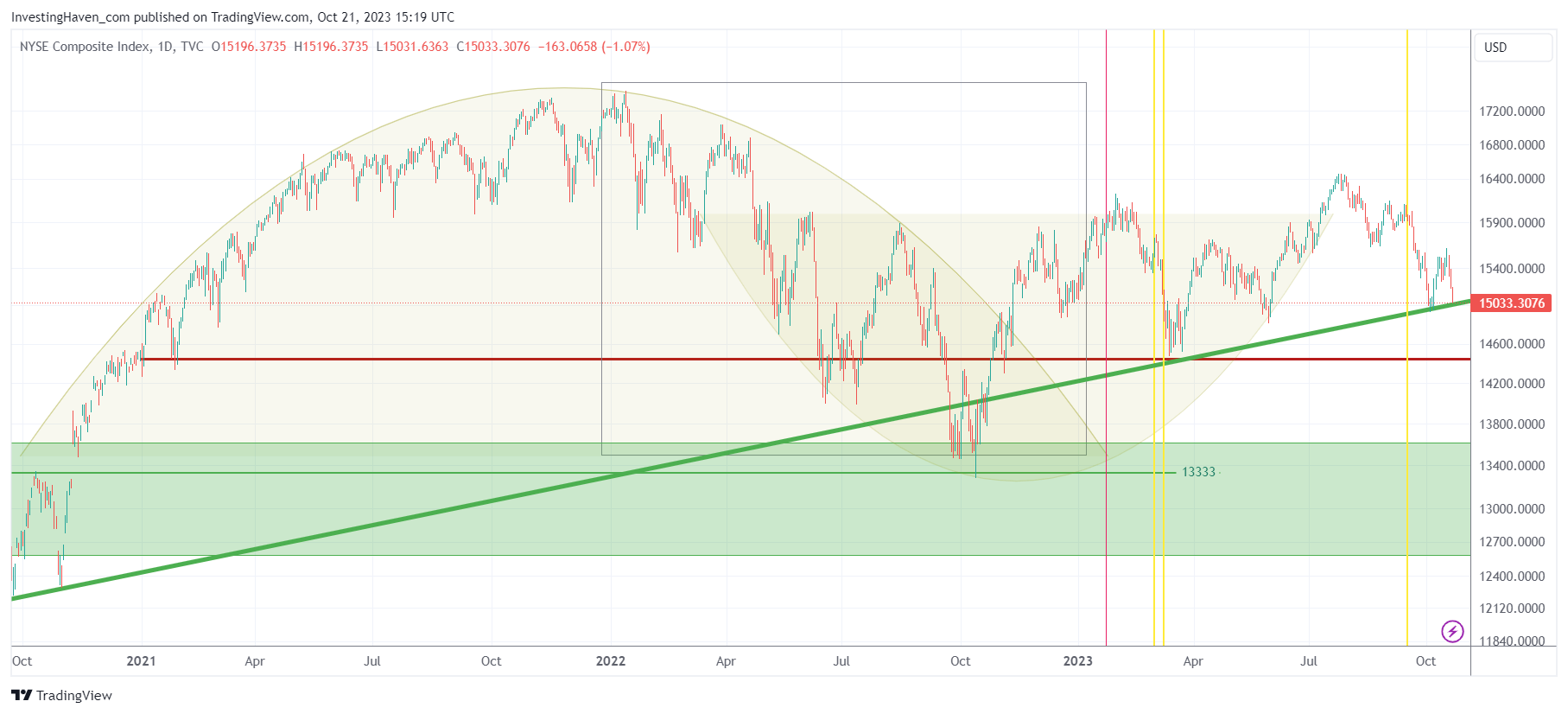

The one stock chart we pick out to shows that stocks are not breaking down is the NYSE Composite Index, representing a broad array of stocks (as opposed to the concentrated and tech heavy S&P 500).

The daily chart over the last 3 years is crystal clear: an epic test of a multi-year rising trendline is ongoing. The same trendline was hit in the last days of September, it was hit on Friday’s session as well.

It is very natural, even normal, that long term trendlines are tested multiple times, at least twice. The same behavior occurred in March, with a triple test (arguably quadruple test) of the same rising trendline.

Note that the NYSE Index traded between 13500 and 16400 in the last 12 months. It currently trades at 15033 points. That’s the mid-point over the last 12 months. It is really fine for pullbacks to reach the midpoint of a longer term range, it’s a healthy pullback provided that midpoint holds.

We selected several stocks our latest Momentum Investing alert [Rotation] Which Sectors & Stocks Are Likely To Outperform In The Coming 6 Months (accessible to current Momentum Investing members but also any new member) which we expect to do really well once leading stock indexes confirm their current support levels.