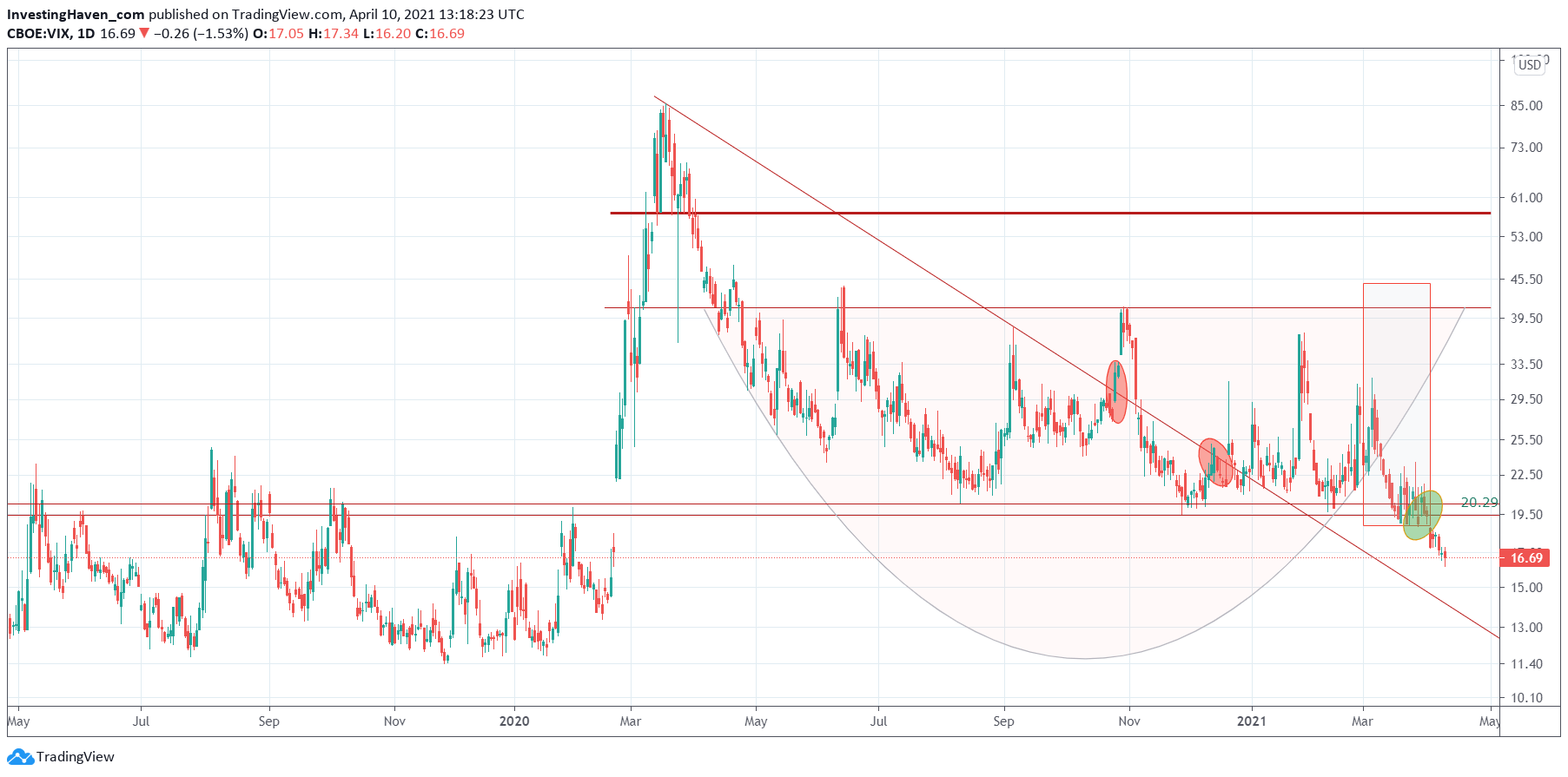

The first week of April marked an historic week in markets. Since the once-in-a-century type of crash last March we have experienced an unusually high number of ‘historic weeks’. Here is the important evolution that took place in the first week of April: BACK TO NORMAL. And it was visible in one of the leading indicators we closely track (VIX).

From our detailed market analysis which we share every weekend with our members:

The VIX chart is the one that makes the point, and it makes it very clearly: on April 1st, the first day of a new 3 month cycle, VIX fell below 20.29 points with a full candle… for the first time since the Corona crash started more than a year ago.

See the annotated green/yellow circle on below chart.

This is BREAKING NEWS, and obviously this went unnoticed to most investors and traders. Mainstream media has no focus on retrieving important data out of the market, the data that is really relevant to market participants. Their focus is different, so no blame game here. But investors and traders need to realize that media are a lagging indicator, not a leading indicator!

From our weekend update:

This structural change in the profile of VIX introduces a new era in markets: the Corona crash period did officially come to an end on April 1st, 2021. Financial markets are in a new era, one that is more similar to the period prior to the Corona crash, when cycles were easier to read (presumably, hopefully) and markets operated at a normal pace (whatever that means). The end of ultra-fast rotations and market moves, is our assumption going forward.

Anecdotally, if we check recent VIX related info in mainstream media we find this Giant VIX trade bets on fear return and this 3 reasons why volatility could come roaring back to a stock market that’s drifting along near record highs, according to UBS. These articles miss the point, and it makes the point that relevant information for investors and traders should not be expected in mainstream financial media.