While many are obsessed with the stock market crash of 2019 we stay focused on our own method. Our proprietary set of 15 leading indicators suggest that there is no market crash coming, maybe another dip in the next months. In this context we believe tech stocks are a great play, and specifically Broadridge Financials (BR) looks juicy with a confirmed breakout on its chart. Broadridge Financials is a riskless way to play tech stocks.

At InvestingHaven we are not dogmatic about sectors or assets, nor are we perma bulls or perma bears in any market. We are eager to spot trends and low risk opportunities. More importantly, we are absolutely obsessed to find the top 3 opportunities per year.

The technology sector has a chance to become a great investment. It may not be the absolute top investment of 2019 but that’s fine. In our top 3 tech stocks 2019 we have listed the tech stocks with aggressive growth potential, in the small to mid cap segment.

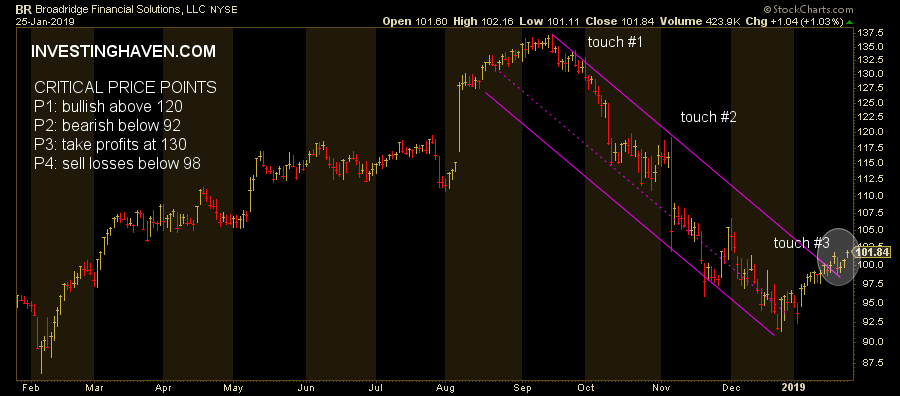

In this article we focus on a trade opportunity: Broadbridge Financials. Recently we tipped Broadridge Financial Solutions as a stock to buy near breakout. Today, we see that the trade is working out well, and look at the price points that matter.

As said in our 100 investing tips and per our 1/99 Investing Principles it is a handful of price points that truly matter:

Only a very limited number of price points have a decisive meaning. It is crucial to identify those critical price points, and actively use them in determining entry and exit points. Applied successfully and consistently it will deliver above average profits over time.

When it comes to Broadbridge Financials these are the 4 price points that truly matter:

- P1: bullish above 120

- P2: bearish below 92

- P3: take profits at 130

- P4: sell losses below 98

This is a classic case of the buy-the-breakout-but-mind-the-false-breakout case. Quite some upside potential, but don’t forget about the downside.