InvestingHaven is not tied to any market, commodity or stock. On the contrary it continuously and actively scans all markets to identify the most juicy investing opportunities based on a strict method (which it continuously updates for the best possible performance). One of the countries that currently shows a great setup is Sweden, certainly an underdog. This article explains why we have a bullish Sweden stock market forecast for 2019 and beyond.

Note that this is one of the many 2019 forecasts which we have published and which are underway, keep a close eye on our 2019 market forecasts as we will cover a variety of markets, stocks, assets, even cryptocurrencies.

Sweden stock market forecast 2019: the fundamentals

Our mantra is ‘start with the chart’, fundamentals come later.

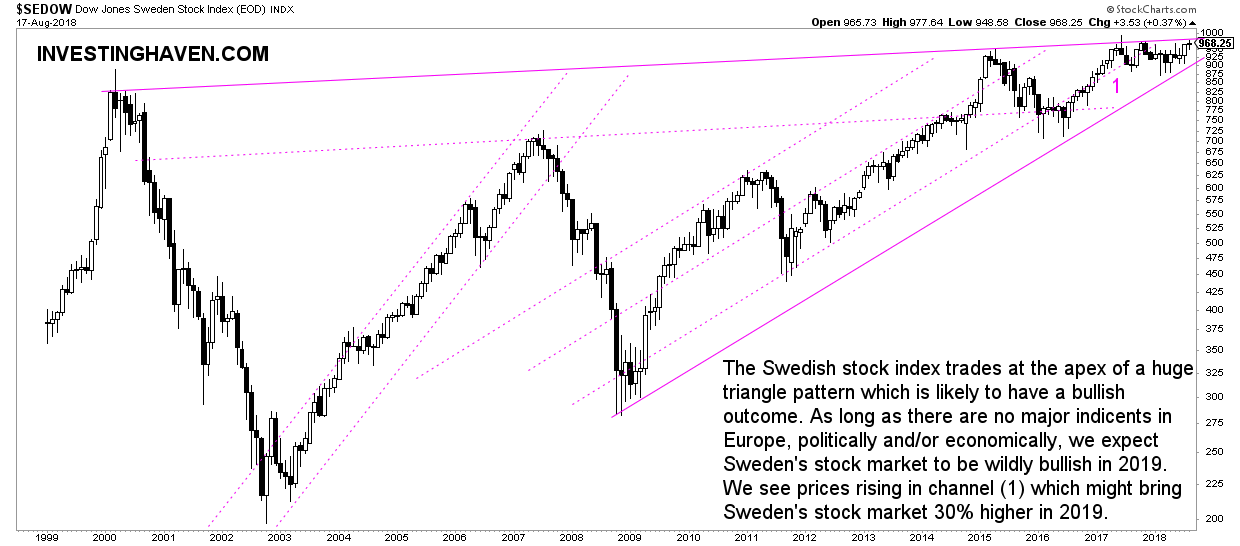

The chart which we’ll discuss in more detail in the next section is embedded below. It is clear what a beautiful chart setup the Sweden stock market has. In and on itself it certainly suggest as a bullish outcome, hence our bullish Sweden stock market forecast for 2019 and beyond.

Still, it’s worth doing some fundamental checks on Sweden. We have identified a couple of economic forecasts for 2019 and beyond which are worth considering.

According to this economic forecast Sweden should benefit from fiscal stimulus and economic growth:

“Looking ahead, growth should be brisk, supported by strong exports, fixed investment, and a more expansionary fiscal stance. In addition, higher wages should aid private consumption, despite more pessimistic consumer sentiment. However, weaker housing investment will likely dampen activity, while elevated household debt poses a downside risk. FocusEconomics panelists see GDP rising 2.6% in 2018, unchanged from last month’s forecast, and 2.1% in 2019.”

Moreover, Bloomberg wrote last month that the results of Sweden’s economy came out stronger than forecasted, we absolutely like this:

“Sweden’s economy expanded twice more than forecast in the 2nd quarter, driving the krona higher as speculation grew that the central bank will raise interest rates later this year.”

In January of this year Reuters reported a better than expected forecast among economists for Sweden in 2018:

“The Swedish economy, the largest of the three, is now expected to growth 2.7 percent in 2018. That’s better than the 2.5 percent predicted in October, although down from the estimated 2.8 percent expansion in 2017.

A near-absence of inflation has been a major cause of concern at the region’s central banks, triggering rate cuts, quantitative easing and other measures, but consumer prices are now expected to accelerate in all three countries from 2018 to 2019.”

All in all, we believe that economic fundamentals of Sweden certainly underpin a bullish Sweden stock market forecast for 2019 and beyond.

Sweden stock market forecast 2019: the chart

- We are at at the same point as in 2001.

- This is the 4th attempt to breakout.

- The continuous series of higher lows is outstanding.

All these factors on the chart suggest a bullish outcome.

The only caveat is of course a sudden crisis in Europe, as we have seen many of time in recent years. We consider the wildcard, and a potential bearish factor. Only if this index dips below 900 points will it be concerning, otherwise it might be wildly bullish in 2019 and beyond.

How to invest in Sweden’s stock market? InvestingHaven did not work out an investing strategy as part of this article. Readers who are interested are invited to drop us a message.