JD.com (JD) is one of our favorite tech stocks in China. It broke down last summer when personal news from its founder and CEO broke out (he went one step too far during a party in the U.S. and got arrested). However, we looked at it as a buy opportunity, and flashed a buy alert early this year: JD.com Stock Price Shows Giant Double Bottom, 45 Pct Upside Potential In 2019. We want to see signs of our China’s stock market outlook as discussed in China Stock Market Outlook 2019 as well as Will The New China Stock Bull Market Start In 2020. This is the whole point: JD.com offers leverages on China’s stock market which is why we see a rather immediate 20% upside potential, and best case doubling from here (as long as China continues to rise).

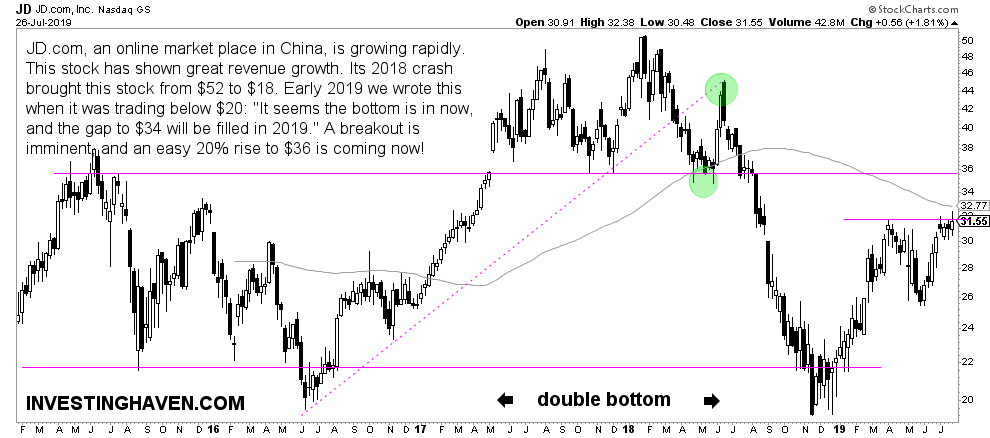

JD.com, an online market place in China, continues to grow rapidly. This stock has shown great revenue growth.

Watch for confirmation of continued strength in its next quarterly earnings report which is due for August 15th, 2019.

Its stock price did well, but really crashed last summer.

Early 2019 we wrote this when it was trading below $20: “It seems the bottom is in now, and the gap to $34 will be filled in 2019.” A breakout is imminent, and an easy 20% rise to $36 is coming now!

We still believe $36 is the first and immediate price target. That’s an ‘easy’ 20% upside potential, provided nothing exceptionally bad happens in China of course!

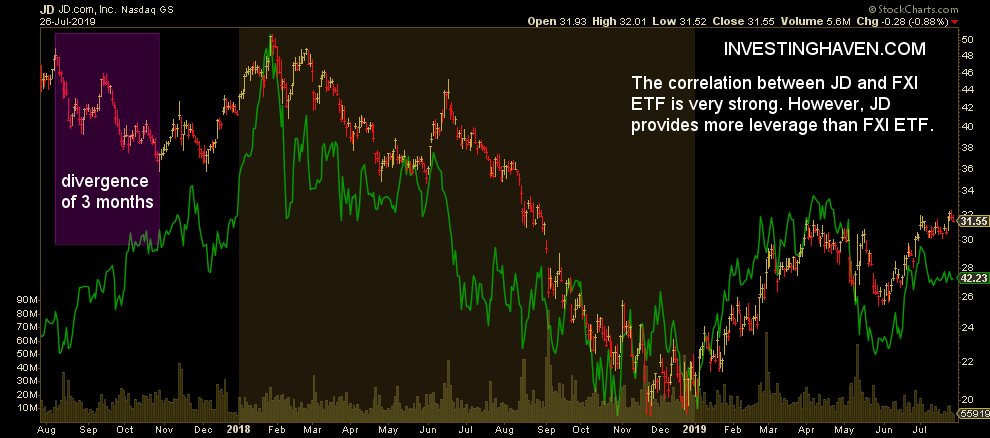

We are also closely watching the correlation between JD.com with FXI ETF (the China large cap stocks ETF).

As seen on the 2nd chart the correlation is very strong. However, what may not be visible on this chart is that JD.com provides much more leverage. So the direction is similar, but the % change is higher with JD.com.