In our premium research methodology, we track 6 crash indicators. They help us understand the likelihood of a pullback, correction or even crash. They also carried important information about this once-in-a-generation crash that started end of February. Full transparency, we were able to decipher what we now call ‘contraction signals’ only after the facts. Whenever any new market crash comes up we’ll be able to read the language of those few smart investors (1% of investors only) that communicate through specific signals in a few sophisticated markets. Anyway, at this point in time, one of those 6 crash indicators is at a make-or-break level. The outcome, most likely due next week, will tell us a lot about our stock market forecast, the shape of the Dow Jones 20 year chart, the gold market as well as the probability of another Black Thursday in the near term.

The one crash indicator we are talking about is the VIX index.

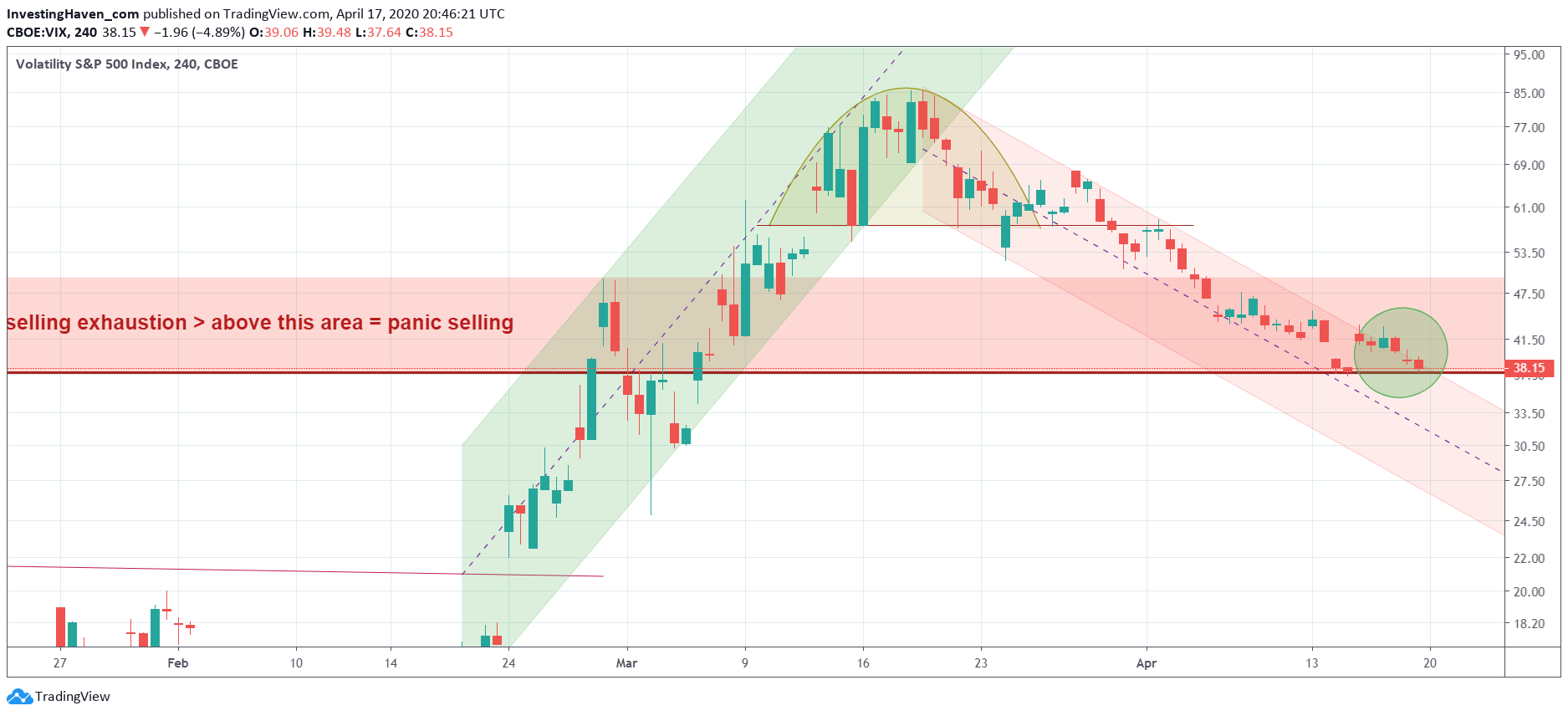

Look at the chart shown below. The VIX index is now ‘testing’ the lower part of the ‘Armageddon area’. Once above 38 points we assume crash conditions in markets. Below 20 points are ‘normal markets’.

One might become excited about a break below 38 points. While it is true that lower readings are better, but there is a long way to 20 points (normal markets).

Yes this crash indicator may resolve in the right direction, but markets remain fragile and fickle. They are very misleading as explained in Stock Market Short Term Uptrend ‘On The Edge’

More than any other time in the past investors need balance in their trading and investing decisions. Those nice green days on stock indexes look very compelling, and easy to trade. Nothing is further from the truth, one wrong sell decision can leave a lot of potential on the table or ‘lock in’ a big loss … while that same market may be trading much higher in a few weeks from now.

Volatility is the big problem, and high levels of volatility give a false sense of action. It’s a mental game. Investors believe they have to do more with higher levels of volatility.

We urge investors to stay calm, stick with a decision and not care too much about moves in other markets. It is tempting to follow the rallies, but those rallies ‘flow’ from market to market, on a week by week basis. Very misleading, very tempting to chase prices higher, only to ‘feel stuck’ a few days later.