Markets move in cycles. The secular cycles are the longest term cycles. Probably THE most powerful cycle of 2020 is the emergence of a new secular bull market in emerging markets. Not only are the charts still lined up consistent with our emerging markets outlook and 2020 forecasts but more importantly this happens as we kick off our Mission 2026 in which we aim to turn 10k into 1M before the end of 2026. This is a public challenge that we started, one never seen before. We will report on the progress publicly.

Yes at InvestingHaven we are ambitious, very ambitious, but always realistic, down to earth and humble. Taking on a challenge in which we turn 10k into 1M in max 7 years, publicly, is not something many dare to do. We are vulnerable to criticism if we don’t get there.

But here is the point: we will get there.

Yes we are confident because we have 2 solid investing methods as well as forecasts on which we worked many years. They are close to perfect now.

No coincidence we are starting this challenge right at a time new bull markets are emerging, one of which being the emerging markets bull market.

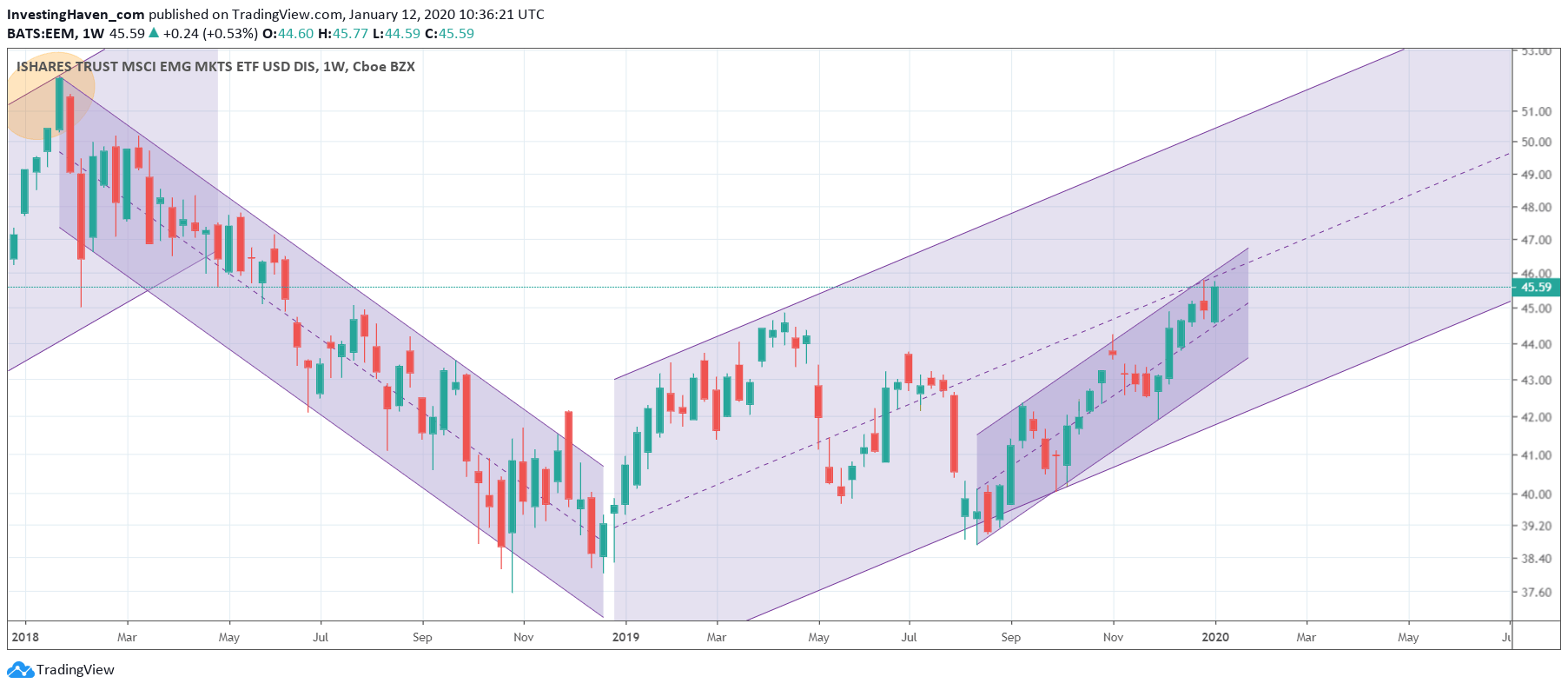

The emerging markets chart (EEM ETF) says it all. Does this need any explanation? It’s a classic no-comment chart.

Obviously the annotations are ours. We did not say it is ‘easy’ to ‘see’ the patterns we have drawn on this chart. The start of a new rising channel is not the typical chart you’ll find in financial media and certainly not in social media. It’s full of charts, but we miss the meaningful charts.

We could apply our 1/99 Investing Principles in this domain as well: 99% of the charts you will find in online media are meaningless, absolutely valueless. It’s just 1% of the charts that may help you as an investor. Good luck ‘separating the wheat from the chaff’.

The emerging markets chart is a pure beauty, and we are playing this new bull market in 2 distinct ways.

On the one hand we take a medium term investment in a very specific emerging markets sector. It’s a classic stock investment.

On the other hand we add fuel to our portfolio by playing the short term cycles with short term trades. This may sound complicated, but it’s as simple as can be. On average we take 1 trade per week.