The Nasdaq index is enjoying solid performance, as explained in more detail in Value Stocks Lagging, Growth Stocks Leading? Wrong, 5 Stocks Leading. Our viewpoint remains to stay focused on the big picture: stocks will eventually resolve higher. As per this most important chart of 2023, not just 5 stocks but a broader market move is underway. However, we believe a dip to shake out optimism is what we’ll get first.

We said that it’s pointless to feel FOMO’ed.

While the performance of the Nasdaq index suggests that the worst is behind us, in terms of market selling, confirming no stock market crash in the near term, we also firmly believe that selling will pick up, particularly in the last 10 days of June.

No, this is not an emotional reaction, this is a rational, data driven conclusion.

On the one hand, the number of bulls is rising, too fast, presumably, especially if a debt ceiling deal will be confirmed.

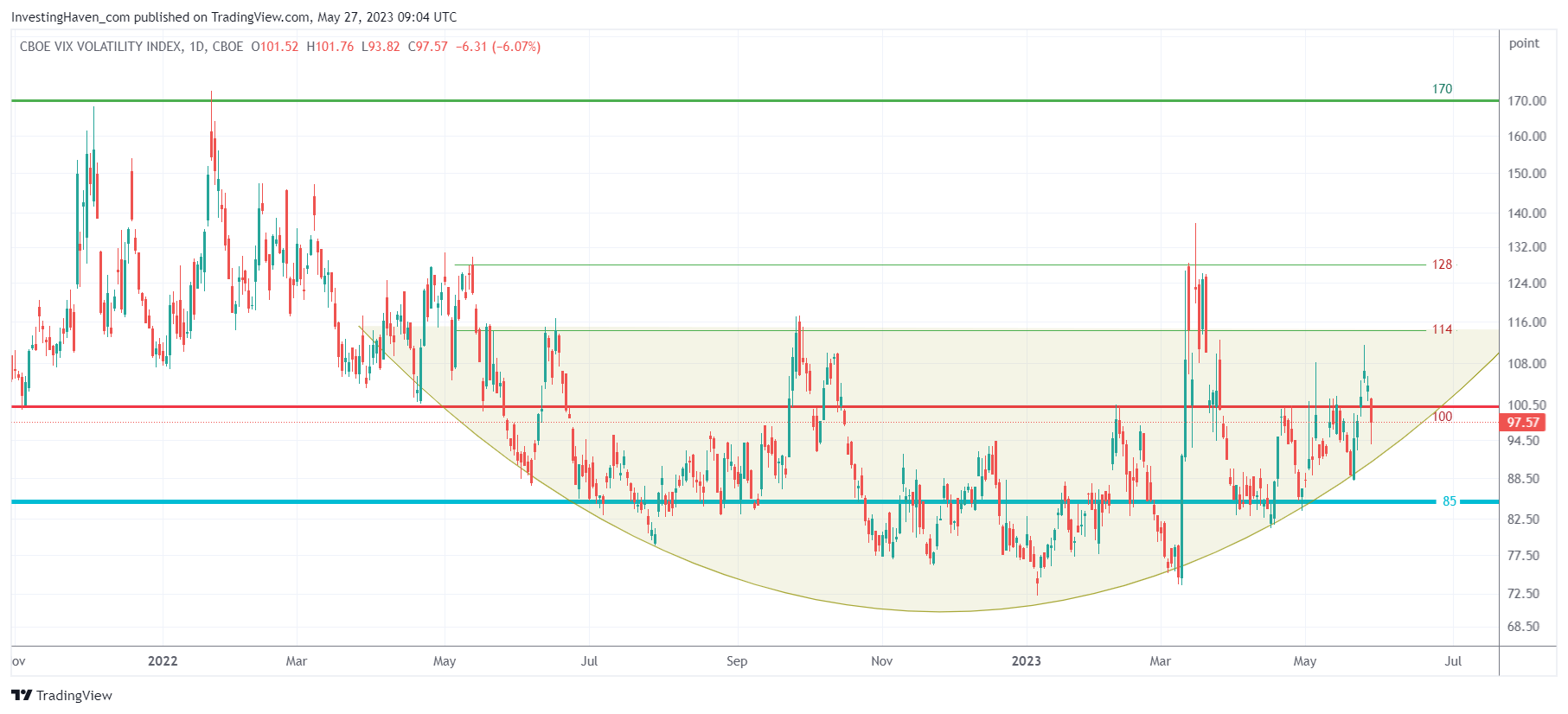

On the other hand, the leading indicator that we trust most, say the leader of all leading indicators, is already working on a turnaround. There is a reason why this is the leader of all leading indicators: it reacts way before the rest of indicators. Below is VIX of VIX, one of the most important charts which we feature every weekend in our market analysis. Its rounded pattern is bullish, while the Nasdaq may be making a higher high, VIX of VIX is also making a higher low (inversely correlated to stock indexes).

We firmly believe that the end of June will the opposite of early June: higher first in June, much lower in the last days of June.

Therefore, we stick to what we said before: “The first days of June are meant to observe what has / has no momentum, the last days of June will be to enter those stocks. First the selection, wait / no action, then action around June 30th, 2023.”