Investors nowadays are very short term oriented. The endless flow of financial news headlines, social media streams, short term charts … they are all meant to create excitement. Nowadays we find ‘day-by-day forecasts‘ per market (let’s get serious, as if this exists). Consequently many get totally distracted from the big picture. When it comes to asset classes and big picture trends we clearly see one thing when we zoom out of the daily clutter: gold miners start a new bull market relative to the broad stock market. This may become a powerful trend or a weak trend we don’t know. What we do know though is that this is a trend smart investors don’t ignore. InvestingHaven followers were informed about this coming trend half a year ago in our must-read gold forecast (scroll down to find the gold mining call for 2020 we made last September).

The chart to make our point is a long term chart.

Yes long term charts have value, yes they have more value than short term charts. No they are not exciting most of the time.

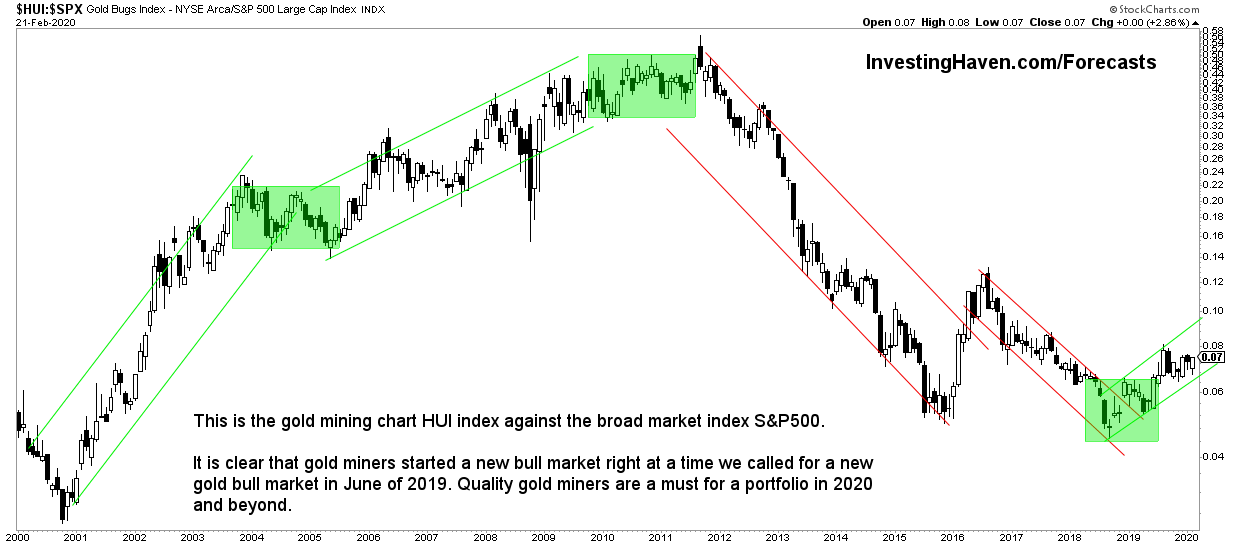

The HUI index (oldest gold mining index) relative to the S&P 500 is shown below on 20 years.

We clearly see 2 distinct phases between 2001 and 2019.

We called for a new gold bull market in 2019, and our forecast was featured on Barron’s: How Gold Could Stage a 20% Rally This Year.

It took a bit of time for gold miners to react, but we believe the reaction is here in front us.

The HUI index relative to the S&P 500 is now clearly in a new uptrend. How long this will last, how powerful it will be, how many 10-baggers we can score … all great questions, and we are researching them.

One thing is for sure for now: this is a trend smart investors don’t miss out on.

Clearly the gold market is offering smart investors great opportunities at this point in time. That’s why we suggested 2 gold positions. One is an aggressive breakout play, and the other one is a secular breakout play. Both are absolutely gorgeous.