When answering a complex question like “will stocks tank or even crash in the coming 9 months” most analysts tend to over-complicate things. Admittedly, it’s not an easy question, consequently the answer cannot be easy. We tend to do the opposite. We apply the KISS principle – Keep It Stupid & Simple. We identified the 2 charts in this article, mid-October of 2023, as the basis for our 2024 forecasts. It also answers the question whether markets will crash in 2024, a common thought that is creating a lot of stress and anxiety among investors.

Ed. note: this article was originally written and published on Oct 15th, 2023. We follow up, on Nov 26th, with up to date charts and commentary. In doing so, we keep the thoughts in this article current.

Contrary to common belief, it is not economic forecasts that is useful to predict a market pullback or crash. While economic analysis may serve useful intellectual information, it is not a leading indicator for market forecasting.

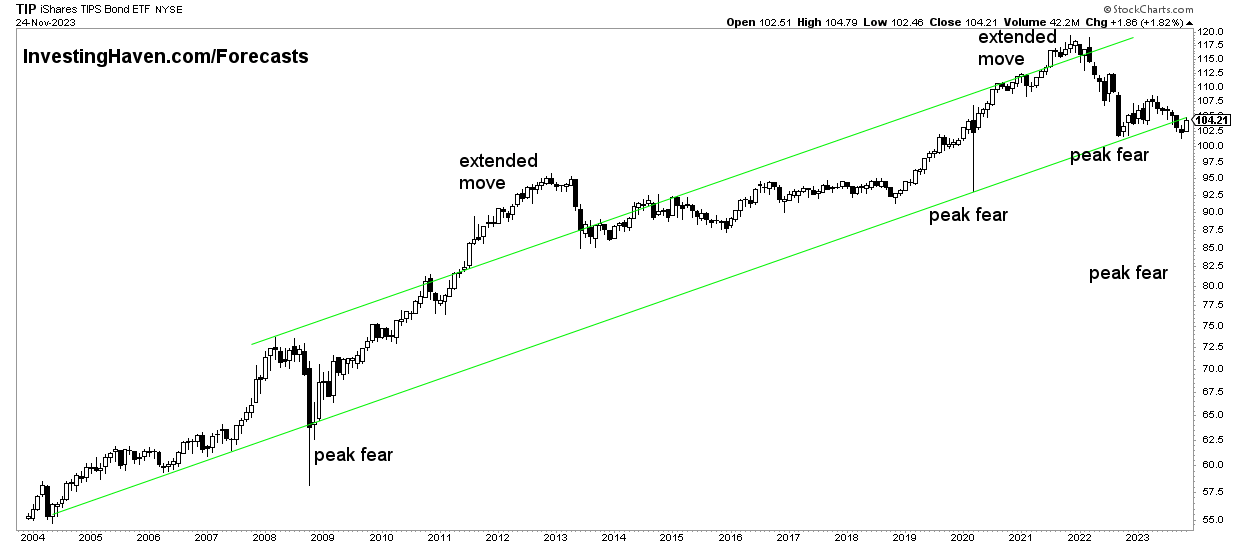

Early this year, we identified TIP ETF as a leading indicator that would forecast if 2023 would be a make-or-break year for markets. We explained it in great detail in multiple posts in the past.

The long term chart pattern is key, is what we said. We don’t want TIP ETF to fall below its 10-year rising channel for more than 3 months.

Commentary from Oct 15th:

We observe a potential double bottom scenario on the monthly TIP ETF chart, with one monthly candle (half-way this month) below the long term rising channel. No damage done, but this situation cannot continue going into 2024. If TIP ETF does not reclaim its rising channel, in Q1/2024, we might see stocks tank in 2024.

Commentary added on Nov 26th:

TIP ETF, a leading indicator for markets and metals, seems to be confirming a double bottom, with a higher low, right at support of its multi-decade rising channel. This bodes very well for markets and metals in the first half of 2026. The level to watch is (a) the 2022 lows as support (b) 112.5 points as resistance.

For now, this chart looks very promising as it is confirming peak inflation and peak rates (read: Be Very Careful With Consensus As Illustrated By The ‘Higher Rates’ Narrative).

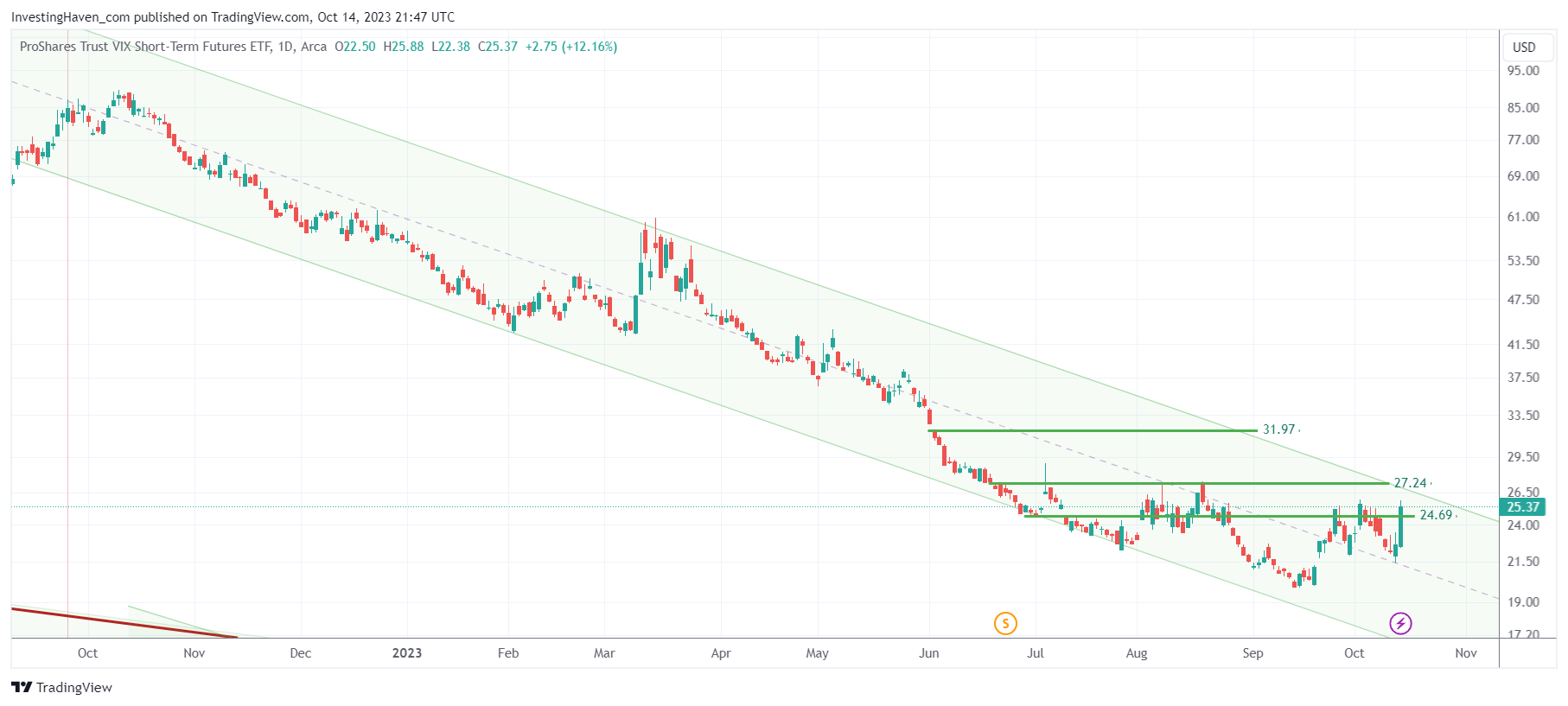

While the above chart is long term oriented, the next chart is short to medium term oriented. It is a short term volatility index, one we cover in our premium weekend analysis shared with premium members.

Note that volatility indexes are inversely correlated to the underlying stock index, in this case the S&P 500.

Commentary from Oct 15th:

The chart says it all – this index should not move above its falling channel. If it does so, particularly in November of 2023, it will not bode well for stocks going into 2024 (in the first months of 2024). As long as this volatility index remains inside its channel, not exceeding 27.24 for more than 5 consecutive days, in the months of October and November, there is no harm done.

Commentary added on Nov 26th:

The chart of this short term volatility index broke down, lately. This bodes very well for markets in 2024. No market crash in 2024, certainly not in the first half of 2024.

While we do not pretend to have served a complete analysis, we certainly offer very easy to use and remember chart analysis.

The answer to the question “will stocks tank or even crash in the first half of 2024” can be answered by (a) not more than 3 monthly candles below 105 points in TIP ETF (b) not more than 5 daily candles above 27.2 points.

Commentary added on Nov 26th: All data points and levels provided a while ago are acting as pivotal price points. They helped our members tremendously well, staying the course, focusing on the bigger trend.

Do you like this analysis? You can receive much more detail and charts, we recommend to become a premium research member >>