This article has 2 investing tips to play the stock market volatility in April of 2019. As said before, we do not anticipate a stock market crash in 2019, at least not as of yet. This is more likely a short term volatility trend until 10-year rates fall back to the 20 – 22 area. Primarily utilities (stocks) will benefit during this rate decline as well as the Japanese Yen (currencies) as the risk-off play takes over for a while. Note that we believe this is a short term trend and in no way does this qualify (as of yet) as a top investing opportunity for 2019.

Investing Tip #1: Utilities

The first investing tip to play short term volatility because of falling interest rates is utilities.

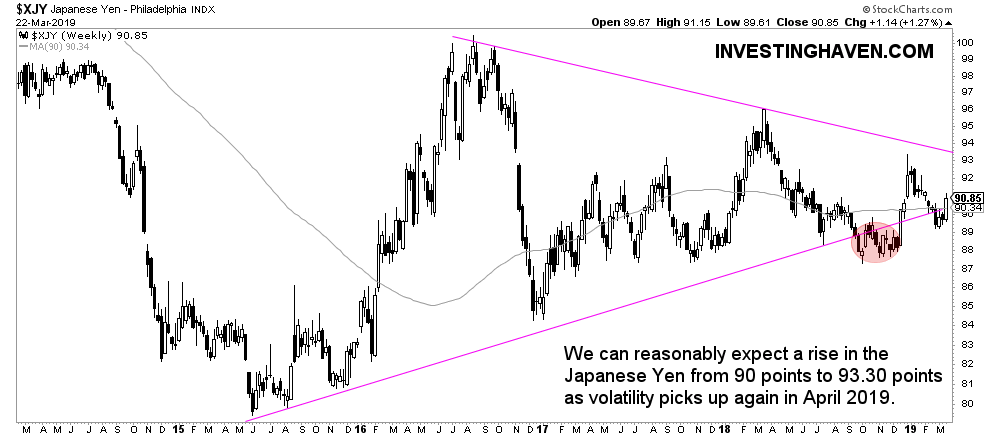

Below is the relative strength chart of utilities vs. the S&P 500 broad index. As seen, there has been only a handful of opportunities in the last 15 years to make money in utilities relative to broad indexes.

The ongoing opportunity is number 6 in 15 years.

If history is any guide we expect the ongoing run higher to move until resistance drawn as an annotation on the chart. The easiest way to play this trend is through the utilities ETF XLU.

Investing Tip #2: Japanese Yen

The Japanese Yen is our investing tip #2.

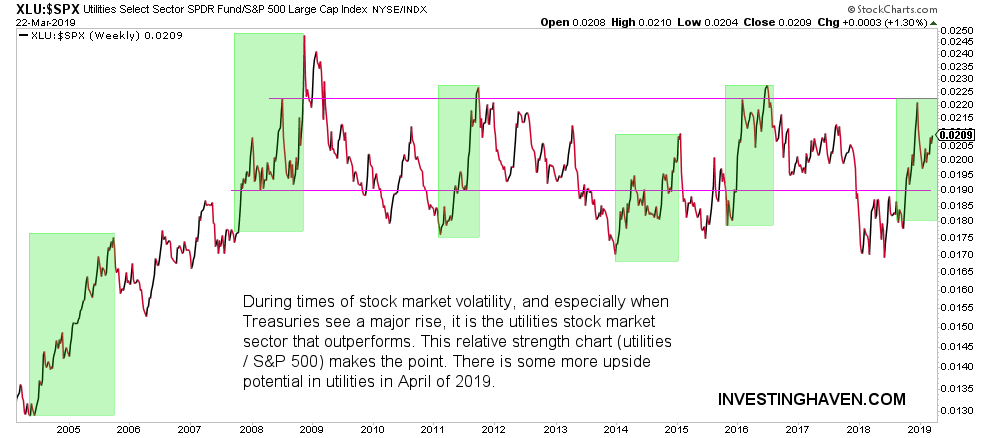

It is known to be a risk-off trade. In other words, most of the time when the Yen rises it happens under rising or high uncertainty in global markets. Case in point: the 2016 rally.

In December there was a strong rally though it was short lived. In January of this year stocks resumed their uptrend and the Yen fell to its support area again.

We believe the Yen has room to rise until the 92.50 to 93.30 area in the next few days and weeks. Again, for now, this has the looking of a tactical play.